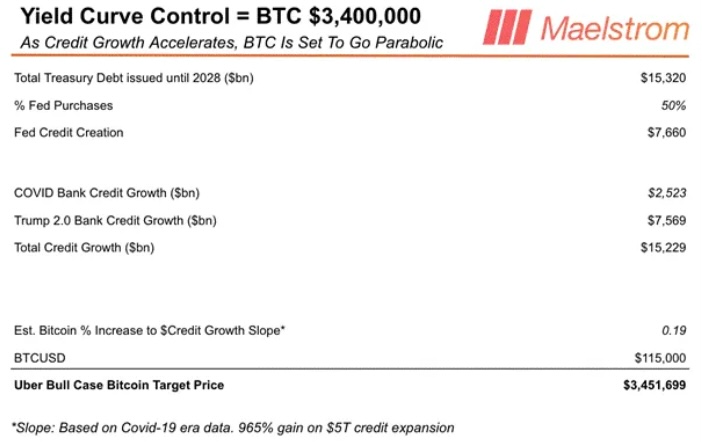

- Hayes derived a Bitcoin price target of $3.4 million by 2028 fueled by expected Fed money printing.

- Hayes noted that Bitcoin price may not reach $3.4 million by 2028, but the general bullish trend is certain.

- In a previous blog post, Hayes predicted BTC price will reach $1 million by 2028.

Arthur Hayes, co-founder of BitMEX and long-time crypto commentator, has laid out his most aggressive Bitcoin forecast yet.

In his latest blog post, he modeled a path to $3.4 million per BTC by 2028, built on expectations that U.S. fiscal and monetary policy under President Donald Trump will flood markets with fresh credit.

Hayes stressed that while the exact number is speculative, the underlying point is clear; Bitcoin trends higher as the Federal Reserve prints more money to absorb ballooning government debt.

Related: Bitcoin and Gold May Coexist on Central Bank Balance Sheets By 2030: Deutsche Bank

Inside Hayes’ Model

Hayes assumes a $2 trillion U.S. deficit each year until 2028, forcing the Treasury to issue new debt while rolling over existing obligations.

With foreign demand for U.S. Treasuries fading, particularly from China and Japan, he expects the Fed to step in and buy roughly half of new issuance, a move he equates with massive money printing.

Drawing on Bitcoin’s response to stimulus during the COVID-19 era, Hayes used a slope of 0.19% BTC appreciation per dollar of credit growth. Extrapolating that relationship, he arrives at a $3.4 million price tag for Bitcoin by 2028.

“The most finger-in-the-air portion of this model is guessing how much Bitcoin will rise per dollar of credit created,” Hayes admitted, noting the reliance on historical precedent.

Hayes’ Realistic BTC Price Target for 2028

Despite the headline number, Hayes was quick to temper expectations. He said the true takeaway is that Bitcoin will be far higher than today’s $115K by 2028, with a floor closer to $1 million per coin.

Earlier this year, he projected BTC could cross that million-dollar mark within the same timeframe as poor monetary policy persists globally.

Broader Market Context

Bitcoin in Global Rankings

Bitcoin currently ranks eighth among the world’s largest assets by market cap, behind only gold and silver in the commodity class. Gold sits at $25.6 trillion, silver at $2.51 trillion.

At $1 million per BTC, Bitcoin’s market cap would reach about $21 trillion, still below gold’s valuation. At Hayes’ extreme $3.4 million projection, Bitcoin would touch $71.4 trillion, a figure that remains less than today’s global debt burden, which the IMF pegs at $251 trillion; equal to 235% of world GDP.

Related: As the Gold Rush Begins, What’s in Store for Bitcoin’s ‘Uptober’?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.