- Binance retains 34.7% of the CEX market, maintaining its dominance despite global regulatory challenges.

- Upbit emerges as a strong contender, driven by compliance and growth in South Korea’s crypto market.

- Leveraged trading trends boost Binance and Bybit, attracting experienced traders with advanced tools.

The cryptocurrency market keeps growing, and centralized exchanges (CEXs) are key in allowing trading for both everyday and big-time investors. Data shows Binance is leading the ranking with close to 35% market share, followed by Crypto.com, Upbit, and other major players.

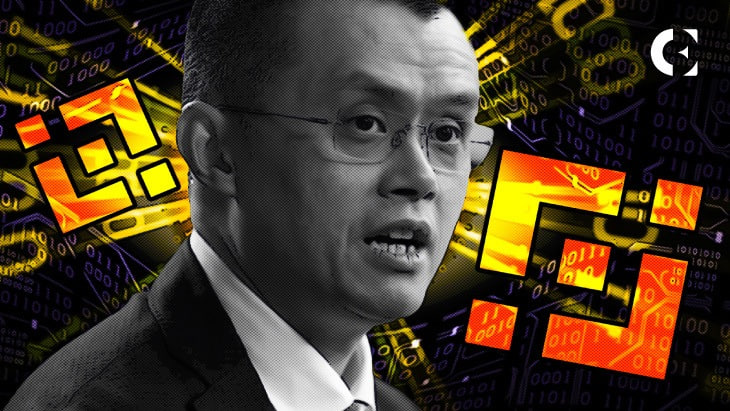

Binance: The Market Leader

Binance is still the king of centralized exchanges, holding a huge 34.7% market share. With $18.27 billion in daily trading, Binance is on top thanks to offering tons of cryptocurrencies, advanced trading tools, and low fees. Even with regulatory issues in places like the U.S. and Europe, Binance is a global force, providing services like staking, futures, and NFT marketplaces. Over 82 million people visit monthly, showing its wide reach.

Related: Binance Tops Crypto Survey as AI and Blockchain Take Center Stage

New Players Making Moves

Crypto.com and Upbit have 11.2% and 9.8% market shares, respectively. Crypto.com is getting popular with user-friendly features like crypto debit cards and loyalty programs. Upbit leads in South Korea, helped by following the rules and fitting in with the regional financial system.

Bybit, with 8.9% of the market, is a hit with derivatives traders due to high-leverage options and reliable infrastructure. Coinbase, based in the U.S., holds 6.5% of the market, drawing in retail and institutional investors with its focus on following the rules and an easy-to-use interface. Other platforms like Gate.io (6.8%), Bitget (6.4%), OKX (6.2%), MEXC (6.1%), and HTX (3.3%) are growing by offering unique features like copy trading and early access to new crypto projects.

Related: Binance CZ Addresses Memecoin Hype: No Purchases, But No Opposition Either

Where the Crypto Exchange Industry is Headed

Centralized cryptocurrency exchanges are the big players, with Binance and Crypto.com leading globally. Sticking to regulations is a big deal, especially in the U.S. and Europe.

Platforms that focus on user experience and innovation, like Crypto.com and Bitget, are raising the bar. Crypto.com’s loyalty programs and Bitget’s social trading features change how users interact with exchanges, giving value beyond just trading.

Leveraged trading and derivatives are now major trends, making platforms like Binance and Bybit even more attractive. With advanced tools and high liquidity, these exchanges are favorites among experienced traders.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.