- Changpeng Zhao mocked US critics as two banks became insolvent.

- During FUD, Binance processed over $14 billion within a week.

- Binance’s spot volumes increased by 13.7% to an all-time high of $504 billion.

Changpeng Zhao, the CEO of Binance, the largest crypto exchange, took to Twitter to mock US detractors as two significant banks in the United States became insolvent and unable to process customer withdrawals.

“They FUD us, and banks fail,” Zhao tweeted, referring to how Binance remained strong despite the constant negative propaganda it suffered from US entities that hoped the exchange would fail. However, the failure was on the side of US-based businesses.

The two recently collapsed US banks are Silicon Valley Bank, with $209 billion in total assets, and Silvergate, a crypto-focused bank. Following the collapse of the FTX crypto exchange last November, Binance battled with continuous negative narratives from multiple quarters that were postulating that the most prominent crypto asset manager could also be facing a liquidity crunch.

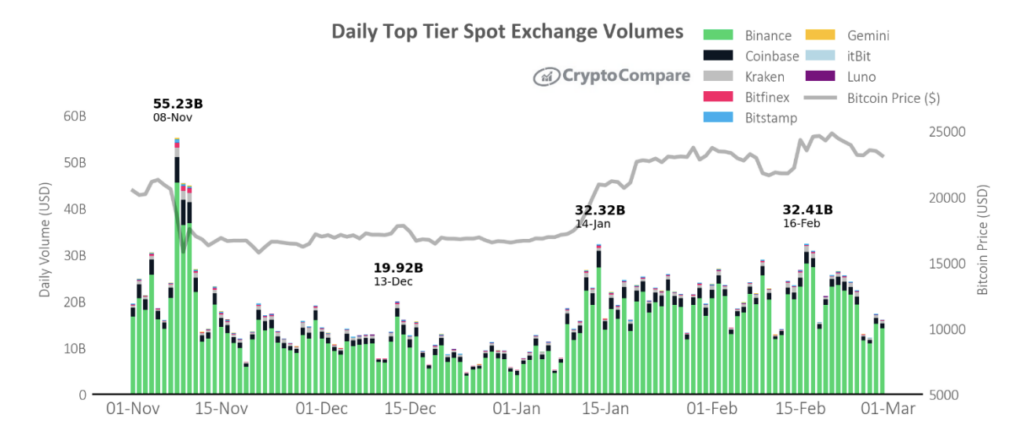

Due to fear, uncertainty, and doubt, crypto enthusiasts rushed to withdraw their funds from Binance. Contrary to the extreme FUD at the time, Binance survived what some people described as one of the most extensive stress tests any financial institution has ever faced. According to on-chain data, the exchange processed over $14 billion in withdrawals within weeks.

Interestingly, data shows that Binance’s reserves have continued to increase. According to a recent report, Binance maintained an upper hand over its competitors regarding the crypto spot market share for the last four months.

CryptoCompare, a market research firm, noted that Binance’s spot volumes increased by 13.7% to an all-time high of $504 billion, leading other top-tier crypto exchanges, such as Coinbase and Kraken, with an extensive margin despite the regulatory frictions and community FUDs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.