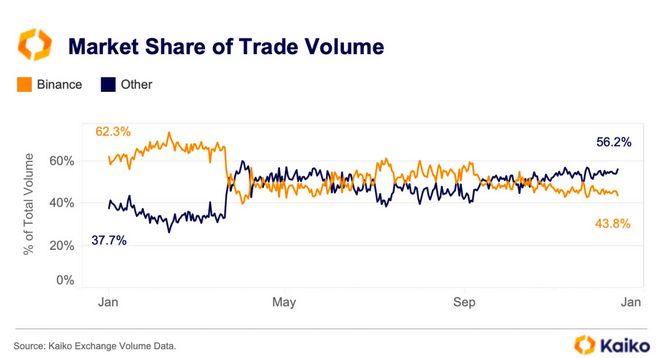

- Binance’s spot volume market share among centralized exchanges dropped 18% this year.

- The drop came after the CFTC and SEC stepped up regulatory actions against the exchange.

- Binance’s market share now stands at 43.8%, down from a peak of 62.3% in January.

The world’s largest cryptocurrency exchange, Binance, saw its spot volume market share amongst centralized exchanges decline significantly this year, as per Kaiko Research report details. The decline came following the exchange’s legal troubles in the United States.

The U.S. Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) stepped up regulatory actions against the exchange. While the CFTC accused the exchange of trying to move Binance.US customers to its global platform, the SEC made similar allegations alongside wash trading accusations.

The FUD that followed the allegations and the regulatory actions led to investors moving their assets away from the exchange, given that the FTX collapse was still freshly ingrained. Kaiko wrote,

These charges did serious damage to Binance.US, causing massive outflows of liquidity and dropping its market share to nearly 0.

Before that, Kaiko noted that Binance’s spot volume market share already dropped by 50% in March. The drop at the time came after the exchange ended its trading promotions and several zero-fee pairs. At the start of the year, the exchange held close to 70% of the spot volume market share amongst centralized exchanges.

Despite these legal challenges, Kaiko noted that Binance has seen some recovery. In particular, the exchange’s $4.3 billion fine settlement with the Department of Justice (DOJ) for violating anti-money laundering rules is treated by markets as bullish.

Furthermore, the exchange’s pass to continue operating in the United States is also seen as a positive development. At present, Binance’s share stands at 43.8%, against 56.2% held by other centralized exchanges.

Going by the data, other centralized exchanges grew from 37.7% at the start of the year to the current figure of 56.2%. Furthermore, the chart shows that the takeover came around September when legal heat against Binance was rising. Meanwhile, the SEC’s action against Binance.US, Binance, and former CEO Changpeng Zhao is still ongoing. In addition, Changpeng Zhao, who pleaded guilty to money laundering violations in November, has his trial set for next year and could face up to 10 years in prison.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.