- Monochrome Bitcoin ETF’s AUM rises from AUD 11.4M to 12M, reflecting strong investor interest.

- Bitcoin holdings in $IBTC ETF increase from 123 to 138, indicating steady accumulation.

- Monochrome partners with Hoseki for daily proof-of-reserves, enhancing transparency in $IBTC.

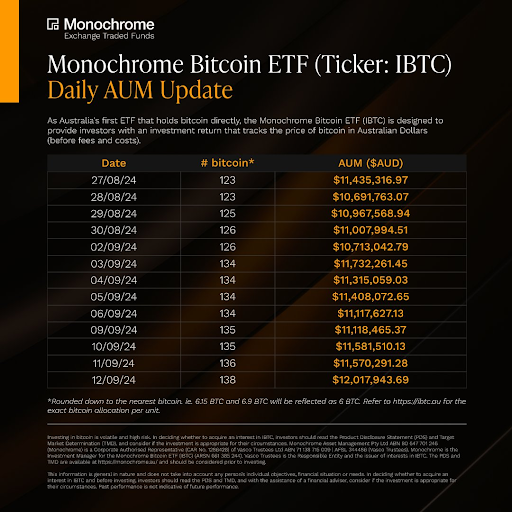

The Monochrome Bitcoin ETF ($IBTC) has seen a steady increase in assets, growing from 123 Bitcoins (AUD 11.4 million) on August 27th to 138 Bitcoins (AUD 12 million) by September 12th, 2024.

This growth in Bitcoin holdings reflects strong investor interest and confidence in the ETF. The ETF’s Assets Under Management (AUM) fluctuated during this period, mainly due to Bitcoin’s price swings.

The most significant single-day AUM increase was on September 3rd, jumping to AUD 11,732,261.45 alongside a rise in Bitcoin holdings from 126 to 134. The AUM rose from AUD 11,435,316.97 on August 27th to AUD 12,017,943.69 by September 12th.

Monochrome Boosts Transparency with Hoseki Partnership

In a move to enhance transparency, Monochrome Asset Management has partnered with Hoseki to implement daily proof-of-reserves verification for the $IBTC ETF. This makes it the first Australian spot Bitcoin ETF to offer such a feature.

Hoseki’s verification system will provide independent confirmation of the ETF’s Bitcoin holdings, giving investors real-time assurance of reserves. This step is expected to raise the bar for transparency and trust within the Australian Bitcoin ETF landscape.

Following the Monochrome movement into the crypto market, Bitcoin’s price saw a decrease of 0.45% over the previous day. Despite this, as of the press time, Bitcoin was trading at $57,988.81.

Read also: IETH: Monochrome’s Bid to Launch Australia’s First Spot Ethereum ETF

Monochrome’s move toward enhanced transparency, coupled with the steady growth in its Bitcoin holdings, signals a positive trajectory for the Australian Bitcoin ETF sector. Despite recent market fluctuations, investor confidence in Bitcoin and related investment products like the Monochrome Bitcoin ETF appears to be holding strong.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.