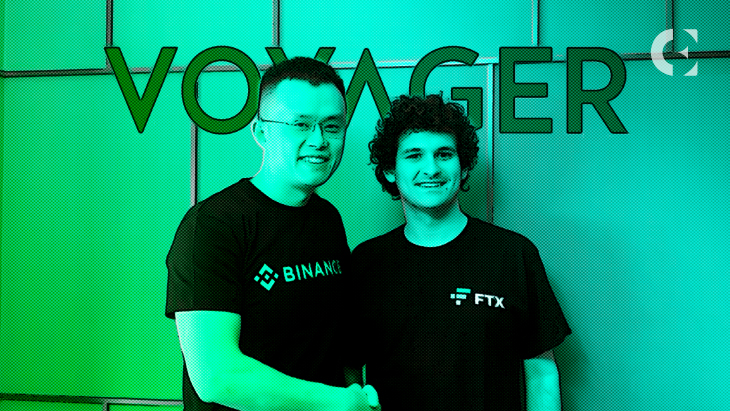

- Binance and FTX are top bidders for Voyager’s assets before the final sale.

- The popular exchange Binance is slightly ahead of FTX with a $50 million bid.

- The auction is scheduled for September 29.

Speaking to the Wall Street Journal, people involved have reported that Binance and FTX have made the highest bids of about $50 million for the assets of bankrupt cryptocurrency lender Voyager Digital. The article adds that neither offer has been accepted so far.

Based on the information provided by the sources, Binance‘s latest offer is around $50 million, which is slightly higher than its rival FTX’s offer.

Established in 2019, Voyager served as a cryptocurrency lending platform that accepted deposits from users in exchange for interest. In 2019, it completed a reverse merger and entered the public markets. The company’s stock peaked in 2021 when the market valued it at $3.9 billion.

In July 2022, the crypto broker filed for bankruptcy, citing market volatility and the surprising collapse of Three Arrows Capital, which shut down just weeks after it suspended withdrawals, trading, and deposits on its platform. Three Arrows Capital supposedly owed Voyager over $650 million.

The bankruptcy petition was filed as Voyager’s stock prices had fallen more than 95%. The crypto lender declared $5 billion in assets and $4.9 billion in liabilities at the time of filing.

Alameda Research, another trading firm owned by billionaire Sam Bankman-Fried, was also a borrower. At the time of its bankruptcy filing, Alameda owed Voyager around $377 million in cryptocurrency loans.

In a court document filed on Monday, the company stated that it would return roughly $200 million to Voyager Digital in cryptocurrency. In June, Alameda also signed a separate, non-binding deal to provide the cryptocurrency lender with $200 million cash, a USDC stablecoin line of credit, as well as a second, 15,000 Bitcoin revolving credit facility.

The auction for Voyager’s assets started on September 13, and the winner will be announced at a hearing on September 29. The Wall Street Journal cites crypto investment company Wave Financial and trading platform, CrossTower as two other potential suitors.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.