- Bank of America now recommends 1%–4% crypto exposure for clients.

- The bank will cover major Bitcoin ETFs starting January 5.

- Bitcoin price stayed near $92,000 despite the major institutional news.

Bank of America has officially started recommending that its clients invest 1% to 4% of their portfolios in Bitcoin and crypto. This is a huge change. The bank manages over $3 trillion in assets and serves 66 million clients worldwide.

Even a small crypto allocation from investors this large could mean hundreds of billions of dollars flowing into digital assets over time.

Who Can Invest and How?

This advice applies to clients using Merrill, Bank of America Private Bank, and Merrill Edge. From January 5, Bank of America advisors will also begin covering four major Bitcoin ETFs:

- BlackRock’s IBIT

- Fidelity’s FBTC

- Bitwise’s BITB

- Grayscale’s Bitcoin Mini Trust

If a client is comfortable with high price swings, advisors can now legally suggest crypto exposure.

From “Too Risky” to “You Should Own Some”

Just a few years ago, big banks warned that Bitcoin had no value and was only for speculation. Now, those same institutions are saying something very different. This is what many analysts call the quiet adoption phase. No hype. No panic buying. Just slow, steady acceptance before the crowd shows up.

So, Why Didn’t Bitcoin Pump?

Surprisingly, Bitcoin barely reacted to the news. BTC is trading above $92,000 after a small rise, but there was no explosive move. Analysts said that in past cycles, news like this could have pushed prices up 10% or more in a single day. For now, the next level experts are watching is $95,000.

A Bullish Signal Flashes in the Background

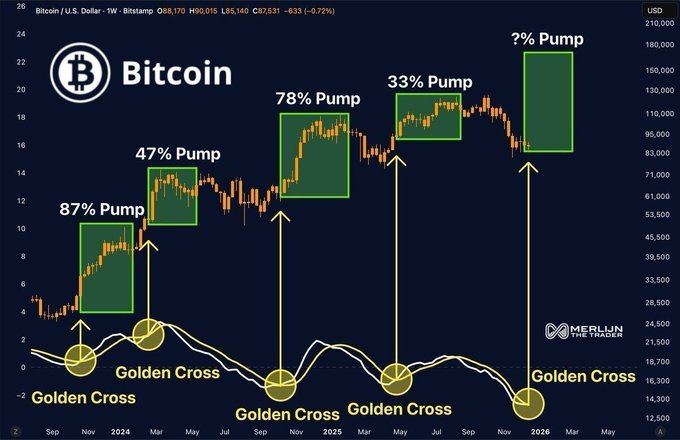

Even though prices are calm, Bitcoin has just printed a Golden Cross, a technical signal that often comes before strong rallies. In the past, similar signals were followed by gains of 87%, 47%, 78%, and 33%.

Interestingly, these signals usually appear when people are still unsure and skeptical — not when excitement is high.

Related: Why Bitcoin and Major Altcoins Rallied After US Action in Venezuela

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.