- Bitcoin price remains rangebound ($106.5K-$111.5K) with Halloween approaching.

- The critical Oct 24 U.S. CPI data is seen as the trigger for a Bitcoin $120K Halloween target or a $100K dip.

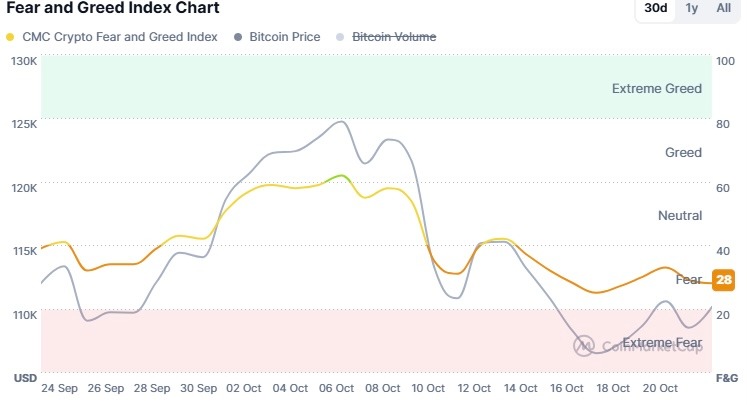

- Technicals show potential bullish patterns, but Fear & Greed index (< 30) signals breakdown risk.

Bitcoin (BTC) price remains locked in a tight consolidation range between roughly $106,500 and $111,500 the past few days. With Halloween just over a week away, traders question whether the historical “Uptober” strength can materialize into a pre-holiday surge towards $120,000, or if the upcoming U.S. CPI inflation data on October 24 will trigger an inevitable dip towards $100,000 support.

The fear and greed index has dropped below 30, suggesting crypto traders are fearing further midterm capitulation.

Related: Bitcoin Price Prediction: BTC Consolidates as Traders Await Breakout Signal

BTC Price Rangebound Below $112K; Can ‘Uptober’ Deliver a Halloween Surge?

Bull Case Pre-Halloween: Weekly Trendline Holds, 4-Hour Pattern Targets $120K

In the weekly timeframe, Bitcoin price has been retesting a crucial rising logarithmic trendline established in the past two years. For as long as the Bitcoin price remains above this support trendline, its macro bullish outlook will remain intact.

However, if BTC price consistently closes below this trendline support in the weekly time frame, its macro bull rally will be either delayed or fully invalidated.

In the four-hour timeframe, the BTC/USD pair has been forming a potential reversal pattern. Since its October 11 capitulation, the BTC/USD pair has been forming a possible inverse head and shoulder pattern, coupled with a bullish divergence of the Relative Strength Index (RSI).

As such, if BTC price consistently closes above the neckline of the inverse head and shoulder pattern, a rally towards $120k in the midterm will be inevitable. The midterm bullish sentiment will be invalidated if the flagship coin consistently closes below the support level around $106.5k.

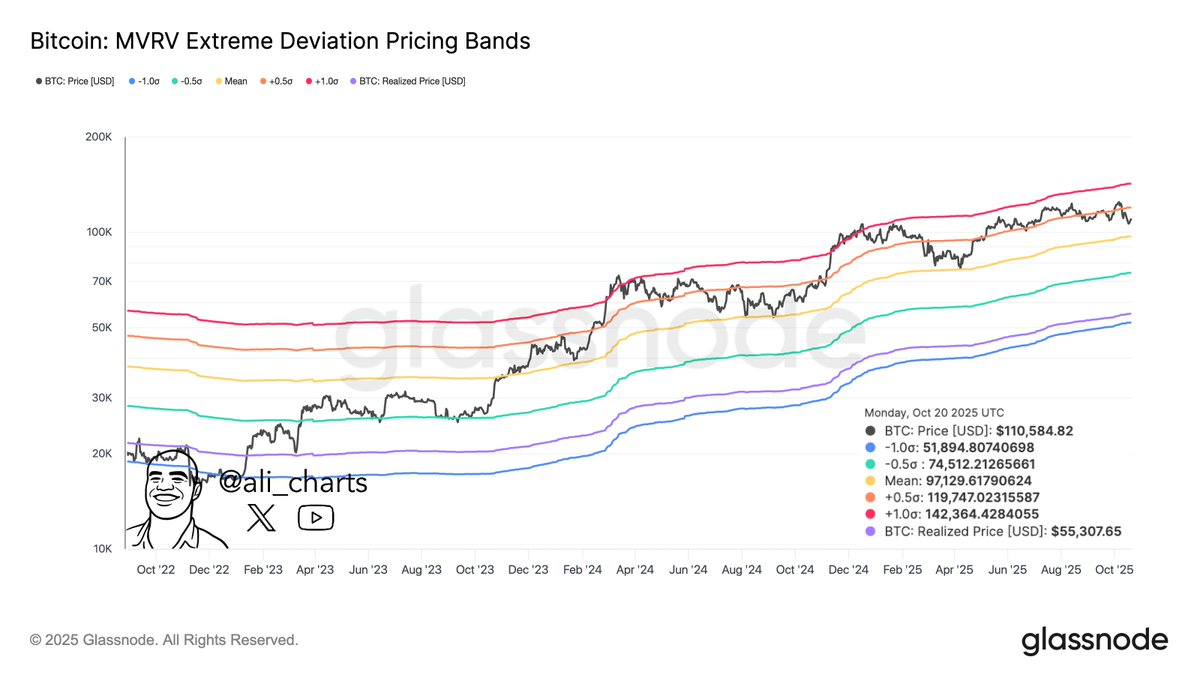

Bear Case Pre-Halloween: Glassnode MVRV Bands Signal $97K Risk

According to Glassnode’s Bitcoin MVRV Extreme Deviation Pricing Bands, the Bitcoin price must rally above the support level of $120k to invalidate a potential drop towards $97,130.

Expert Split: Kendrick Sees Dip Risk, Novogratz Eyes $120K+ Year-End

According to Standard Chartered’s Geoff Kendrick, the Bitcoin price may briefly drop below $100k amid trade war worries. Geoff, however, noted that a BTC price drop below $100k would be an opportunity to seize as the flagship coin is well-positioned to reach $200k in the near term, possibly before the end of this year.

The bank noted that the Bitcoin price will gain in value, fueled by gold’s weaknesses. However, Geoff cautioned that the BTC price must remain above the 50-week Moving Average to maintain the macro bullish momentum.

Meanwhile, Mike Novogratz, CEO of Galaxy, noted that the Bitcoin price will likely hold the support level above $100k. He noted that the Bitcoin price will rally beyond $120k if President Donald Trump makes a move on the Federal Reserve amid anticipated rate cuts.

“The most likely outlook is we’re ranging between $120k-$125k at the end of the year,” Novogratz noted.

The upcoming CPI data will likely determine which short-term outlook gains traction heading into Halloween.

Related: Bitcoin Price Today Steady at $108K, Ethereum $3,600, Solana $185 After Hong Kong ETF Approval

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.