- Attorney Bill Morgan reveals how the 2023 banking crisis disrupted Ripple’s On-Demand Liquidity (ODL) system.

- Ripple partner Tranglo faced severe liquidity issues, forcing a temporary switch from XRP to fiat pre-funding.

- XRP adoption declined, with only 7 out of 93 active Tranglo customers using ODL in 2024.

Pro XRP lawyer Bill Morgan has uncovered new details about Ripple’s On-Demand Liquidity (ODL) system. The information comes from Currenc Group’s March 6 SEC filing. The document outlines financial risks and reveals how the 2023 banking crisis impacted Tranglo’s XRP transactions.

Tranglo, a key Ripple partner in Southeast Asia, faced severe liquidity challenges after the collapses of Silicon Valley Bank, Signature Bank, and Silvergate Bank.

Many crypto exchanges, including two used by Tranglo, struggled to process XRP transactions. Because of this, several ODL partners stopped using XRP for a bit and switched to using regular money they had on hand.

How the Banking Crisis Disrupted XRP Transactions

The filing explains how the failure of major U.S. banks created a liquidity shortage for crypto markets. Many exchanges relied on these banks for cash flow. When they collapsed, liquidity dried up. Two exchanges that Tranglo used—Independent Reserve and Coins.ph—could not convert XRP into local currencies fast enough.

Related: Crypto Lawyer Shares His Take On Ripple’ ODL XRP Sales

The disruption forced Tranglo to ask its ODL partners to pause XRP transactions. In response, nine out of eleven ODL partners switched to fiat pre-funding to keep operations running. This showed the risks of relying on crypto for quick cash, especially when traditional banking support is lost.

Declining ODL Adoption in 2024

The filing also provides insight into ODL adoption in 2024. It reveals that only seven out of Tranglo’s ninety-three active customers used ODL in the first nine months of the year. These transactions made up 4.8% of Tranglo’s remittance revenue and 3.6% of total payment transactions.

While ODL remains part of Tranglo’s business, its limited adoption suggests some partners are hesitant to adopt it after past disruptions. Most have chosen to stick with fiat pre-funding instead of returning to XRP-based settlements.

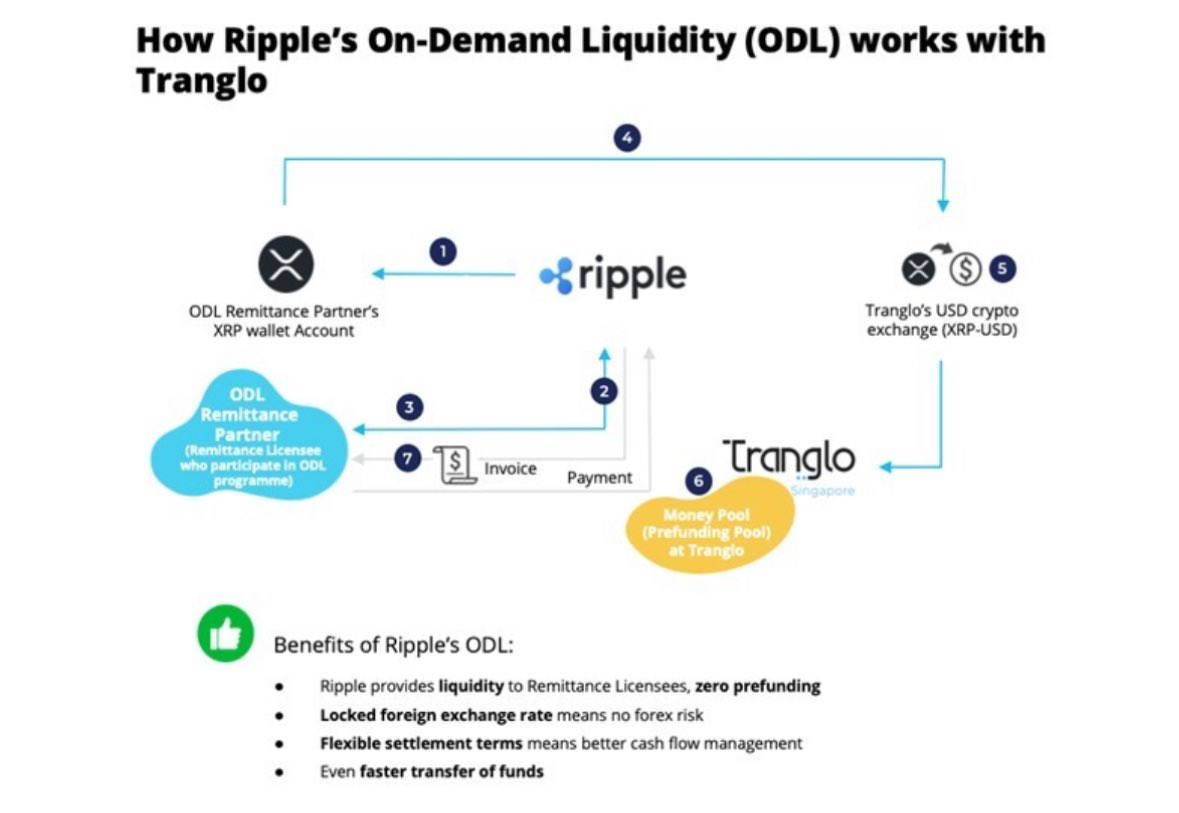

Tranglo’s ODL Process and the Role of XRP

Morgan noted that the filing contains one of the most detailed breakdowns of Tranglo’s ODL system. Pages 82 to 85 explain how XRP facilitates cross-border transactions. A diagram in the prospectus shows the process, confirming that XRP remains integral to Tranglo’s operations.

Related: XRP Price Alert: Support Test, Bearish Signals, Bullish Hopes

Ripple’s ODL eliminates the need for pre-funded accounts by using XRP as a bridge currency. The system enables faster settlements and lowers costs. However, the 2023 banking crisis revealed its potential weaknesses during liquidity shortages.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.