- Hayes sees the GENIUS Act as effectively putting US stablecoin issuance in the hands of banks or heavily regulated entities

- His logic is that SLR relief opens institutional gateways, bank-regulated stablecoins improve trust and stability, and geopolitical calm signals a renewed risk-on environment

- Hayes believes that all of these factors combined set the stage for new Bitcoin all-time highs

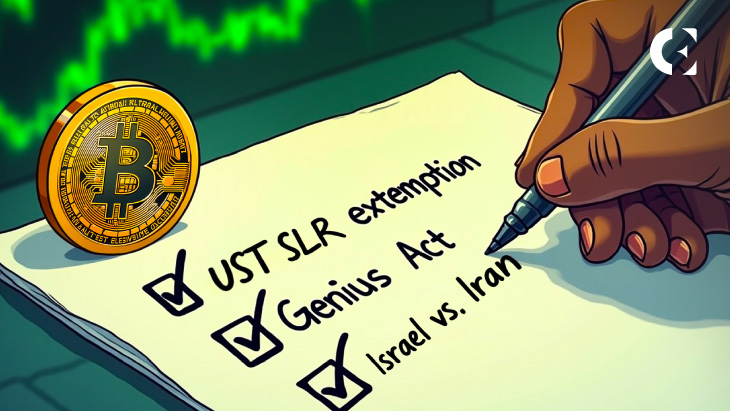

Arthur Hayes outlined a bullish thesis for Bitcoin and crypto at large, centered on three key fronts.

The first one notes the progress toward excluding UST (US Treasury) stablecoins from the Supplementary Leverage Ratio (SLR) regulation, which would reduce capital charges for banks holding stablecoins. This could unlock more bank involvement, increasing liquidity and institutional support for crypto, but only if US regulators finalize it.

Second, Hayes sees the GENIUS Act (now passed by the Senate) as effectively putting US stablecoin issuance in the hands of banks or heavily regulated entities. He believes this shift is positive for crypto as it brings transparency, trust, and regulatory legitimacy to the stablecoin sector.

Finally, Hayes touched on the current geopolitical situation as well, saying “Ignore the reality, Trump, Netanyahu, and Kahmenei are all pretending the conflict is finished so investors should too.”

In the end, his logic is that SLR relief opens institutional gateways, bank-regulated stablecoins improve trust and stability, and geopolitical calm signals a renewed risk-on environment.

Hayes believes that all of these factors combined set the stage for new Bitcoin all-time highs.

Banks, bills, and Bitcoin

On June 17, the US Senate passed the GENIUS Act in a bipartisan 68-30 vote. The law frames dollar-backed stablecoins as legitimate payment instruments and defines tight reserve and disclosure rules.

With this, banks get to issue stablecoins above the $10 billion cap, while smaller issuers may operate under state licensing. This framework suits vendors like Circle, but critics worry it will embed stablecoins too deeply into quasi-bank roles.

The SLR matter Hayes mentioned is part of an ongoing debate about exempting stablecoin reserves from SLR counts. Supporters say it frees banks to hold more liquidity-heavy assets, while the opponents cite systemic risk implications.

All things considered, we’ll have to wait and see if Hayes was correct. But given the steady regulatory advancements, expanding institutional infrastructure, and easing geopolitical tensions, the broader economic environment seems ripe for Bitcoin’s next big rally.

If the above comes to fruition, it could drive big capital in crypto and not just Bitcoin. Still, there are risks and any delay, reversal, or misstep could squash the momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.