- CZ jokes about his “100% losing” entries as he warns traders to watch risk in choppy markets.

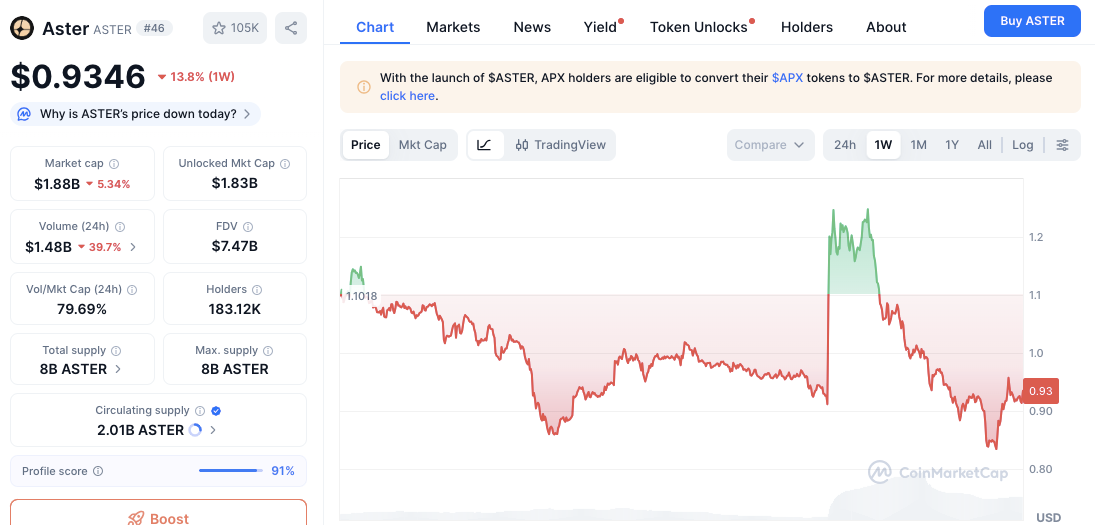

- Aster (ASTER) is down 14% on the week, holding a fragile $0.90 to $0.93 support band.

- Mixed MACD/RSI signals show early stabilization, but unlock overhang and weak sentiment cap upside.

Changpeng Zhao has reignited a familiar crypto lesson after saying his coin buys “always go down” and that traders should keep risk front of mind. The Binance founder used past cycles to make the point, recalling Bitcoin’s drop from $600 to $200 in 2014 and BNB’s 2017 pullback, framing it as proof that even early, well-known players mistime markets.

CZ was humorously noting his “100% record” of entering losing positions, but it landed in a market already dealing with ETF outflows, thinner liquidity, and fast rotations, so traders read it as a reality check rather than a meme. The implication is simple: this is not a backdrop for overextended bids.

Related: CZ’s $2M Aster Purchase Triggers 30% Price Spike and Frenzied Trading

Aster Tracks That Tone With A 14% Weekly Drop

Aster’s price action behaved exactly like a market that just heard “be careful.” ASTER is trading around $0.93 after slipping nearly 14% over the past week, having lost the $1.00 handle before recovering a few cents.

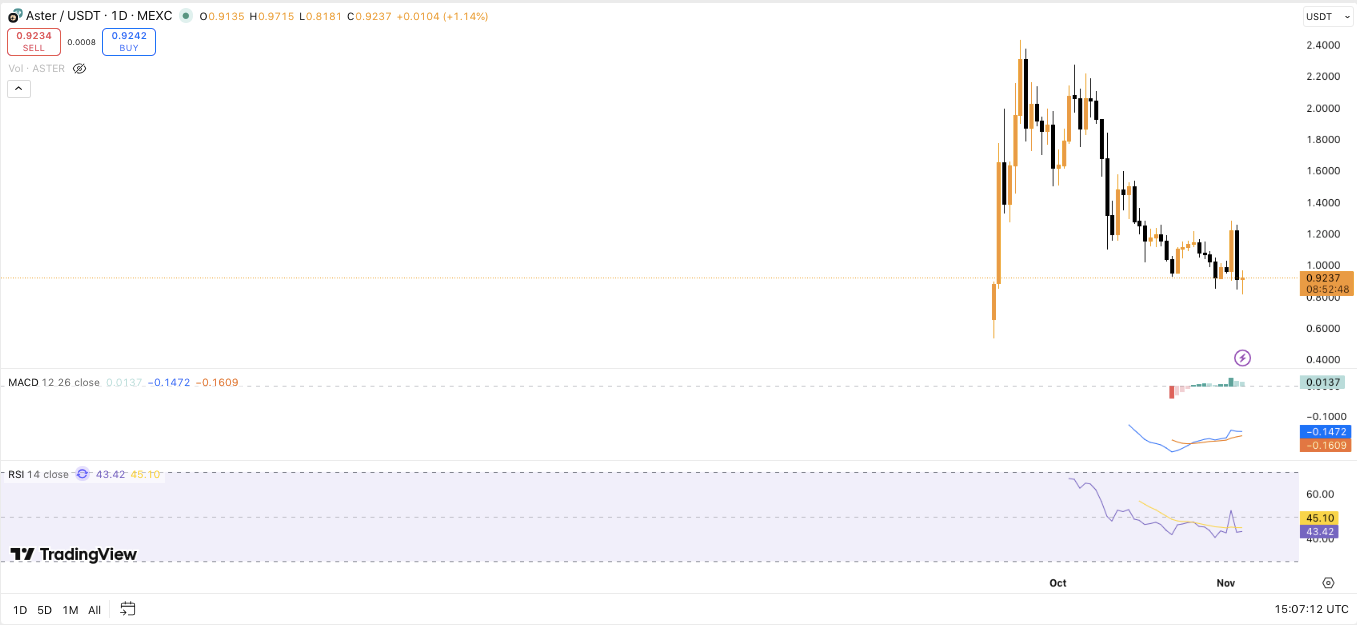

The chart now shows a clean sequence of lower highs and lower lows, which signals sellers still control the pace and rallies will be sold first. That makes the nearby $0.90 shelf the line to defend; lose it and $0.85 opens up quickly. Hold it, and a slow consolidation between $0.85 and $1.10 becomes the base case.

$0.90 To $1.10 Is The Working Range

Immediate support sits at $0.90, where price has twice rebounded. A break below could expose $0.85 as the next downside target. On the upside, resistance at $1.00 and $1.10 remains critical. A sustained move above these levels may indicate renewed buying strength. Until then, a consolidation phase between $0.85 and $1.10 appears likely.

Liquidity, Unlock Overhang, And Volatile Flows

Aster’s market capitalization of $1.88 billion and a fully diluted valuation of $7.47 billion reveal a circulating supply of roughly 25%. Such a ratio often signals potential pressure from future unlocks. Moreover, its 79.69% volume-to-market cap ratio indicates heightened trading activity, which could magnify price swings in either direction.

Momentum Signals Are Early, Not Confirmed

Momentum tools give a cautious but not bearish read. The MACD is trying to cross higher, which usually precedes short-term stabilization if buyers show up.

The RSI at 43.4 has lifted from oversold territory, which means sellers are easing off, but it is still below 50, so strength is not confirmed. Put together, the signals say “bounce possible, trend not yet reversed,” which again matches the caution CZ was pointing toward.

Related: Aster Price Prediction: ASTER Tests $1.10 Support As Buyers Return With Fresh Inflows

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.