- Binance wallets and users control roughly 87% of the USD1 stablecoin circulating supply today.

- USD1 integration expanded after CZ received a presidential pardon from Donald Trump.

- A $2 billion USD1 transaction significantly boosted the stablecoin’s market visibility globally.

A growing concentration of a Trump-associated stablecoin inside Binance is raising fresh questions about the financial links between the world’s largest crypto exchange and the family-backed digital-asset venture World Liberty Financial, according to blockchain data reviewed by Forbes.

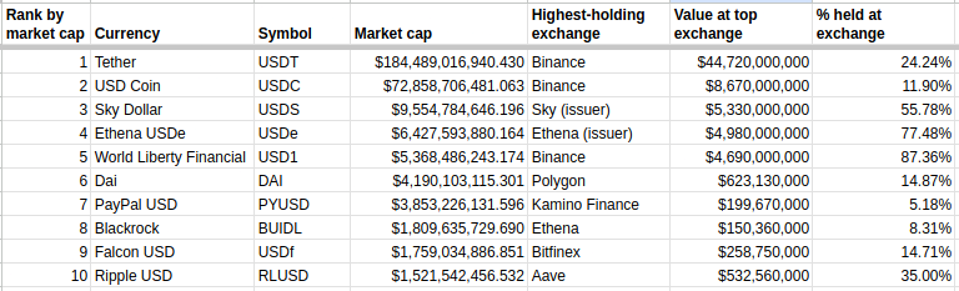

The exchange and its users currently hold about $4.7 billion worth of USD1, roughly 87% of the stablecoin’s total $5.4 billion supply, marking the highest single-exchange concentration among the top stablecoins by market capitalization.

A Timeline That Draws Scrutiny

The relationship between the companies has developed alongside major legal and political milestones involving Binance co-founder Changpeng Zhao.

- 2023: Zhao agreed to step down as chief executive as part of a $4.3 billion settlement with U.S. authorities after pleading guilty to anti-money-laundering compliance failures.

- 2024: He served a short prison sentence following the case.

- 2025: President Donald Trump granted Zhao a presidential pardon.

- 2025 onward: Binance significantly expanded its integration of USD1, adding trading pairs, launching promotional campaigns, and holding a growing share of the token’s supply.

The sequence has led some analysts and political observers to question whether Binance’s expanding role in the Trump-linked stablecoin ecosystem could be interpreted as strengthening financial ties after the pardon, though no evidence has been presented showing any direct arrangement.

Additionally, Binance has expanded trading pairs for USD1 and conducted promotional campaigns encouraging users to hold the token, moves that helped embed the stablecoin more deeply within the exchange’s ecosystem. In one promotion, USD1 holders were offered incentives paid in World Liberty Financial’s governance token, WLFI.

The $2 Billion Deal That Boosted USD1

In 2025, USD1 was used in a roughly $2 billion transaction connected to an Abu Dhabi-backed investment fund, a deal that significantly boosted the stablecoin’s market capitalization at the time.

Observers said that Binance retained the USD1 rather than redeeming it, meaning the reserves backing those tokens remained invested in short-term U.S. Treasury instruments. At current Treasury yields of roughly 3.6% to 3.8%, analysts estimate that the interest generated from those reserves could translate into tens of millions of dollars in annual income for the stablecoin issuer, which is partly owned by a Trump-affiliated entity.

Company Responses

Binance has said its role in listing and promoting USD1 follows the same framework used for other digital assets and denies any special arrangement tied to political developments. World Liberty Financial has similarly described exchange promotions as standard industry practice and rejected suggestions that Binance holds influence over the company’s operations.

However, some crypto users speculated that CZ may have effectively provided Trump with an indirect payoff in exchange for a pardon and future goodwill.

Related: Trojan Partners with World Liberty for an End-to-End USD1 Integration

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.