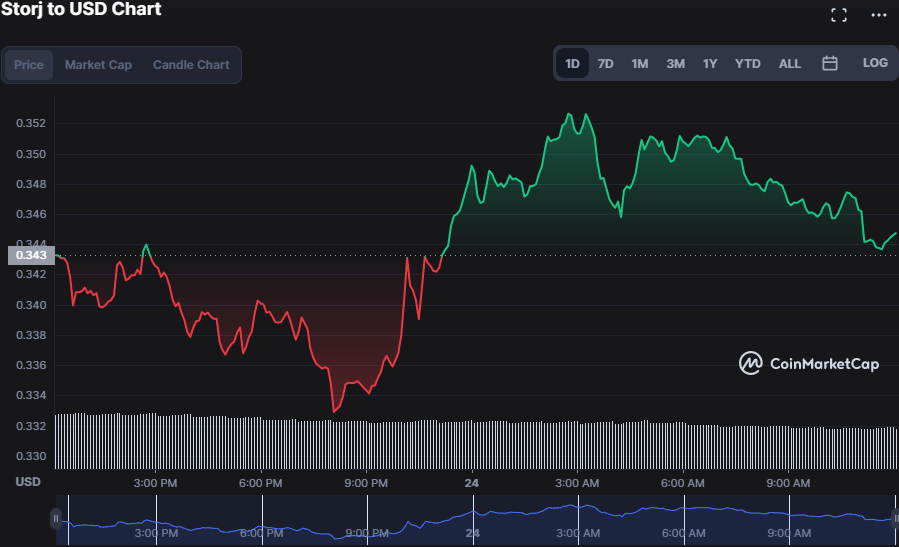

- Analysis of the Storj price shows a consistent increasing tendency.

- Support for STORJ is at $0.3328, while resistance is at $0.353.

- Prices for STORJ have decreased by 0.56% to value at $0.3399.

The Storj (STORJ) market has been steadily rising over the last several hours, finding support at $0.3328 and encountering resistance at its intraday high of $0.353. The bears, however, succeeded in pulling the prices down during the upswing by 0.56% to $0.3399.

The market capitalization, which climbed by 0.48% to $142,558,628, and the 1-day trading volume, which decreased by 27.61% to $15,957,853, both support this optimistic trend. In an upswing, declining volume can be a sign that it is time to sell and take profits.

Bulls will continue to dominate the market, according to the upward-pointing Keltner Channel bands on the STORJ price chart. Top and bottom bands make contact at 0.3604 and 0.3141, respectively. This constructive notion is confirmed by the market’s upward tendency towards the top band.

Bullish dominance is anticipated to continue once Chaikin Money Flow (CMF) crosses over the “0” line. This development is visible on the STORJ market, where the CMF indicator reads 0.07 and is pointing upward, indicating that the current trend is progressing. Additionally, because the Coppock Curve is trending positively with a reading of 10.0652, it is likely that the upward trend will continue.

The Relative Strength Index (RSI) has a reading of 58.20, which is neither oversold nor overbought. Since there is equal selling and buying pressure, as shown by the reading, the current trend is predicted to continue at this rate.

The Stoch RSI reading of 73.86 suggests that the STORJ market is approaching its peak as it approaches the overbought region, but because it is trending south and moving away from the overbought region, investors can breathe a sigh of relief.

The Storj (STORJ) market is still dominated by bulls, and technical indicators point to a further strong surge.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.