- Japanese 2-year bond yields hit 1.01%, strengthening the Yen and forcing a global risk sell-off.

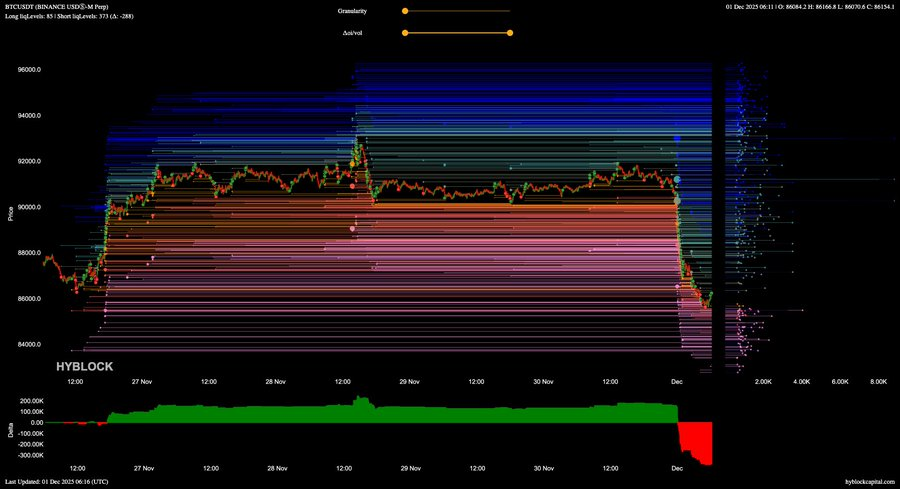

- The move unwound the “Yen Carry Trade,” flushing $646M in leveraged crypto bets overnight.

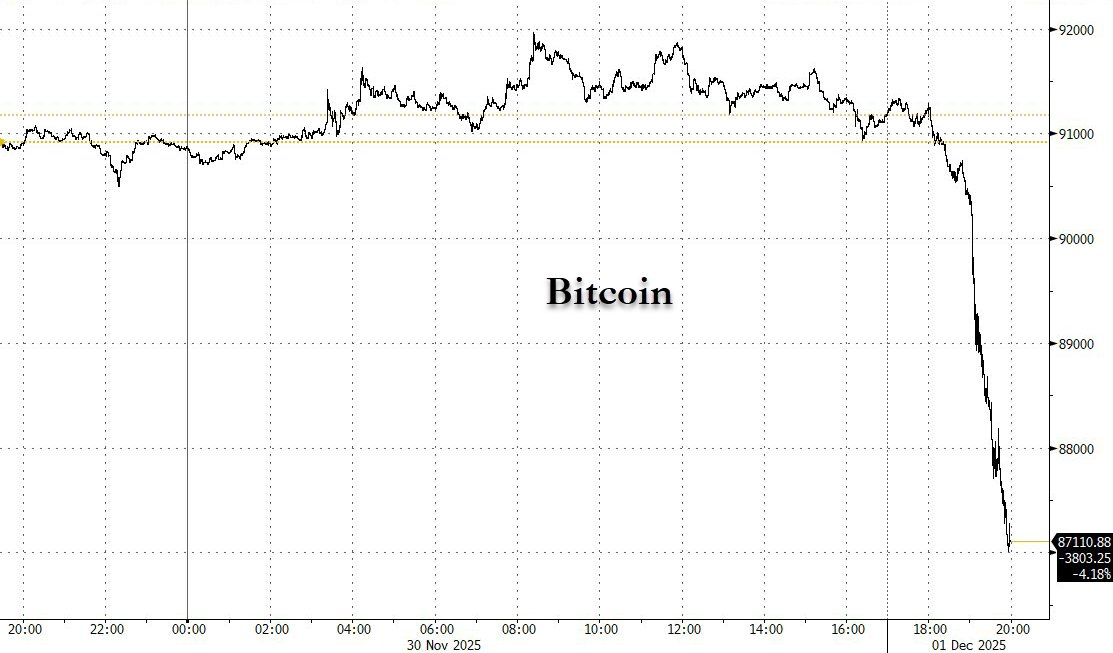

- Bitcoin plunged to $86,000, while XRP bucked the trend with a 7% rally on independent catalysts.

Japan’s sudden jump in bond yields not only shook Asian stocks, it directly hit the crypto market. The crypto market is now going through a sharp downturn today, with selling pressure hitting almost every major coin.

Bitcoin and Altcoins Crash vs. XRP’s Market Divergence

The global crypto market cap has dropped to $2.92 trillion, down over 5% in 24 hours. Bitcoin is trading near $85,992, down 5.3%, but still performing better than most altcoins. Ethereum is at $2,829, also down 5.4%.

So while BTC & ETH bore the brunt of the macro shock, XRP emerged as a statistical anomaly.

The token rallied 7.6% on the day at $2.02.

Solana has fallen more than 7%, now at $126, while Dogecoin dropped nearly 8% to $0.137.

Early on December 1, more than $646M in crypto positions were liquidated, and 89% of them were leveraged long positions. Bitcoin alone saw $185M in long liquidations, the highest since October 2025.\

The stronger yen, rising yields, and thinning liquidity were the main catalysts for Monday’s crypto sell-off. According to experts, when liquidity tightens in Asia, crypto becomes more sensitive, and even small moves can turn into bigger crashes.

Related: Strategy CEO Phong Le Says We Would Sell Bitcoin: Here’s Why and When

Yen Carry Trades Start Unwinding

Japan’s 2-year bond yield spiked to 1.01%, the highest level since 2008. This happened as traders increased their bets on a possible BOJ rate hike in December, sending the yen higher.

A stronger yen creates problems for crypto because many traders use yen carry trades, borrowing cheap yen to fund risky bets in Bitcoin and Ethereum. When the yen rises, these trades become more expensive, forcing traders to unwind them quickly.

Bank of Japan Governor Kazuo Ueda signaled that the central bank is prepared to discuss a possible interest rate increase at its upcoming December 19 meeting. His comments pushed market expectations of a hike to nearly 76%, immediately impacting bonds, stocks, and global risk assets.

Ueda said the BOJ will review both the benefits and drawbacks of raising rates and will make a decision based on the latest economic data.

What’s Next For Bitcoin?

Bitcoin wiped out a huge wave of long positions as it fell from $90,000 to $86,000. The next big support zone sits around $83,000–$85,000, where a large cluster of liquidations remains.

If BTC cannot stay above $86,000, price will likely drift down to that lower zone before any real bounce.

Related: Uzbekistan Legalizes Stablecoins for Payments Beginning January 2026

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.