- Bitcoin and AI tech stocks have shown a clear divergence in their trajectories and performance.

- AI stocks surged with the popularity of ChatGPT.

- Bitcoin is underperforming in comparison to AI tech stocks.

The paths and performance of Bitcoin and AI tech stocks have clearly diverged in recent times. While AI tech stocks have become an important sector within the larger technology industry, Bitcoin has attracted a lot of interest and investment as the very first cryptocurrency.

Bitcoin has drawn fervent admirers as well as critics, causing considerable price changes. Several variables, including market demand, legislative changes, institutional adoption, and investor mood, have an impact on the price of Bitcoin.

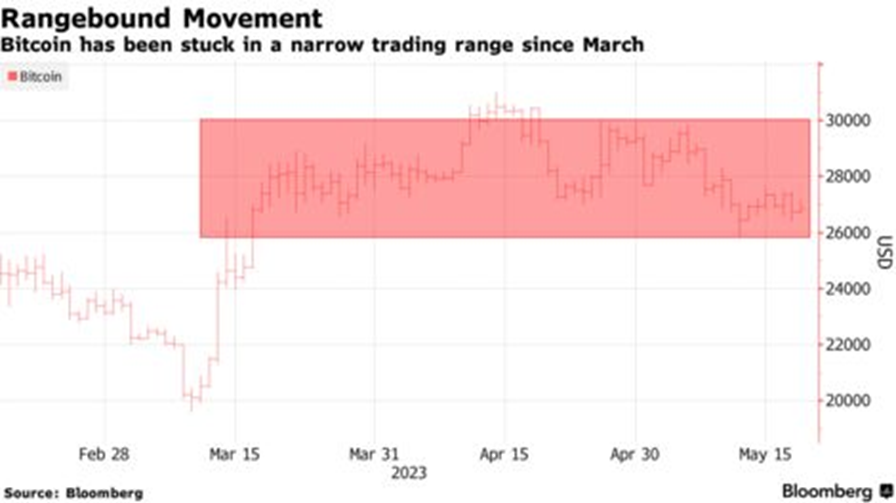

Data from Bloomberg shows that Bitcoin has been stuck in a narrow trading range since March.

AI Tech Stocks Exhibits Stagnant Growth

A wide spectrum of businesses engaged in artificial intelligence technologies and applications are represented by AI tech stocks. Due to the revolutionary potential of AI in numerous areas, including healthcare, finance, transportation, and more, this industry has consistently experienced growth and investment interest.

Advancements in automation, data analytics, machine learning, and other AI-related topics are frequently linked to AI tech stocks. While the price of Bitcoin has fluctuated wildly, AI tech stocks have often seen a more steady growth trend. Market acceptance of AI solutions, technological improvements, company-specific changes, and general investor sentiment toward the technology industry all have an impact on how well AI tech stocks do.

Cryptocurrencies and their tightened scrutiny by US regulators have also affected the price of crypto assets, causing them to decouple from AI tech stocks.

Fiona Cincotta, senior market analyst at City Index, stated:

There has been that decoupling, with the Nasdaq 100 charging higher while Bitcoin has been trading lackluster.” “Bitcoin is in that period of consolidation.

Bitcoin Price Performance

The price of Bitcoin has been quite fluctuating in the past few months. According to CoinMarketCap data, Bitcoin is down by over 15% YTD and 4.4% in the last 30 days. From a yearly high of $31,693, BTC has plummeted to a low of $26,808 at press time. BTC, which breached $28,000 two days ago, has fallen below the $27,000 range with a 1.4% drop in value over the last 24 hours.

It’s crucial to remember that when market dynamics change and new advancements present themselves, the gap between Bitcoin and AI tech stocks may alter over time. As with any investment, it is advisable to do extensive research and consult an expert before making a choice.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.