- ARKM hits a 52-week low of $0.5545 amid a bearish trend in the last 24 hours.

- Rising trading volume sparks hope for ARKM bullish reversal.

- Oversold conditions forecast ARKM price rebound if bearish momentum dwindles.

A bearish trend has dominated the Arkham (ARKM) market in the last 24 hours, with the price bouncing between a 52-week support of $0.5545 and a resistance of $0.6051. At press time, the bears were in control and drove the price down to $0.5567, a 7.38% drop from the previous high.

While the market capitalization of ARKM decreased by 7.33% to $83,508,117, the 24-hour trading volume climbed by 14.58% to $26,928,431. Notwithstanding the bearish trend, the rise in trading volume implies greater activity and interest in the ARKM market.

Due to increasing trading activity, investors watch the market for signs of a reversal. A positive comeback and break of the $0.6051 resistance level may signal a shift in market mood and entice additional buyers.

The Money Flow Index (MFI) rating currently stands at 15.02, signifying an oversold condition. As selling pressure appears to be waning, this may indicate that the market is reaching a bottom, and a rebound could be on the horizon. Should the MFI surpass the 20 levels, a shift in momentum toward buying pressure could prompt a potential recovery.

On the other hand, the Relative Strength Index (RSI) is currently at 25.21, moving below its signal line. This level confirms the ongoing bearish trend, but if the RSI dips below 20, it could hint at an oversold scenario, possibly triggering a reversal in the market’s direction.

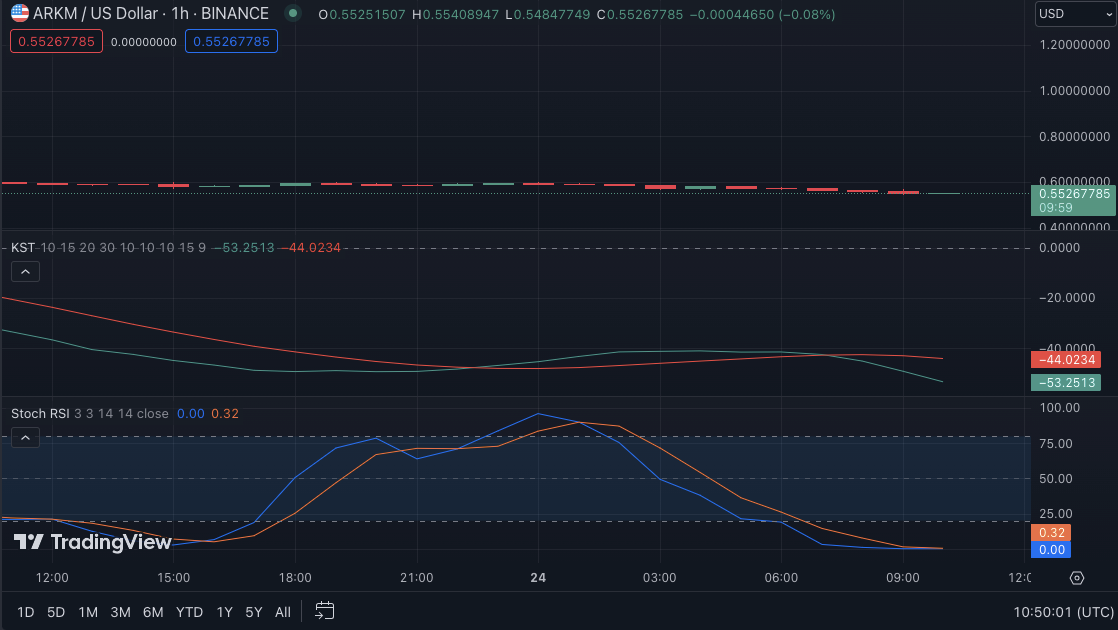

The Know Sure Thing reading of -53.5951 aligns with bearish momentum, adding to the market pressure. However, with the RSI approaching oversold territory, a temporary bounce or consolidation is possible before the downward trend resumes.

Moreover, the stochastic RSI rating of 0.00 indicates an extremely oversold condition, heightening the likelihood of an imminent rebound. This convergence of oversold signals from both the RSI and stochastic RSI lends weight to the possibility of a short-term price recovery.

In conclusion, despite the 52-week low and prevailing bearish momentum, ARKM’s increased trading volume and oversold indicators may pave the way for a potential short-term rebound.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.