- Reports showed $21.75B left Binance in 7 days; Yi He said the figure came from price-effect math, not withdrawals.

- Binance denied listing-profit claims, citing refundable deposits over 1 to 2 years and warning of legal action.

- BTC on Binance held $111K support, with a $113K to $114K test framing the near-term tape.

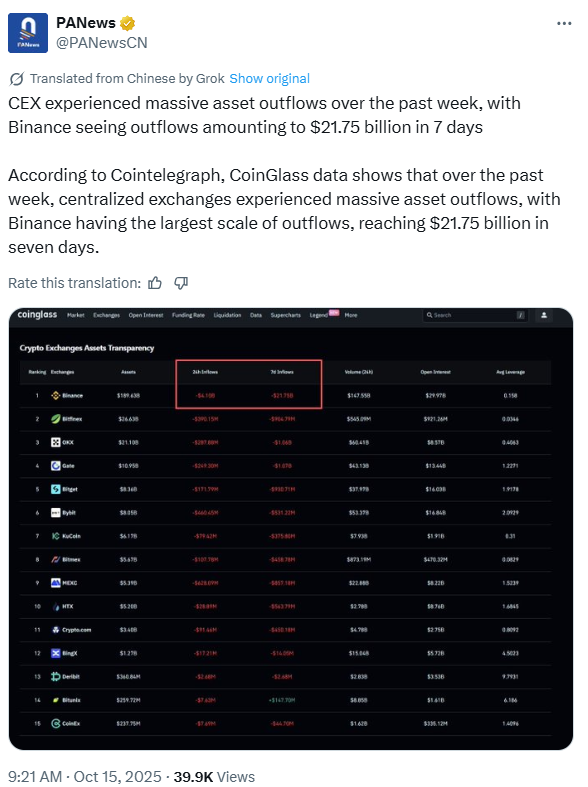

Centralized exchanges (CEXs) have witnessed major asset outflows over the past week, with Binance recording the largest share, approximately $21.75 billion in seven days, according to data cited from CoinGlass.

The report initially sparked concerns about large-scale withdrawals and potential investor flight from the world’s largest crypto exchange.

Related: Binance Nears Korea Return as FIU Review of GOPAX Deal Points to Year End Approval

What the $21.75B number represents

CoinGlass dashboards headline showing $21.75 billion in seven-day outflows at Binance set the narrative, so the calculation method had to decide its meaning.

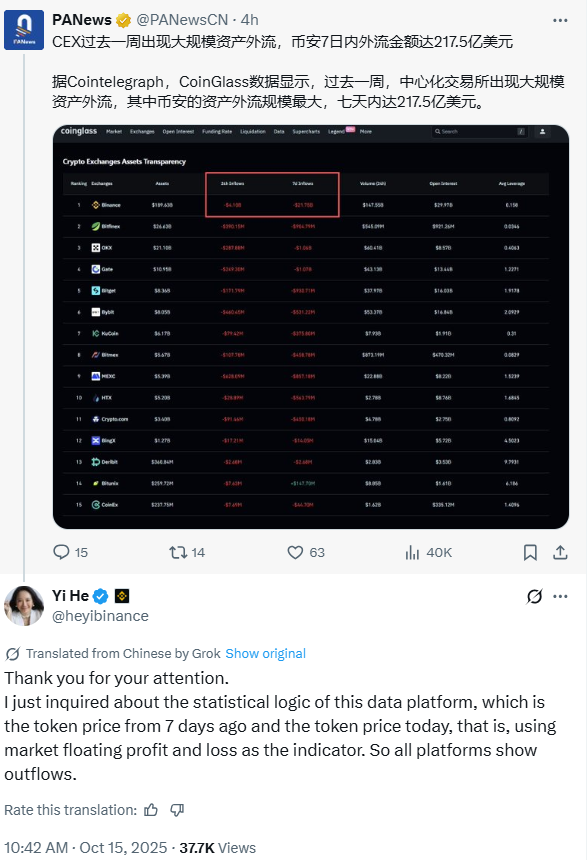

Binance Marketing Chief Yi He addressed the matter, explaining that the data platform’s calculation method was misleading.

Yi He said the platform re-priced assets using last week’s balances against today’s prices, so market declines looked like net withdrawals. Using such a method meant converting price moves into faux flows (net outflows), which explains why several CEXs also appeared negative in the same window.

The Binance executive reframed the $21.75 billion figure as a data artifact rather than a reflection of real capital movement.

How Binance reframed exchange flows

Binance argued the dataset compared point-in-time inventories to new prices, which mechanically marks assets down and prints outflow totals even if coins never left the exchange; the logic follows the accounting, not the blockchain.

By shifting attention from wallet movements to calculation mechanics, Binance redirected scrutiny toward how third-party tools label flows; that shift matters because traders price liquidity risk differently when they see valuations versus withdrawals.

If readers separate price revaluation from netflow, the outflow panic unwinds quickly; if they do not, market sentiment can still tighten spreads and widen funding costs.

BTC on Binance: Levels to Watch

Internal Binance data reveals that Bitcoin trading activity continues to experience heightened volatility. The cryptocurrency recently dipped below $111,000, nearing its lower support range, as selling pressure persisted.

At press time, the digital asset trades roughly around $112K as traders remain cautious following a recent liquidity shock. Market analysts at Binance interpreted the ongoing movement as a consolidation phase.

Should Bitcoin maintain support above $111,000, the market could see a short-term rebound toward $113,000–$114,000.

Listing Allegations and Binance’s Response

Meanwhile, Binance also addressed allegations concerning its token listing practices. The exchange stated it does not profit from token listings and that any deposits collected are typically refundable within one to two years.

The clarification followed claims from Limitless Labs CEO CJ Hetherington, who alleged Binance sought 8% of his project’s token supply. He also claimed that the CEX and its founders have been dumping tokens in the open market.

Binance strongly denied the accusations, describing them as false and defamatory, while emphasizing that it maintains confidentiality in listing communications. The exchange added that it operates transparently and without charging listing fees.

The exchange said that the allegations of token dumping are “also entirely untrue and unsubstantiated,” stating that it could take legal action “to protect our interests.”

Related: Altseason 2025 Setup Builds as Bitcoin Dominance Slows, Analysts Eye Rotation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.