- Bitcoin reclaimed key Fibonacci levels, signaling renewed bullish momentum above $116K.

- Crucial resistance sits at $117,968, with potential upside toward $118,500–$120K.

- Strong futures interest and Saylor’s trillion-dollar strategy reinforce long-term bullishness.

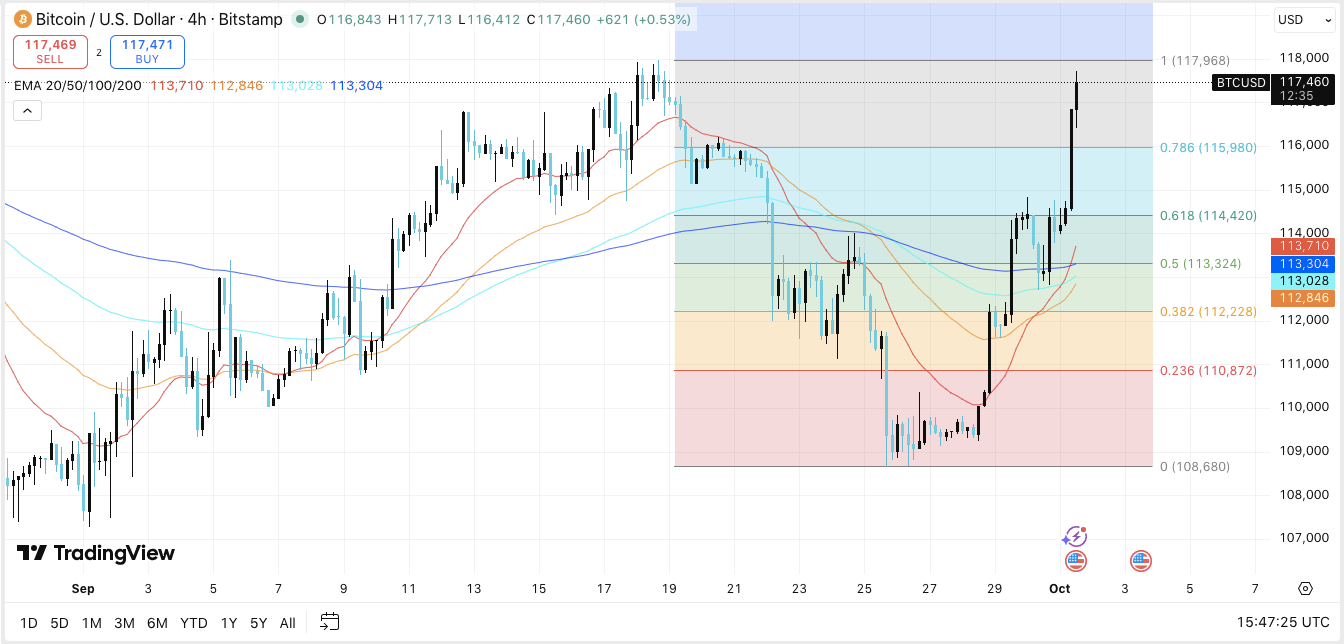

Bitcoin has recently demonstrated remarkable strength, reclaiming key Fibonacci retracement levels on the 4-hour chart. This move signals renewed bullish momentum as the cryptocurrency approaches critical resistance zones.

Traders and investors are closely watching the $117,968 level, which has acted as a short-term ceiling. A decisive breakout above this area could propel Bitcoin toward higher targets, potentially reaching $118,500–$120,000 in the near term.

Key Levels and Trend Outlook

Immediate support for Bitcoin lies around $115,980 and $114,420, corresponding to the 0.786 and 0.618 Fibonacci levels. Should selling pressure intensify, the $113,324 zone, aligned with multiple EMAs, offers a strong demand area. Beyond that, $112,228 marks the next critical support if the market faces a deeper pullback.

The upward trajectory from the $108,680 low has flipped the 50 and 100 EMA zones into support near $113,000. Maintaining momentum above $116,000 could encourage buyers to push toward fresh highs. However, failure to hold above $115,980 may trigger a retracement toward the EMA cluster around $113,000–$113,500.

Futures Market Activity Signals Continued Engagement

Bitcoin futures open interest has surged throughout 2025, rising from under $20 billion early this year to over $80 billion in October. This growth indicates increased speculative activity and growing institutional participation.

While expanding open interest supports a bullish outlook, it also signals heightened volatility during sharp price swings. Currently, the $80 billion level underscores strong market engagement, reinforcing Bitcoin’s dominance in derivatives trading.

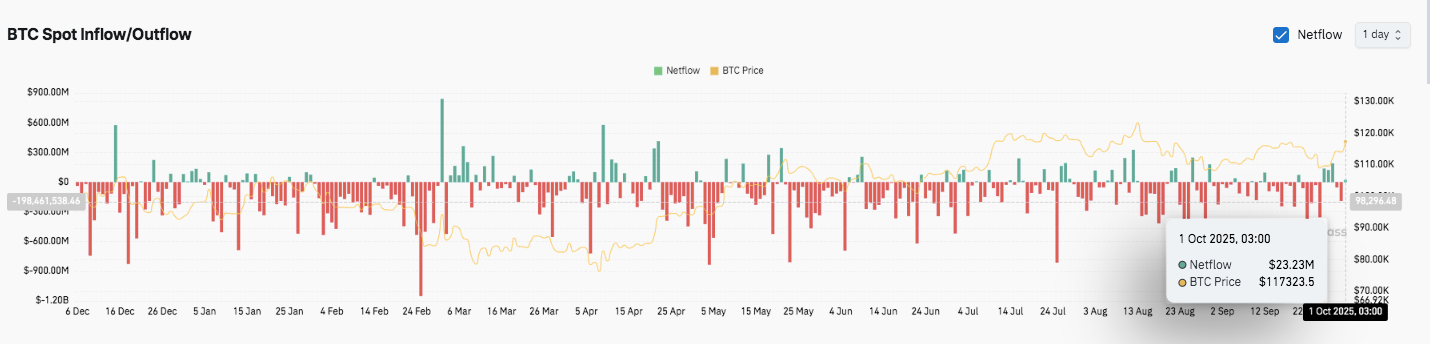

Recent inflows and outflows also reflect cautious accumulation. On October 1, Bitcoin saw a modest positive outflow of $23.23 million, suggesting minor short-term selling pressure. Despite this, broader accumulation trends remain intact, supporting a bullish mid- to long-term perspective.

Related: Buying Bitcoin in 2025? Here’s the Safest and Easiest Route

Michael Saylor’s Ambitious Trillion-Dollar Strategy

Strategy executive chairman Michael Saylor has outlined an ambitious vision for corporate Bitcoin adoption. He compares Bitcoin’s transformative potential to breakthroughs such as electricity and oil, framing it as a form of digital energy. Saylor envisions a “trillion-dollar endgame,” aiming to accumulate Bitcoin at scale while redefining corporate treasuries.

According to Saylor, Bitcoin offers a unique combination of property, capital, and energy in cyberspace. It enables the transfer of value across both time and space, creating opportunities for businesses and institutions seeking long-term preservation of wealth. Significantly, this strategy could influence corporate treasury practices and institutional engagement with digital assets.

Technical Outlook For Bitcoin Price

Bitcoin has shown strong recovery after reclaiming key Fibonacci retracement levels, signaling renewed bullish momentum heading into October.

Key Levels and Trend Outlook

- Upside levels: $117,968 short-term ceiling, followed by potential extensions toward $118,500–$120,000 if buyers maintain strength.

- Downside levels: Immediate support lies at $115,980 (0.786 Fib) and $114,420 (0.618 Fib). Further support zones are $113,324 (EMA cluster) and $112,228 if selling intensifies.

- Resistance ceiling: $117,968 remains a key level to break for medium-term bullish momentum.

The technical picture suggests Bitcoin is consolidating above major EMA clusters, with decisive breakouts likely to expand volatility and trend continuation in either direction. Maintaining above $115,980 is critical for bulls to sustain upward pressure.

Will Bitcoin Go Higher?

Bitcoin’s near-term trajectory depends on buyers holding support zones while attempting to breach $117,968. A successful breakout could drive momentum toward $118,500–$120,000, while failure to hold $115,980 may see retracements toward $113,000–$113,500.

Related: Ethereum Price Prediction: Can ETH Break $4,300 to Reach the $4,565 Target?

Futures market activity and inflows/outflows indicate cautious accumulation alongside strong institutional participation. Positive developments, including Michael Saylor’s “trillion-dollar strategy” vision, add a structural bullish narrative, reinforcing Bitcoin’s potential as a long-term store of value.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.