- ASTER stalls below $0.65 as Fibonacci resistance continues to cap upside momentum

- Ichimoku cloud pressure remains heavy, keeping the rebound corrective not bullish

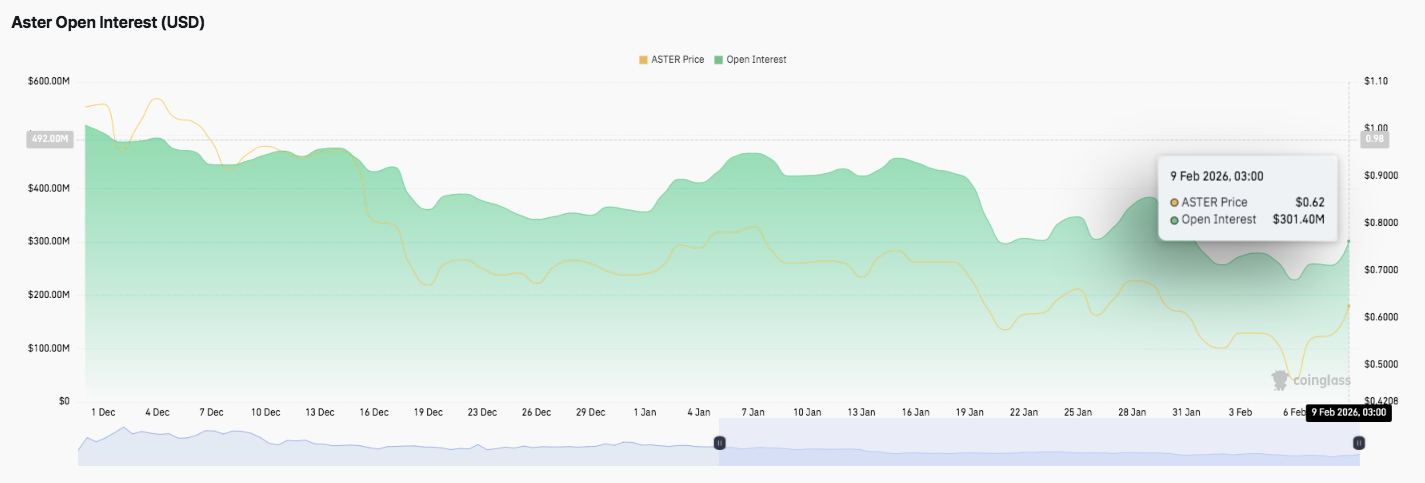

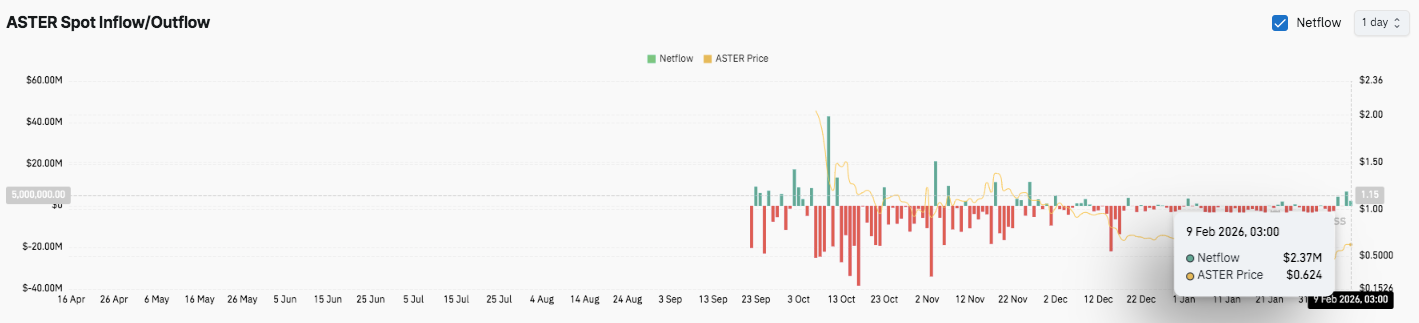

- Open interest stabilizes near $300M while spot inflows hint at early accumulation

Aster is attempting to stabilize after a sharp decline, with price rebounding from the $0.406 swing low. The recovery has pushed ASTER back toward the $0.62–$0.63 range, an area traders closely monitor. This zone overlaps with a major Fibonacci retracement and a previous supply region.

Consequently, it has become a near-term barrier that continues to cap upside momentum. Market data suggests the move reflects stabilization rather than a clear trend shift. Hence, traders remain cautious while price trades below confirmed breakout levels.

Resistance Caps the Recovery Attempt

Price action on the 4-hour chart shows ASTER repeatedly stalling below the $0.65 area. This level aligns with the 0.618 Fibonacci retracement and earlier rejection points.

Significantly, sellers have defended this zone on multiple tests, limiting follow-through. A higher resistance band sits between $0.71 and $0.72, which marked a major breakdown earlier. A move into that range would require sustained buying strength and broader market support.

On the Ichimoku setup, ASTER has climbed toward the cloud but has not cleared it. The cloud remains thick overhead, signaling continued overhead pressure.

The Kijun-sen near $0.61 now provides immediate support, while the Tenkan-sen around $0.60 reflects short-term balance. However, price must hold above the cloud to confirm a bullish shift. Until then, the structure continues to favor a corrective recovery.

Momentum indicators reinforce the cautious outlook. The Directional Movement Index shows weakening bullish momentum, with positive directional strength rolling over. Meanwhile, ADX remains elevated, indicating the prior trend still influences price action.

Related: Solana Price Prediction: SOL Defends $87 After 20% Surge While ETFs Continue To Exit

Consequently, the rebound appears vulnerable without renewed momentum. A decisive 4-hour close above $0.65 could revive upside interest. Failure at resistance increases pullback risks toward $0.60 or $0.55.

Derivatives and Spot Data Suggest Stabilization

Open interest trends add further context. Derivatives data shows a steady contraction from early December through late January. Open interest declined from above $450 million toward $300 million as price fell.

This pattern suggests traders reduced leveraged exposure rather than rotating aggressively into new positions. Additionally, open interest has stabilized near $300 million during the recent bounce. This stabilization implies traders await clearer direction before committing capital.

Spot flow data presents a more constructive signal. ASTER experienced persistent net outflows through late 2025, reflecting sustained sell-side pressure. However, selling intensity eased into early 2026.

Recently, flows turned modestly positive, showing a $2.37 million net inflow. Moreover, this shift suggests accumulation interest near lower levels. While inflows remain limited, they indicate reduced downside pressure and improving market balance.

Technical Outlook for Aster (ASTER)

Key levels for Aster remain clearly defined as price trades near a critical decision zone. ASTER currently holds above short-term support but continues to face overhead supply, keeping the structure neutral-to-cautious.

Upside levels: Immediate resistance sits between $0.65 and $0.67, where price has faced repeated rejection. A confirmed break above this zone could open the path toward $0.71–$0.72, which marks a prior breakdown level and a deeper Fibonacci retracement. Beyond that, sustained momentum could allow a move toward the $0.78 area, though that scenario would require stronger volume and trend confirmation.

Downside levels: On the downside, $0.60–$0.61 remains the first support area, supported by prior consolidation and short-term trend structure. A loss of this zone would likely expose $0.55–$0.56, followed by $0.50, which represents the last higher-low structure from the recent rebound.

Resistance ceiling: The $0.65 region stands out as the key level to flip for short-term bullish continuation. Price remains below the thicker portion of the Ichimoku cloud, suggesting recovery rather than trend reversal. A sustained hold above this area would improve the medium-term outlook.

The broader technical picture suggests ASTER is compressing after a sharp rebound, with momentum beginning to slow. Open interest stabilization and improving spot flows point to reduced downside pressure, but conviction remains limited. Consequently, volatility expansion likely depends on a decisive break from the current range.

Will Aster Move Higher?

ASTER’s near-term direction hinges on whether buyers can defend the $0.60 support long enough to challenge the $0.65–$0.67 resistance cluster. A clean breakout could trigger continuation toward $0.71, while rejection risks another pullback toward $0.55. For now, ASTER remains in a pivotal zone, where confirmation, not anticipation, will determine the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.