- Due to the bulls’ hesitation, the bears seize the 1INCH market.

- Bulls’ efforts have raised the price to an intra-day high of $0.5697 in the previous 24 hours.

- Indicators suggest that bullish power will increase shortly.

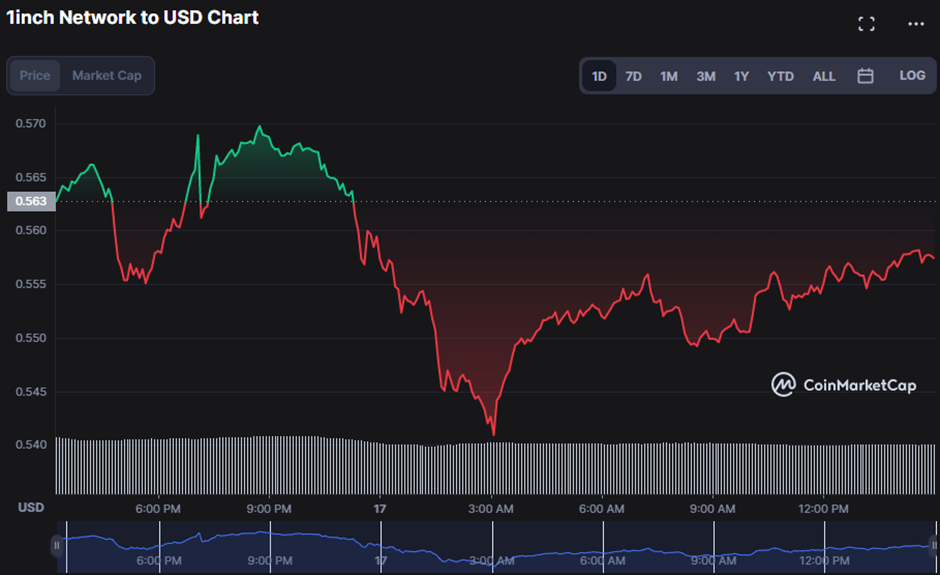

Over the past 24 hours, the market price of 1inch Network (1INCH) has been relatively rangebound between the levels of $0.5406 and $0.5697 due to the dominance of bearish sentiment. As of this writing, 1INCH has dropped 1.66%, to $0.5568, due to this bearish sentiment.

Fearing a price drop, traders exited the market, reducing market capitalization and 24-hour trading volume by 1.44% to $441,730,352 and 14.32% to $46,239,156, respectively. Despite dropping, 1INCH is still trading above its $0.5406 support level.

With the upper Keltner Channel band sitting at 0.574 and the lower bar at 0.529 on the 4-hour price chart, traders will likely be on the lookout for a break above the 0.574 level to signal a continuation of the bullish trend and an opportunity to enter long positions. A green candlestick forming and a price movement above the 0.549 middle bands might signal to traders that a chance for purchasing has occurred, signaling a possible entry point for long holdings.

Presently, the market’s momentum is turning slowly in a positive direction, as shown by the Relative Strength Index’s (RSI) movement below its signal line at 55.47. If the price manages to break over 0.574 on the 4-hour chart, it may encourage traders to open long positions as the upward momentum continues to grow.

In addition, the Relative Volatility Index (RVI) reading of 45.77 reflects the negative momentum progression. This level indicates that the downward price action has yet to calm and that additional bearish pressure may prolong.

The 20-day moving average crosses above the 100-day moving average, hitting 0.551 and 0.550, respectively, indicating a bullish crossing. This bullish crossover signals that price appreciation is possible since the MAs head higher. Since the price movement in the 1INCH market advances above both MAs, the bearish hand is weaker than the bullish hand, which is a buy signal.

The CMF reading of 0.39 reinforces the bullish crossover since it suggests that money is moving into the 1INCH market and confirms that buyers are taking control. This reading indicates that the bulls are attempting to increase the price, and momentum looks to be building in the 1INCH market.

Bulls’ dominance is growing in the 1INCH market, indicating that bears’ influence is fading, giving traders optimism for a turnaround.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.