- Q4 2025 was to showcase crypto’s historic strength, but Bitcoin has instead faced a 24% dip.

- High-profile predictions from Eric Trump, Michael Saylor, and Tom Lee have largely missed.

- Some see a multi-year corrective phase, while others argue long-term bullish trends remain intact.

The final stretch of 2025 was supposed to be the moment crypto reaffirmed its historic fourth-quarter strength. Instead, the market finds itself deep in a correction, far from the bullish forecasts that dominated headlines just weeks ago.

From Eric Trump’s bold optimism to Michael Saylor and Tom Lee’s sky-high year-end targets, Q4 has delivered surprises, but not the type many expected.

Eric Trump’s “Unbelievable Q4” Meets a Harsh Reality

In late September, Eric Trump predicted an “unbelievable” Q4 for crypto, driven by rising M2 money supply, renewed quantitative easing, and seasonal strength. Historically, Bitcoin averages a 77% surge in Q4, while Ethereum typically posts double-digit gains.

But halfway through the quarter, the opposite has unfolded.

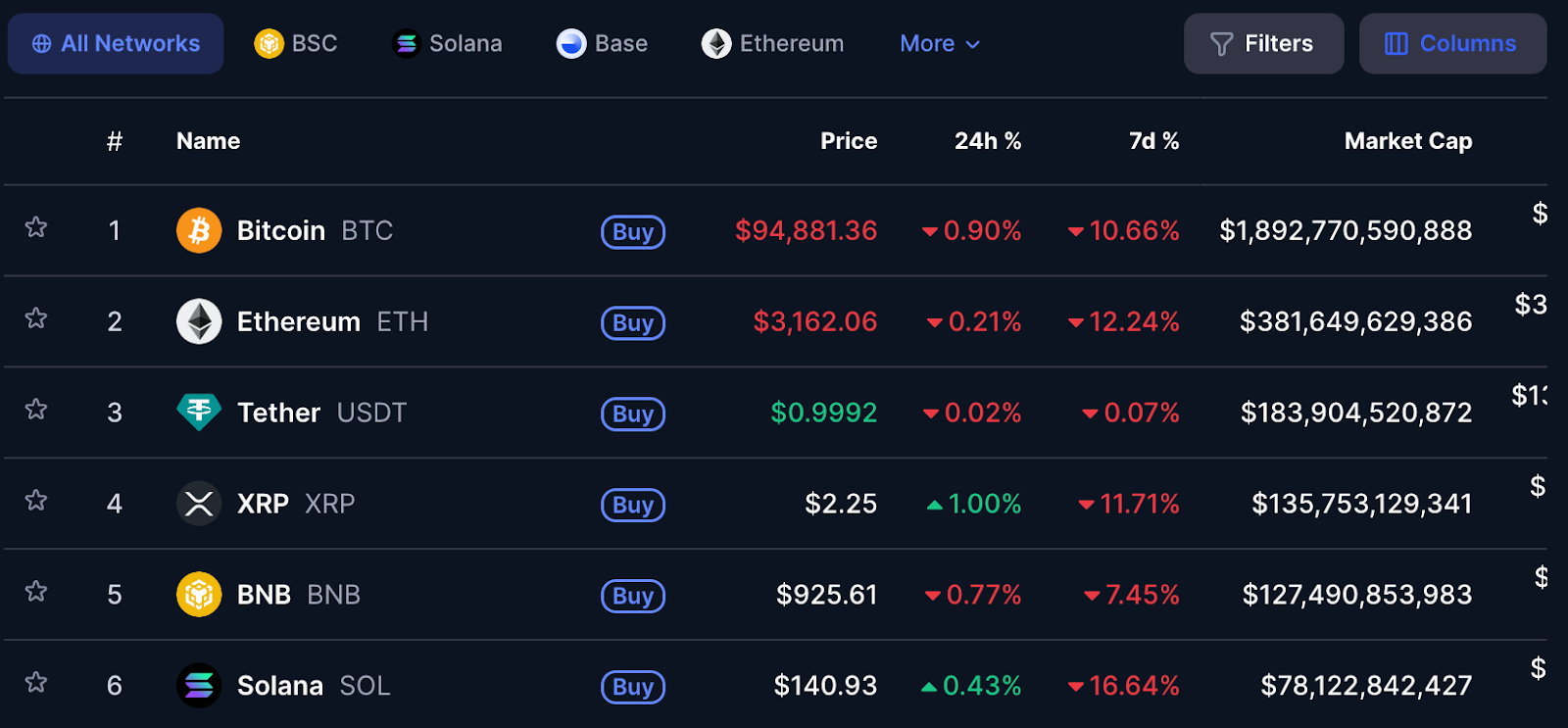

Bitcoin has dropped 16.76% since Sept. 30, falling from $114,056 to below $93,000. Ethereum has slid more than 23% over the same period. Instead of a liquidity-driven melt-up, the market is battling hawkish macro conditions, profit-taking at cycle highs, and renewed volatility.

However, Eric has urged investors not to focus on the short-term pullback, arguing that Bitcoin’s long-term average return of ~70% per year dwarfs traditional assets. His view is that corrections are natural, and the bigger picture remains intact.

Saylor, Lee, and the Christmas Rally That Hasn’t Arrived

Back in September, the industry entered Q4 with remarkable confidence. Michael Saylor told CNBC that many equity analysts expected Bitcoin to surpass $150,000 by Christmas. This projected a 33% rally from its early-September price of $112,210.

Tom Lee went further, forecasting $200,000 by December 25, citing Bitcoin’s sensitivity to rate cuts and the historically bullish fourth quarter. Analysts from Canary, Steno Research, and even Standard Chartered echoed similar year-end targets.

Today, those predictions look increasingly out of reach. Bitcoin has not just stagnated; it has corrected 24% from its October all-time high of $126,000.

Cycle Top Confirmed? A Bearish Case Takes Shape

A key shift in sentiment arrived today from “Mr. Wall Street,” a well-followed Bitcoin cycle analyst. He argues that Bitcoin has already topped this cycle at $126,000 and is now entering a multi-year corrective phase.

His chart suggests:

- Next support: $82,000–$74,000

- Major accumulation zone: $60,000–$54,000

- Timeline: Potential bottom by Q4 2026

The analysis highlights a structure of lower highs and lower lows forming since Bitcoin lost the $104,000 support. Still, not everyone agrees with the bearish scenario.

Is the Rally Really Over? Analysts Split

Some on-chain analysts say Bitcoin hasn’t flipped bearish yet. CryptoQuant CEO Ki Young Ju points to the 6–12 month holder cost-basis at $94,635, a level Bitcoin is currently hovering around. Remaining above that line, he argues, preserves the bull-market structure.

At the same time, Michael Saylor has called for patience, reminding investors that better days are ahead. Tom Lee supported the long-term view today in a new post, noting:

- Bitcoin has seen six declines greater than 50% and three crashes of over 75% since 2017

- Yet it still delivered a 100x return for those who held through the pain

Indeed, Q4 prices are well below expectations. High-profile predictions have broken down. However, analysts are divided between a major correction and a long-term continuation of the bull market.

Whether Q4 will redeem itself or continue to diverge from historical norms now hinges on how the market reacts to the weeks ahead. At the moment, predictions have collided with reality, and reality is writing its own script.

Related: Bitcoin Q4 Bull Market Intact as CryptoQuant Analysts Flag Signals Toward $130K

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.