- Bitcoin held above short-term holder cost basis amid cautious market sentiment.

- It rebounded from $107K to $113K, posting a 2.4% weekly gain.

- Key metrics show fragile recovery with weak volumes, steady futures, and rising profitability.

Bitcoin traded just above the Short-Term Holder cost basis last week, with Glassnode’s Market Pulse highlighting fragile stabilization across spot, futures, ETF, and on-chain indicators as cautious sentiment continued to dominate.

The week also featured a brief dip toward $107,000 followed by a recovery to $113,000, as traders tested support levels. Notably, Bitcoin now trades at $112,947 after a 0.8% uptick in the past day, increasing its weekly gain to 2.4%.

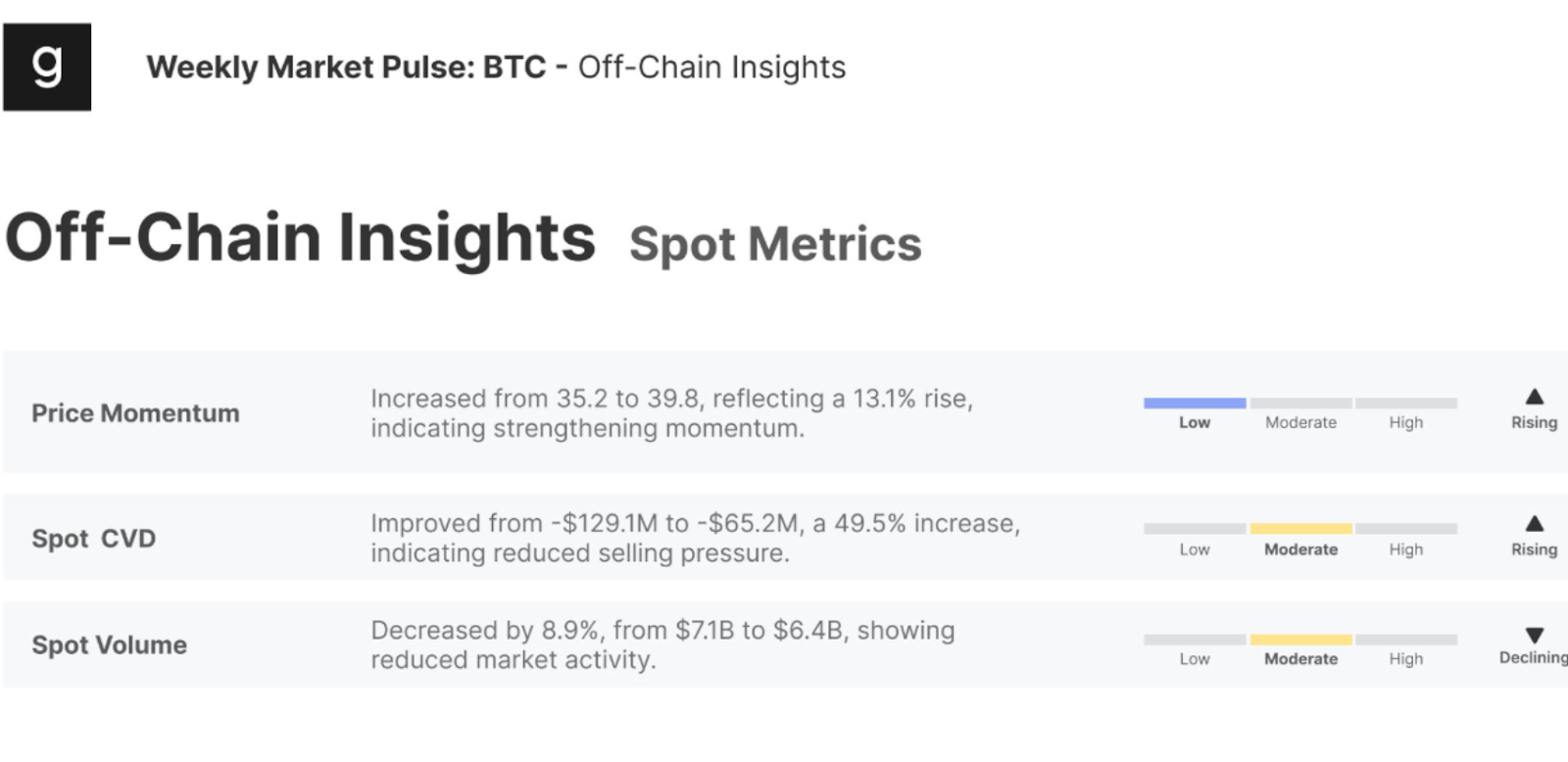

Spot Markets: Selling has Paused, But Buyers Aren’t Convinced

Momentum in the spot market shows that aggressive selling has eased, but buyers are not yet stepping in with conviction. The Relative Strength Index (RSI) rose 13.1%, from 35.2 to 39.8. This indicates reduced seller dominance, though it remained below the neutral threshold of 40.7.

More importantly, while the spot cumulative volume delta (CVD) improved by nearly 50%, showing less selling pressure, overall spot trading volumes actually dropped 8.9%.

Related: Bitcoin (BTC) to Hit $200,000 in Q4? Tom Lee Explains How

This combination of easing sell pressure and weak buy volume is a classic sign of a fragile, low-conviction market.

The Glassnode report noted that Spot CVD improved from -$129.1 million to -$65.2 million, a 49.5% increase, indicating reduced selling pressure.

Futures Market: Traders are Holding, Not Adding Risk

Futures activity held firm. Open interest rose slightly to $45.2 billion, close to its upper statistical band of $47.2 billion. This suggests traders kept positions open without adding significant new leverage.

However, funding rates for long positions fell 8.4% to $2.5 million, showing reduced appetite to pay premiums for bullish exposure. Meanwhile, perpetual futures cumulative volume delta improved 74.9% to negative $186.7 million, highlighting buy-the-dip behavior during the week’s move to $107,000.

Options Market: The “Smart Money” is Hedging for a Drop

Options market participation decreased, with open interest dipping 1.2% to $43.1 billion, down from $43.7 billion. Volatility spreads narrowed from 18.4% to 17.4%, signaling calmer expectations and a reduced risk premium.

Nonetheless, traders maintained a defensive posture. The 25-delta skew rose to 10.1%, exceeding its high-end threshold of 7.4%, indicating persistent demand for downside protection and growing bearish sentiment.

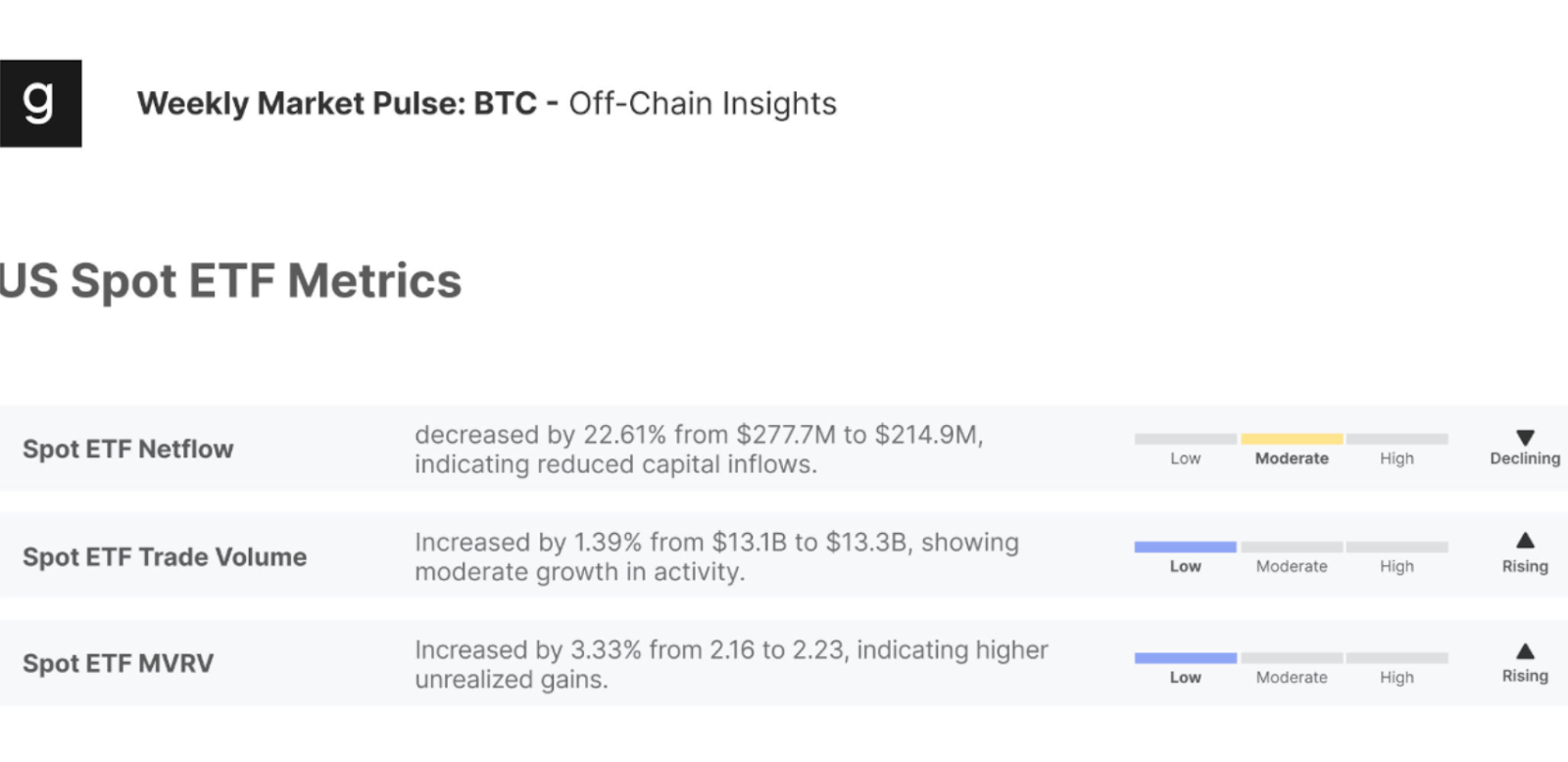

ETF Flows: Institutional Buyers are on the Sidelines

U.S.-listed spot Bitcoin ETFs saw slower inflows last week. Net flows declined 22.6%, from $277.7 million to $214.9 million. While ETF trading volume ticked up slightly to $13.3 billion, it remained below historical norms.

The ETF market value-to-realized value (MVRV) ratio rose modestly, from 2.16 to 2.23, suggesting mild unrealized gains and limited short-term profit-taking.

On-Chain Activity Sees Modest Uptick

Network activity strengthened slightly. Active addresses increased 3.8% to 719,300, moving back within the historical range. Transfer volumes slipped 3.6% to $8.3 billion, while transaction fees dropped 6% to $490,700, signaling reduced demand for blockspace.

Meanwhile, capital flows showed mild improvement. Realized capitalization rose 2.7% to 2.8%, while the short-term to long-term holder supply ratio edged higher. The share of hot capital declined slightly, reflecting less speculative churn.

Related: Bitcoin ETFs See $246 Million Inflows, But Overall Market Remains Cautious

Notably, more investors are in profit. The share of supply in profit climbed to 89%, up from 88%. Net unrealized profit/loss rose 18.6% to 1.14, while the realized profit-to-loss ratio advanced 42% to 1.4, showing investors were locking in gains at a measured pace.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.