- Bearish four-hour structure persists as Bitcoin stays below all major EMAs near term.

- Failure at key Fibonacci levels signals heavy supply and limited rebound strength.

- Rising outflows and easing open interest reflect defensive positioning, not capitulation.

Bitcoin entered late January under visible pressure as sellers kept control on the four-hour chart. After failing near the recent $97,900 peak, price action shifted decisively lower. Market participants observed a steady pattern of lower highs and lower lows.

Consequently, short-term sentiment turned cautious as Bitcoin traded beneath every major exponential moving average. This alignment reinforced expectations of further downside risk unless buyers regain critical levels.

Short-Term Structure Remains Fragile

Price behavior continues to reflect a bearish market structure. Bitcoin remains capped below the 20, 50, 100, and 200 EMAs. Hence, each recovery attempt meets selling pressure quickly.

The market rejected multiple bounce efforts beneath the 0.382 Fibonacci retracement. That failure highlighted strong overhead supply near the upper $89,000 region. Additionally, volatility expanded on downside moves, suggesting distribution rather than steady accumulation.

Support now defines the near-term narrative. The $87,400 to $87,600 zone has attracted bids so far. A brief reaction developed there, although conviction remains limited.

However, analysts noted that a break below this range could expose $86,000. That level aligns with major horizontal support and the lower Donchian boundary. Significantly, deeper losses could target $84,400, which matches the macro Fibonacci base.

On the upside, resistance remains layered and heavy. The first barrier appears between $88,300 and $89,200. This area overlaps prior consolidation and short-term moving averages.

Moreover, sellers defended the 0.5 to 0.618 Fibonacci band near $91,000 during previous rebounds. That region continues to attract supply. A more meaningful structure shift requires a reclaim above $92,800. Without that move, bearish control likely persists.

Derivatives and Spot Flows Add Context

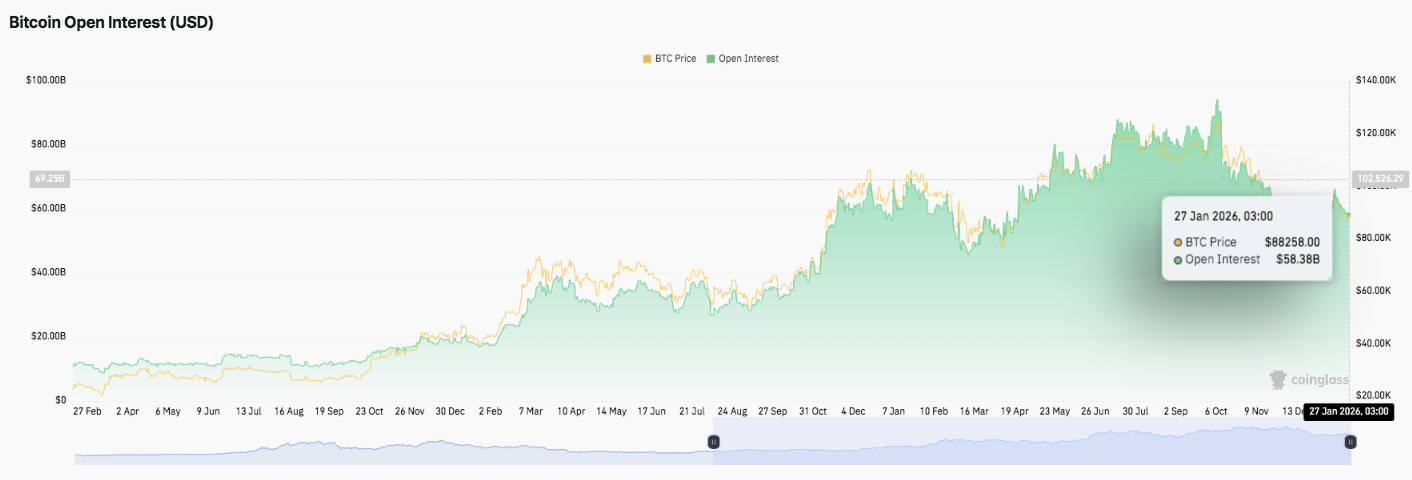

Derivatives data provides additional insight. Open interest expanded steadily throughout 2025 alongside rising prices. Periodic drawdowns accompanied corrections, indicating leverage flushes rather than participation loss. Recently, open interest slipped toward $58 billion. Consequently, traders appear to unwind positions after heightened volatility, not exit the market entirely.

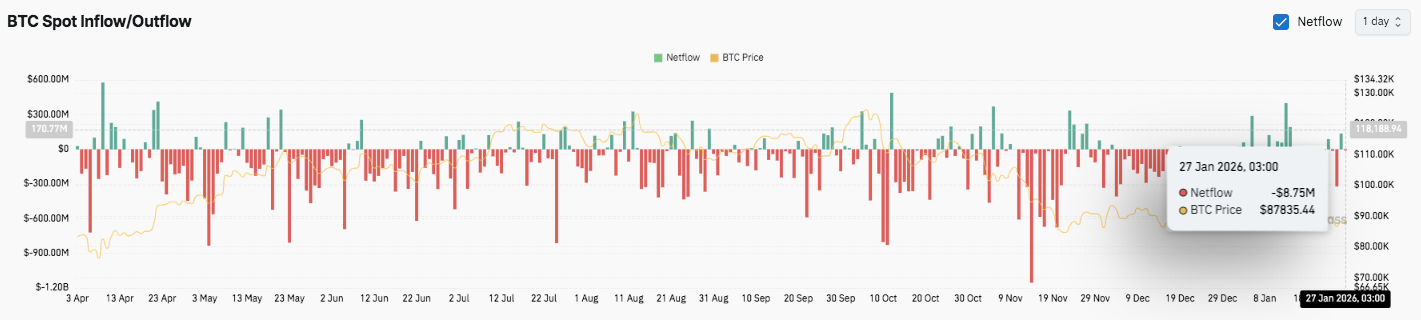

Spot flows, however, paint a more defensive picture. Outflows consistently outweighed inflows during recent sessions. Several sharp outflow spikes coincided with price pullbacks. Moreover, late January recorded net outflows near $88.75 million while Bitcoin traded around $87,800. That behavior reinforced cautious sentiment and fragile demand.

Technical Outlook for Bitcoin Price

Key levels remain clearly defined as Bitcoin trades near a critical decision zone heading into late January.

Upside levels sit at $88,300–$89,200 as the first recovery hurdle, followed by $90,800–$91,200 near the 0.5–0.618 Fibonacci retracement. A stronger breakout could extend toward $92,800–$93,000, which marks the broader breakdown level.

On the downside, $87,400–$87,600 remains immediate support. Below that, $86,000 stands as major horizontal support, with $84,400 acting as macro downside protection.

The technical structure suggests Bitcoin remains locked in a short-term bearish trend, defined by lower highs and sustained trading below the EMA ribbon. Momentum remains seller-controlled, while downside volatility hints at distribution rather than accumulation.

Will Bitcoin Go Up?

Bitcoin’s near-term outlook hinges on whether buyers can defend the $87,400 support zone. A hold could allow a relief bounce toward $89,200. However, sustained bullish momentum only emerges above $92,800.

Failure to hold $87,400 risks accelerating losses toward $86,000 and potentially $84,400. For now, Bitcoin remains in a pivotal range, with confirmation required before the next directional move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.