- Aster consolidates above key support, signaling steady bullish recovery potential.

- Futures stability reflects renewed trader confidence and moderate leverage buildup.

- Persistent spot outflows show investors remain cautious despite price stabilization.

The Aster (ASTER) market continues to show signs of stabilization as traders cautiously rebuild positions following weeks of volatility. The token trades near $1.11, holding above its short-term support area and maintaining a neutral-to-bullish bias.

Despite recent selling pressure, technical indicators suggest that buyers are gradually regaining control, supported by steady futures participation and moderated volatility. Consequently, the market appears to be entering a recovery phase, though a decisive breakout is still required to confirm the next directional move.

Technical Structure Indicates Controlled Recovery

The ASTER/USD 4-hour chart reveals a consolidative structure, with the 20-period EMA at $1.103 providing consistent dynamic support. This moving average has absorbed recent pullbacks, highlighting sustained buying interest near the lower range. Besides, the Bollinger Bands remain moderately narrow, signaling reduced volatility as traders await a potential breakout.

Resistance remains visible around $1.146 to $1.148, aligning with the 61.8% Fibonacci retracement zone. A close above this level could strengthen bullish momentum and open the path toward the $1.198–$1.20 region, representing the 78.6% retracement.

However, failure to surpass the $1.15 barrier may extend the current consolidation phase. On the downside, supports lie near $1.05 and $0.93, with deeper weakness possibly testing $0.82. Hence, maintaining prices above the EMA-9 remains crucial for sustaining bullish sentiment.

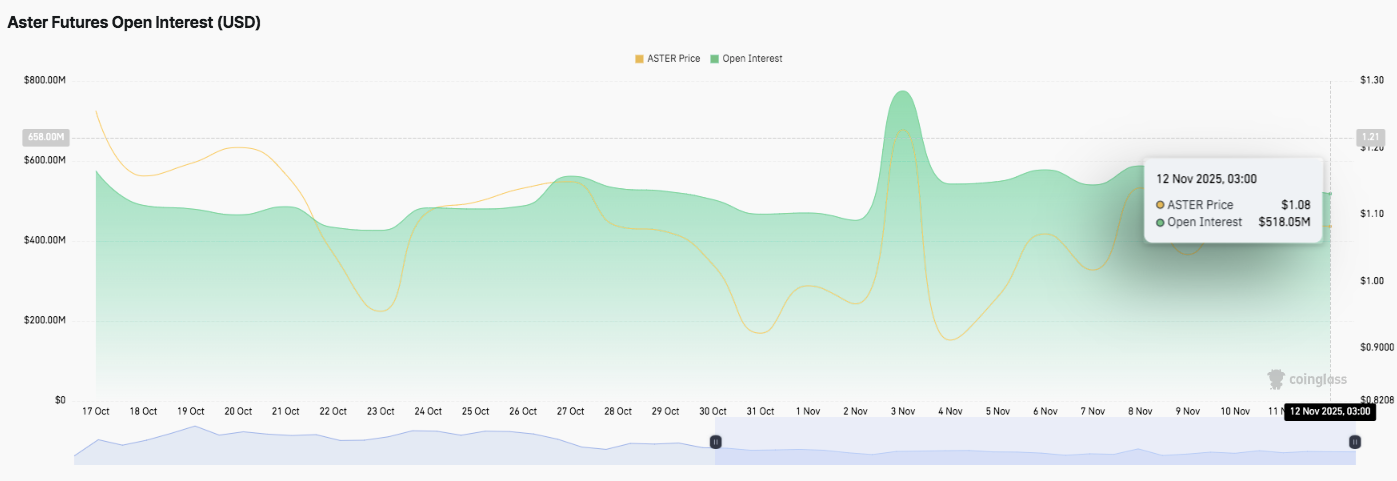

Futures Data Reflects Gradual Confidence Return

Aster Futures data suggests a cautious return of leverage to the market. Open interest fluctuated between $400 million and $800 million throughout the past month. After peaking above $750 million in early November, it stabilized near $518 million by November 12.

This period coincided with Aster’s recovery from $1.03 to $1.08, reflecting moderate optimism among traders. Moreover, the earlier surge in open interest had aligned with sharp price swings, signaling speculative activity. The current stability, however, points to renewed market engagement without excessive leverage, which could support healthier price movement ahead.

Spot Netflows Signal Lingering Caution

Despite improving futures sentiment, spot market data continues to show sustained outflows. On November 12, approximately $997,000 exited exchanges as Aster traded around $1.12.

This persistent trend highlights investor caution, as many participants lock in profits or reduce exposure. Consequently, the ongoing capital outflows may restrict immediate upside momentum unless fresh demand emerges to absorb selling pressure.

Technical Outlook for Aster Price

Key levels remain well-defined heading into mid-November.

Upside targets include $1.146, $1.17, and $1.198 as immediate hurdles. A decisive move above $1.20 could extend toward $1.25–$1.27, confirming short-term bullish momentum.

On the downside, critical supports sit at $1.05 and $0.93, with a break below $0.82 likely exposing deeper downside risk. The 20-period EMA near $1.103 continues to act as a dynamic support, cushioning pullbacks and maintaining steady buying interest.

The technical picture suggests ASTER is consolidating in a narrow range above short-term support. Bollinger Bands remain moderately tight, indicating reduced volatility but signaling potential expansion once price breaks key levels. Historical price swings and recent open interest data suggest moderate leverage buildup, pointing to cautious but engaged trader activity.

Related: CZ’s ‘I Buy Tops’ Reminder Lands As Aster Sinks 14% To $0.90 Support

Will Aster Break Higher?

Aster’s near-term direction hinges on whether buyers can defend the $1.103–$1.116 range long enough to challenge the $1.146–$1.148 resistance cluster. If upward momentum gains strength, ASTER could retest $1.198–$1.20 and potentially push toward $1.25. However, sustained spot outflows and weakening liquidity suggest that a failure to hold the EMA support may trigger a pullback to $1.05 or lower.

For now, ASTER remains in a pivotal consolidation zone. The short-term narrative points to cautious optimism, but conviction flows and technical confirmation will determine whether the next move favors bulls or bears.

Related: ‘Anti-CZ Whale’ Nets Nearly $100M as Aster Drops Following Binance Founder’s Tweet

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.