- A recent report by the BIS found that 2022’s crypto crash had little impact on traditional finance.

- The collapse of Terra and FTX had the most impact on bitcoin investors from emerging economies.

- The report claimed that trading activity on major exchanges boomed following the crash.

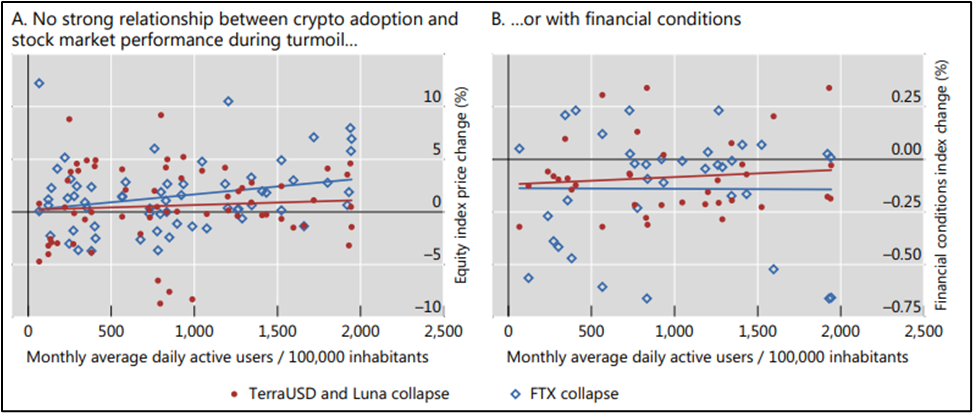

A recent report by the Bank of International Settlements (BIS) found that the turmoil in the crypto market last year had little impact on the broader financial conditions. Market data gathered by the BIS suggested that there is a weak correlation between crypto losses and stress in the broader financial market.

The crypto crashes induced by the collapse of Terra and the downfall of FTX last year had a devastating impact on the crypto industry. However, according to BIS’s latest bulletin, data suggests that crypto crashes have a limited impact on equity prices or broader financial conditions. This also highlights the fact that the stress in the crypto industry rarely spills over to the wider financial industry.

The following graph takes a closer look at the relationship between crypto adoption and the broader financial system amid the crypto crashes. By looking at the losses incurred during the crashes and the change in local equity prices, one can conclude that the aggregate impact on the broader financial system was limited, despite the impact on individual investors.

“Despite crypto’s large user base and the substantial losses to many investors, the market turmoil in 2022 had little discernible impact on broader financial conditions outside the crypto universe, underlining the largely self-referential nature of crypto as an asset class.”

Additionally, the BIS’s report also found that the trading activity on major crypto exchanges like Binance and Coinbase saw a massive rise in the aftermath of Terra’s collapse. Furthermore, the data set on retail bitcoin holdings revealed that bitcoin investors from emerging economies were hit the hardest by 2022’s crypto crashes.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.