- Illicit crypto transactions drop to historic lows across major exchanges.

- Binance leads with only 0.007–0.016% of volume linked to illicit activity.

- Industry compliance and monitoring improvements drive safer crypto trading.

The crypto sector is entering a new phase of maturity, with illicit transaction volumes on centralized exchanges falling to historic lows. This is according to a new analysis published by Binance, which uses independent data from Chainalysis and TRM Labs.

Notably, the findings show that illegal activity now accounts for only a tiny fraction of global exchange volume. This marks one of the most evident signs yet that the industry’s compliance standards and detection systems have strengthened over the past two years.

Illicit Activity Drops to 0.018–0.023% Across Major Exchanges

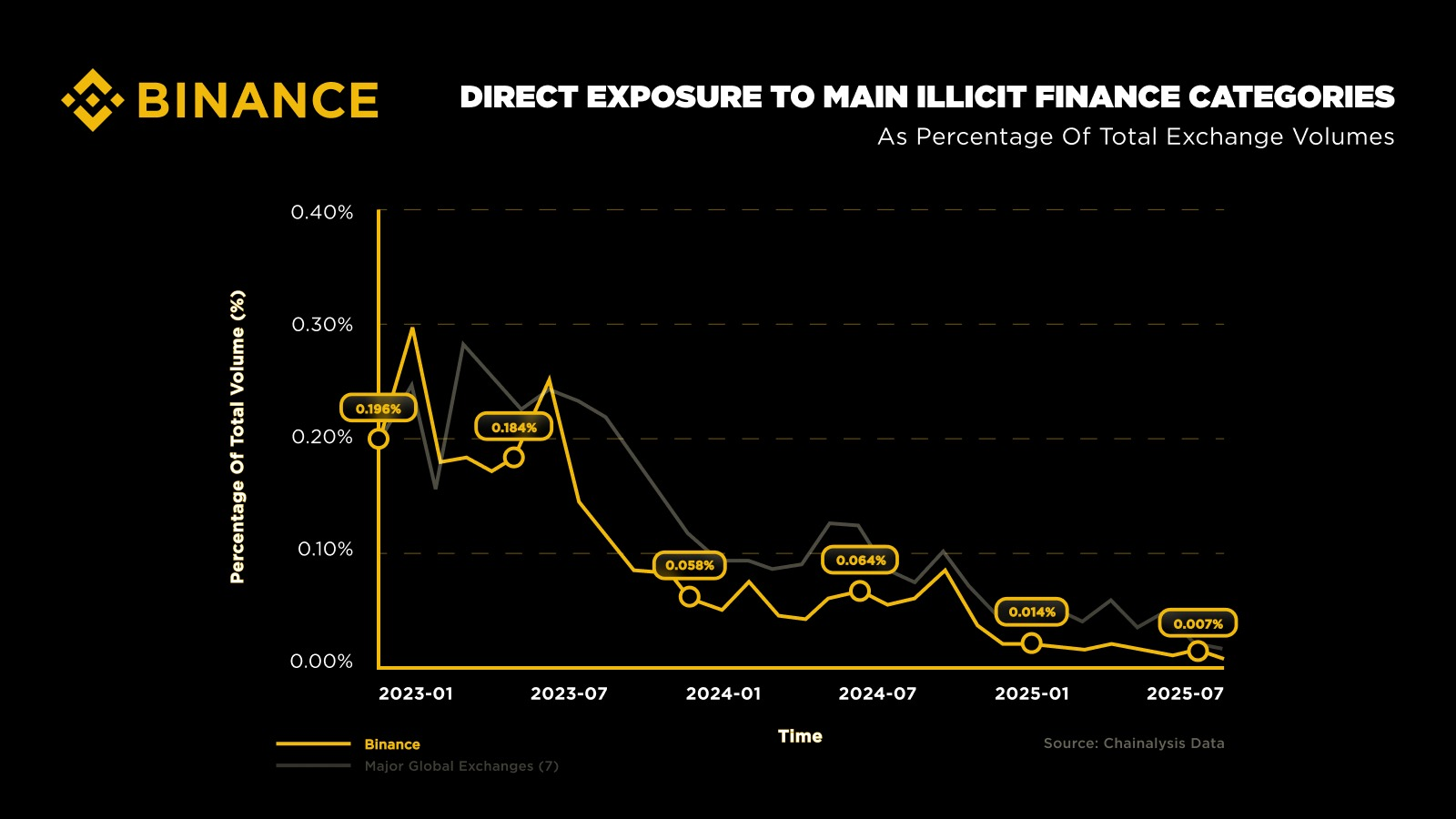

Across the seven largest centralized exchanges by volume, only 0.018% to 0.023% of total transactions as of June 2025 were directly linked to illicit blockchain addresses. The figure represents a dramatic improvement from 2023 levels. It follows closer collaboration among exchanges, analytics firms, and law enforcement agencies.

The report highlights Binance as the strongest performer. Chainalysis data shows that only 0.007% of Binance’s 2025 transaction volume was tied to illicit sources, less than half the average of the next six largest exchanges.

TRM Labs’ data aligns with that trend, placing Binance at 0.016%, compared to the 0.023% average for competitors.

Notably, Binance processes daily volumes comparable to the combined activity of the six next-largest platforms. The report stressed that keeping illicit exposure this low at such a magnitude highlights advanced monitoring capabilities and disciplined compliance practices.

Related: Binance Soaks Up 90% Of ERC-20 Stablecoin Deposits, Pushing ETH Higher On Spot

A 96–98% Reduction Since 2023

Both analytics firms show that Binance reduced its illicit exposure by 96% (Chainalysis) to 98% (TRM Labs) between January 2023 and June 2025, outpacing improvements by other major exchanges by 4–5 percentage points.

In 2025 alone, Binance processed more than $90 billion in daily volume across roughly 217 million trades, yet maintained industry-leading safety ratios.

How Binance Achieved These Results

Binance attributes the improvement to a multilayered approach that mixes people, technology, and collaboration:

- 1,280+ compliance and risk specialists, representing 22% of the company’s global workforce

- Hundreds of millions of dollars invested annually into KYC, transaction monitoring, and anti-fraud tools

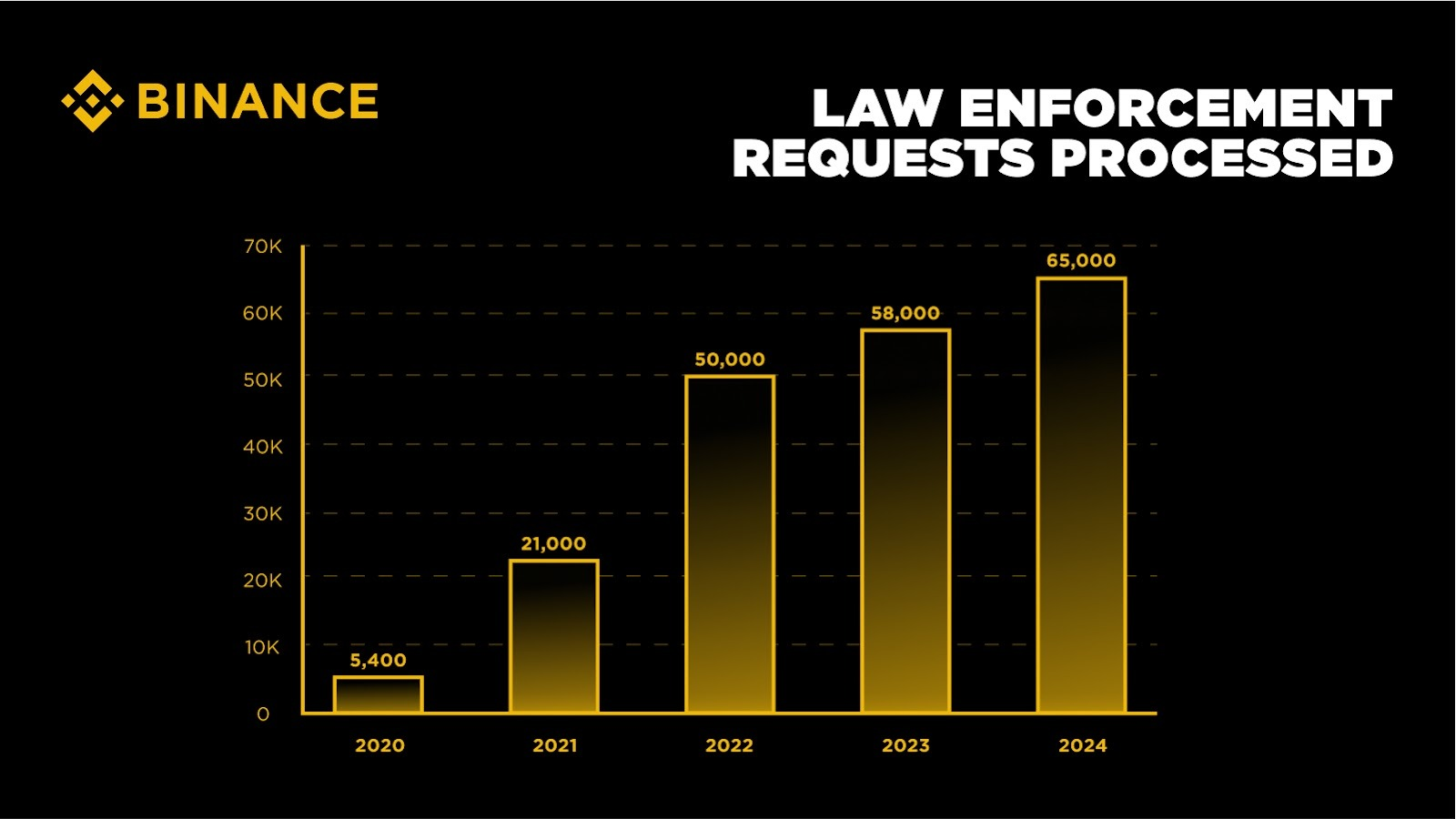

- 240,000+ law enforcement requests handled and 400+ training sessions for investigators worldwide

- Participation in collective action networks like the Beacon Network and T3+ program with Tether, TRON, and TRM Labs

- Enhanced transaction-monitoring powered by AI and machine-learning models.

Crypto Now Cleaner Than Traditional Finance, Data Suggests

The report also places crypto in a broader financial context. Global illicit finance via traditional channels still reaches trillions of dollars annually.

Meanwhile, blockchain-tracked illicit flows across the top seven exchanges remain in the low billions. They are even “well below” the levels seen in traditional banking, according to a 2025 White House report cited by Binance.

Because blockchain transactions are publicly traceable, regulators and investigators can follow value flows in ways impossible in fiat systems. Combined with modern compliance frameworks, this transparency is pushing illicit crypto usage toward near-negligible levels.

Binance argues that the trend shows an industry transformation. Crypto exchanges today operate under strict standards, setting benchmarks that rival or surpass those of traditional finance. As adoption grows, the data signals that digital assets can scale globally without sacrificing user safety.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.