- Bitcoin price today trades at $112,967 after breaking below key $114,500–$115,000 support levels.

- On-chain data shows $92.7M in outflows and weak SOPR, signaling fading profitability and selling pressure.

- Market liquidations exceed $400M as BTC tests $112,000 liquidity zone, raising risks of deeper correction.

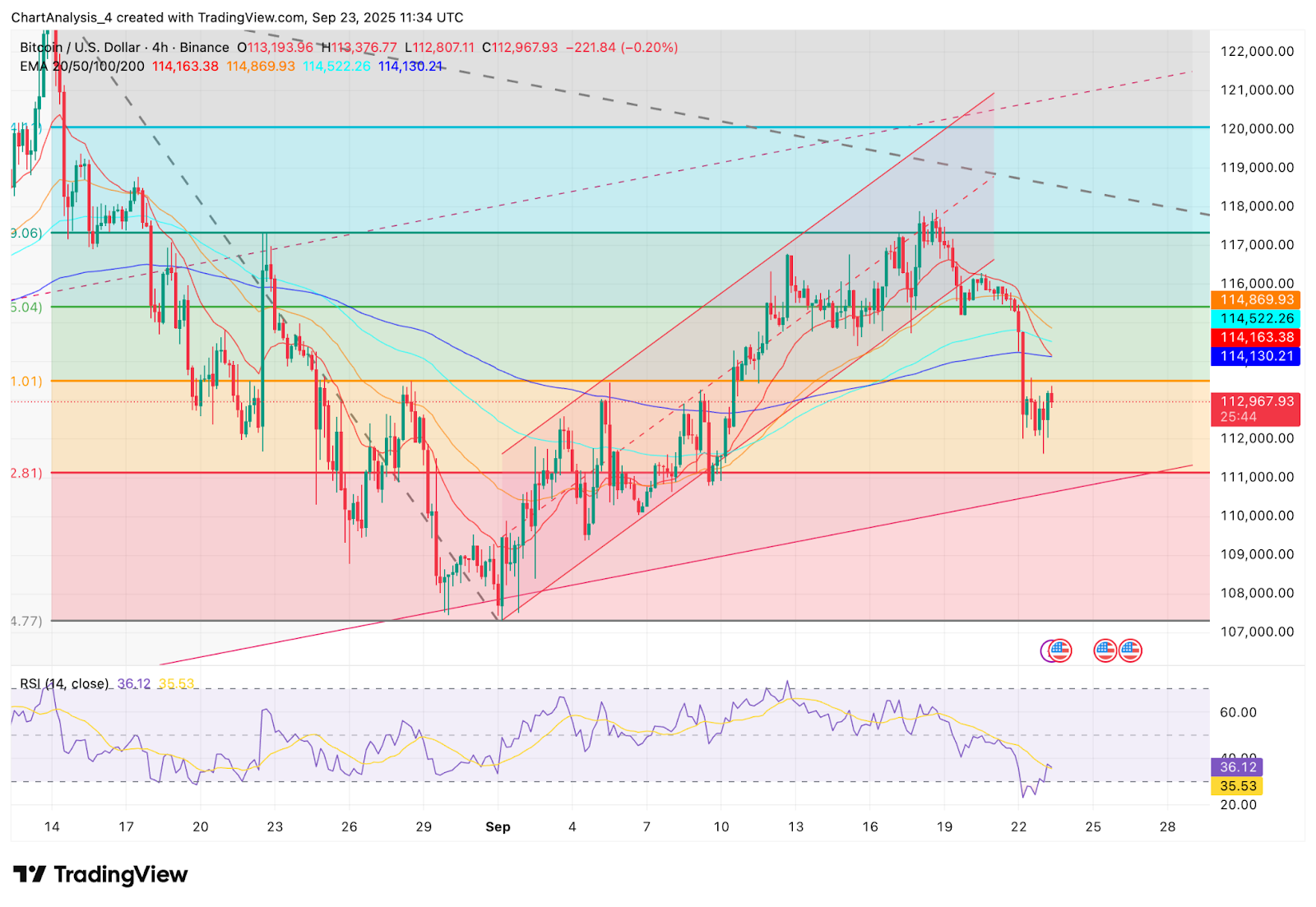

Bitcoin price today is trading at $112,967, slipping after a failed defense of the $114,500–$115,000 zone. Sellers forced price into the $112,000 region, a level where heavy liquidity bids were clustered according to CoinGlass data. The breakdown has sparked concerns that the bull cycle may be stalling despite recent macro catalysts.

Bitcoin Price Breaks Below EMAs

The 4-hour chart highlights the loss of key moving averages as BTC fell from its September high near $117,800. The 20-EMA has crossed below the 50-EMA and is converging with the 100-EMA, signaling increasing bearish momentum. Support near $112,000 coincides with liquidity levels where $400 million in bids were stacked between $111,500 and $110,000.

Related: Cardano Price Prediction: ADA Stalls Below $0.84 Amid RWA Tokenization Hype

Momentum remains weak. The RSI sits at 36, close to oversold territory but still lacking signs of a bullish reversal. Traders warn that failure to hold above $112,000 could expose the broader range toward $110,000 and $108,500. On the upside, BTC must reclaim $114,800 and $116,000 to restore buyer control.

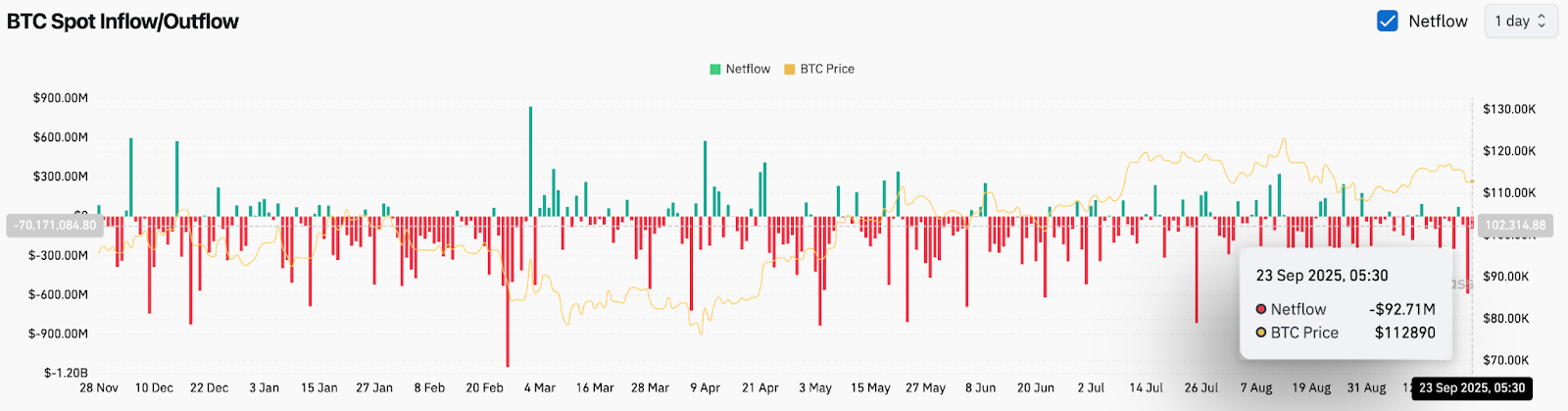

On-Chain Flows Confirm Bearish Tilt

Exchange flows underline the selling pressure. Data from September 23 shows $92.7 million in net outflows from spot exchanges, a sign of capital leaving centralized venues. While large outflows are sometimes interpreted as accumulation, the broader pattern since mid-September has reflected persistent selling.

At the same time, Bitcoin’s Spent Output Profit Ratio (SOPR) has trended lower, showing that coins spent on-chain are increasingly being sold at a loss or with diminished profit margins. This fading profitability underscores the risk that the rally may be running out of steam.

Market Liquidations Intensify

The sudden downturn liquidated more than 402,000 traders in a single day, with total notional losses crossing $400 million. The Bitcoin liquidation heatmap confirms that price action targeted dense liquidity clusters around $112,000, suggesting the decline was partly driven by engineered stop runs.

Derivatives data also points to a weakening market structure. Futures open interest has fallen sharply since last week’s peak, while the taker buy/sell ratio sits at -0.79, reflecting stronger selling activity. Historically, such readings have preceded multi-week corrections, similar to the January-to-April drawdown earlier this year.

Analysts Warn Of Cycle Exhaustion

Macro catalysts have failed to sustain momentum. The Federal Reserve’s recent rate cut, once expected to bolster risk assets, has not fueled a sustained rally. Joao Wedson, founder of Alphractal, argued that Bitcoin is showing “clear signs of cycle exhaustion,” with the Sharpe ratio weaker than in 2024 and institutional risk-reward less attractive.

Related: XRP Price Prediction: Why Is XRP Going Down?

This backdrop has fueled debate about whether the bull cycle is ending. Some analysts highlight that altcoins could draw more attention if Bitcoin’s profitability metrics remain weak even at higher valuations.

Still, not all voices are bearish. Veteran investor Gary Cardone recently claimed Bitcoin could surge to $1 million within two years, arguing that the asset will “break all the models.” While long-term optimism remains strong, short-term signals favor caution.

Technical Outlook For Bitcoin Price

Bitcoin price prediction in the near term centers on whether $112,000 support can hold. Below this level, the next downside targets sit at $111,000 and $109,000, where trendline and liquidity confluence provide protection. A failure there could open risks toward $107,000.

On the upside, resistance stands at $114,800, followed by $116,000. A close above these levels would flip short-term momentum and revive bullish prospects toward $118,000 and beyond. Until then, the technical structure points to consolidation with downside risk.

Outlook: Will Bitcoin Go Up?

Bitcoin price today reflects a market caught between heavy selling pressure and long-term bullish narratives. On-chain indicators and derivatives positioning show fading confidence, while liquidity-driven drops continue to weigh on sentiment.

Related: Avalanche (AVAX) Price Prediction: Will AVAX Hit $50 Soon?

If buyers defend $112,000 and spot flows stabilize, a recovery toward $116,000 is possible. Otherwise, downside risks remain active, with analysts cautioning that the bull cycle may be entering a pause. For now, Bitcoin’s trajectory will be dictated by whether liquidity sweeps evolve into deeper corrections or trigger a rebound from key support.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.