- U.S. Treasury Secretary Bessent has reiterated the urgency of crypto market structure legislation.

- Second meeting signals compromise on stablecoin yield, no deal yet.

- Bitcoin whales are increasing their holdings amid regulatory optimism.

United States Treasury Secretary Scott Bessent has urged the Senate to prioritize the passage of the CLARITY Act. Bessent slammed industry participants against the crypto market structure legislation, led by Coinbase Global Inc. (NASDAQ: COIN), amid discussions on stablecoin yield with the White House.

“I think it is impossible to proceed without it. We have to get this Clarity Act across the finish line,” Bessent stated.

Bessent Advocates for CLARITY Act Passage in 2026

According to Bessent, the United States Senate must pass the CLARITY Act to give the country a step ahead as the crypto capital of the world. As such, Bessent urged crypto industry participants against this bill to either onboard or leave the country for other jurisdictions.

Notably, Coinbase CEO Brian Armstrong pulled out the company’s support for the CLARITY Act due to concerns of stablecoins yields. According to Armstrong, banks should build competitive stablecoins that pay investors higher yields.

Already, the Senate Agriculture, Nutrition, and Forestry voted 12–11 on a party-line vote with no Democratic support. As such, Bessent has urged bipartisan support to push the bill towards the President’s desk soon.

White House Arbitrates On Stablecoin Yields Issue

The White House under President Donald Trump has pushed to end the bipartisan impasse by addressing the core issue. On Tuesday, February 10, the White House brought together industry experts from the banking sector and the crypto space to harmonize on the stablecoin yield issue.

Tuesday’s meeting was the second time and was led by Patrick Witt, who sits on the President’s Council of Advisors for digital assets. According to Ripple CLO Stuart Alderoty, compromise is in the air regarding stablecoin yield, but no specific deal was reached

“The Trump Admin’s decision to keep convening stakeholders reflects a real commitment to working through these issues as the Senate Banking Committee continues its work,” Dan Spuller, Vice President at Blockchain Association, stated.

The need to pass the CLARITY Act is both a political move and an economic stance. Furthermore, the crypto community in the United States has surpassed 50 million, thus forming a solid voting bloc ahead of the 2026 midterm elections.

What’s the Market Impact?

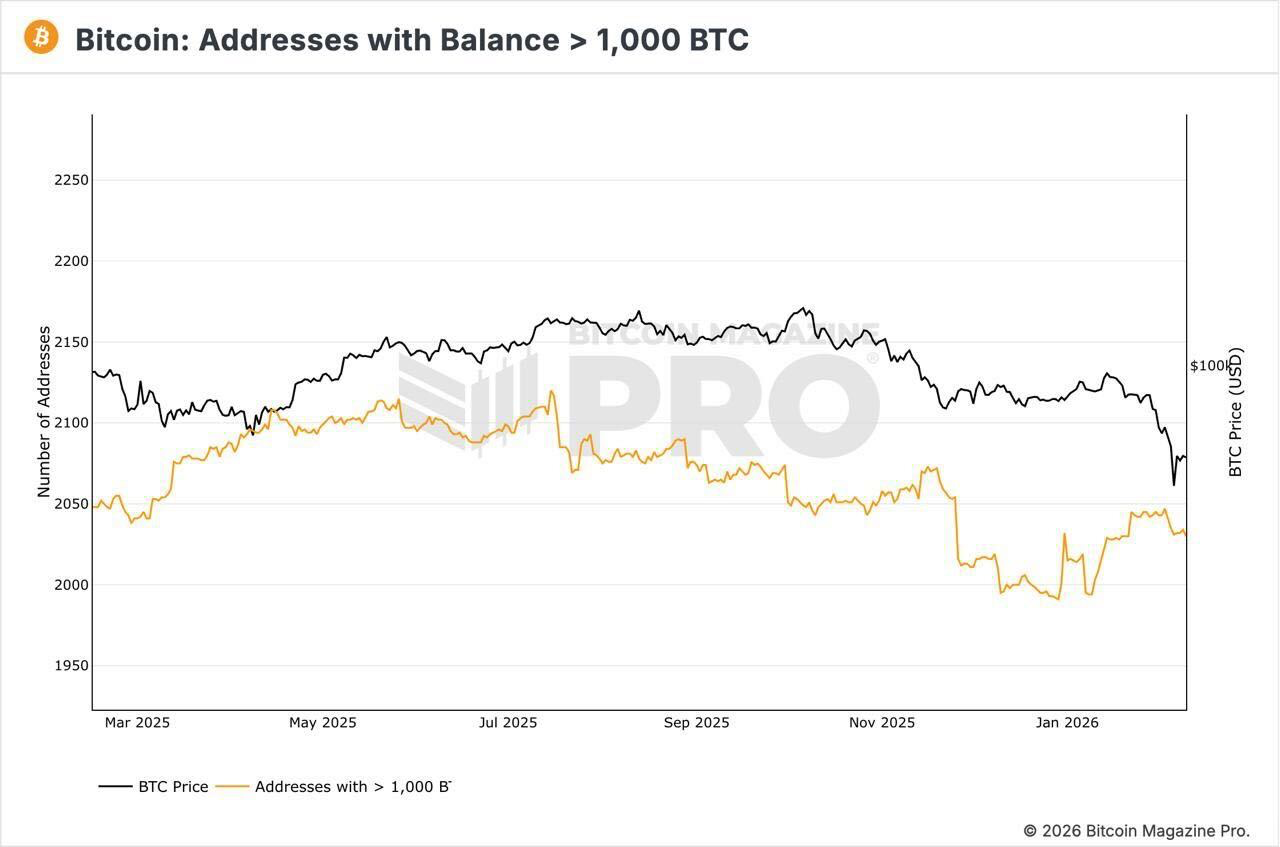

The unwavering support of crypto market structure legislation by the Trump administration has bolstered demand from institutional investors. Amid the ongoing crypto capitulation fueled by a significant decline in its Open Interest (OI), onchain data shows large whales have been accumulating.

For instance, Bitcoin addresses with at least 1000 BTC have been accumulating in the recent past, surging to around 2050 after a decline below 2000. As such, the imminent passage of the CLARITY Act would improve regulatory clarity and potentially support capital flows into the broader altcoin market.

Related: CFTC Revises Rules to Let National Trust Bank Issue Stablecoins

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.