- XRP advocate Bill Morgan dismisses talk of weak ETF demand after GraniteShares filed two 3× leveraged XRP ETFs.

- Skeptics warn leveraged funds could amplify volatility and delay approvals amid the U.S. shutdown.

- Morgan says history favors long-term holders, recalling his <$0.50 entries before XRP’s 400 % rally.

XRP advocate Bill Morgan has stated he will keep panic buying XRP, responding to critics who claim the digital asset faces “weak demand.”

His remarks followed GraniteShares’ latest filing with the U.S. Securities and Exchange Commission to launch new leveraged XRP funds. Notably, some critics argue interest in XRP ETFs is low and wonder if XRP is losing momentum or preparing for a comeback. But the ETF filings show a different story.

Morgan believes that the increasing number of ETF filings signals that the market still regards XRP as one of the top digital assets, alongside Bitcoin, Ethereum, and Solana.

Related: Caleb Franzen Maps XRP Fibonacci Targets at $4.40 and $6 as Traders Watch $2.68 Support

GraniteShares Pushes for Leveraged XRP ETFs

Morgan’s comments came soon after global fund issuer GraniteShares filed with the U.S. SEC to launch two 3x leveraged ETFs based on XRP.

The proposed ETFs, 3x Long XRP Daily and 3x Short XRP Daily, are designed to give investors triple the daily gains or losses of XRP. They could start trading around December 21, 2025, about 75 days after the October 7 filing.

Because these are leveraged ETFs, they can magnify both profits and losses. For example, if XRP falls 33.3% in one day, investors in the 3x Long ETF could lose their entire investment. A similar price jump could wipe out those in the short ETF.

GraniteShares’ applications join seven other XRP ETF filings currently under SEC review. To Morgan, the persistence of these submissions proves that institutional interest has not disappeared but only paused by regulatory bottlenecks.

“This Will End Badly,” Analyst Warns

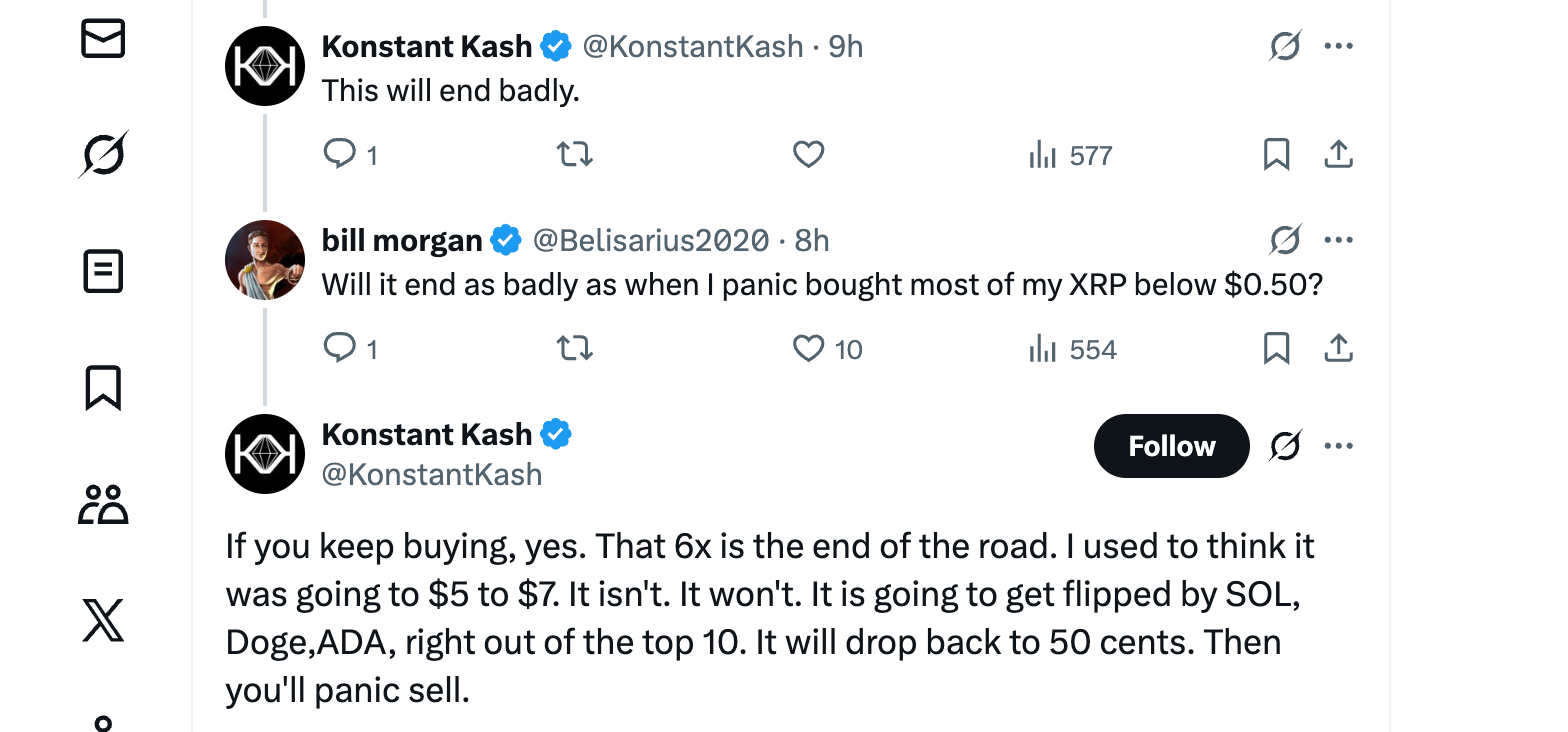

Not everyone shares Morgan’s optimism. Analyst Konstantin Kash responded to Morgan’s tweet with a warning: “This will end badly.”

Morgan fired back by referencing his earlier decision to accumulate XRP when it traded below $0.50. “Will it end as badly as when I panic-bought most of my XRP below $0.50?” he asked.

Since then, XRP has surged over 400%, climbing from under $0.50 to $2.87. This sharp rally from November lows highlights XRP’s resilience and the sustained confidence among investors despite ongoing criticism.

Yet, Kash remains skeptical, criticizing XRP’s fundamentals. He argues the token’s value is inflated and ownership is highly concentrated. “20 wallets hold 50% of the entire supply,” he said, calling the system “a racket.”

He predicts XRP’s price could fall back to $0.50 and be overtaken by rivals such as Solana, Dogecoin, and Cardano. In response, Morgan pointed out that around 70% of XRP’s supply held in those wallets is locked in Ripple’s escrow accounts, meaning it’s not in active circulation or being used to manipulate the market.

Related: BNB Flips XRP to Become the World’s Third-Largest Cryptocurrency by Market Value

Delayed Approvals Stalls ETF Trading

Meanwhile, the ongoing U.S. government shutdown has disrupted the SEC’s operations, causing delays in ETF approvals. Earlier this month, the SEC missed its deadline to decide on Canary Capital’s proposed Litecoin ETF, sparking concerns that XRP-related filings could face similar delays.

Analysts note that the SEC now uses the Generic Listing Standards framework, which lets it approve or reject ETF applications at any time. As a result, the usual approval timelines no longer apply.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.