- Bitcoin trades below key EMAs, facing heavy resistance near $90K–$90.7K.

- Derivatives cooling as leverage drops, reducing volatility and upside momentum.

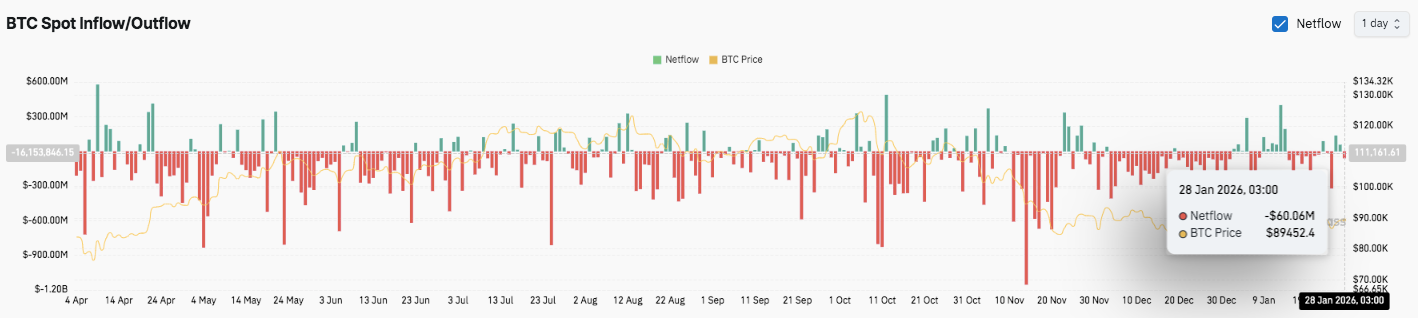

- Corporate BTC accumulation rises, yet spot inflows remain weak and cautious.

Bitcoin hovered near $89,200 during the latest four-hour session as traders watched for signs of stability after a sharp rejection near $98,000. The pullback erased recent breakout hopes and pushed price back into a prior consolidation range.

Short-Term Structure Remains Fragile

On the 4H chart, Bitcoin remains below its 50, 100, and 200 exponential moving averages. These averages cluster between $89,300 and $90,700, forming heavy overhead resistance. Consequently, every recovery attempt faces immediate selling pressure.

Momentum indicators confirm hesitation. The Chaikin Money Flow reading sits near negative territory, reflecting limited fresh capital entering the market. Besides, the failed breakout near $98,000 weakened trader confidence and reinforced a corrective tone.

Support near $88,550 to $88,000 has become the first line of defense. A breakdown below $87,630 could accelerate selling toward the broader range low near $84,400. However, holding above $88,000 may allow extended consolidation. Hence, price behavior around this zone will likely shape short-term direction.

Derivatives Cool as Leverage Resets

Derivatives data shows a familiar expansion-and-reset pattern. Open interest rose sharply during prior rallies, peaking above $80 billion as leverage increased.

However, each surge ended with abrupt drawdowns. These resets flushed speculative positions and slowed momentum. Recently, open interest retreated toward the $60 billion area. Consequently, leveraged exposure now appears more conservative.

This cooling phase suggests traders remain wary after repeated liquidation events. Moreover, lower leverage reduces volatility but also limits upside acceleration. Without renewed conviction, Bitcoin may struggle to reclaim the $91,200 to $92,800 recovery zone. A sustained move above that area would signal improving structure.

Spot Flows Lag Despite Corporate Accumulation

Spot market data continues to show heavier outflows than inflows. Selling pressure persists near resistance, while inflow spikes remain brief. Additionally, this imbalance reflects cautious investor behavior rather than aggressive accumulation. Weak spot demand aligns with Bitcoin’s muted price action.

Despite near-term technical pressure, corporate adoption adds a contrasting signal. Steak ‘n Shake recently expanded its Strategic Bitcoin Reserve by $5 million. This move lifted its total holdings to roughly $15 million, equivalent to about 168.6 BTC.

Significantly, the company directs all Bitcoin payment proceeds into its reserve system. Hence, this approach links operational activity with long-term digital asset exposure.

Technical Outlook for Bitcoin (BTC/USD)

Key levels remain clearly defined for Bitcoin as it trades near $89,200 following a sharp rejection from the $97,900–$98,000 zone.

Upside levels include $89,600–$90,300 as the first resistance cluster, followed by $91,200–$92,800 as a critical recovery area. A decisive breakout above $92,800 could open the door for a retest of the $97,900 swing high and restore bullish momentum.

On the downside, $88,550–$88,000 acts as immediate support and a near-term pivot. Failure to defend this zone exposes $87,630, with $84,400 standing as major structural support.

The technical picture shows BTC trading below key EMAs, suggesting the market remains compressed inside a corrective range after a failed breakout. This setup often precedes volatility expansion in either direction.

Will Bitcoin Break Higher or Extend the Pullback?

Bitcoin’s near-term outlook hinges on whether buyers can reclaim the $90,000–$92,800 resistance band. Sustained acceptance above this area would signal trend stabilization and improve medium-term sentiment.

However, continued rejection keeps downside risks active. A break below $87,600 would weaken the structure and shift focus toward $84,000. For now, BTC sits in a pivotal zone where conviction flows and technical confirmation will determine the next decisive move.

Related: XRP (XRP) Price Prediction: XRP Trend Stays Bearish as Ripple Targets Institutional Liquidity

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.