- Bitcoin (BTC) transaction volume has just reached a one month low.

- Bitcoin’s price has been in a downtrend over the last two days.

- BTC’s price is resting on a support level and looks to break above the 9 EMA line.

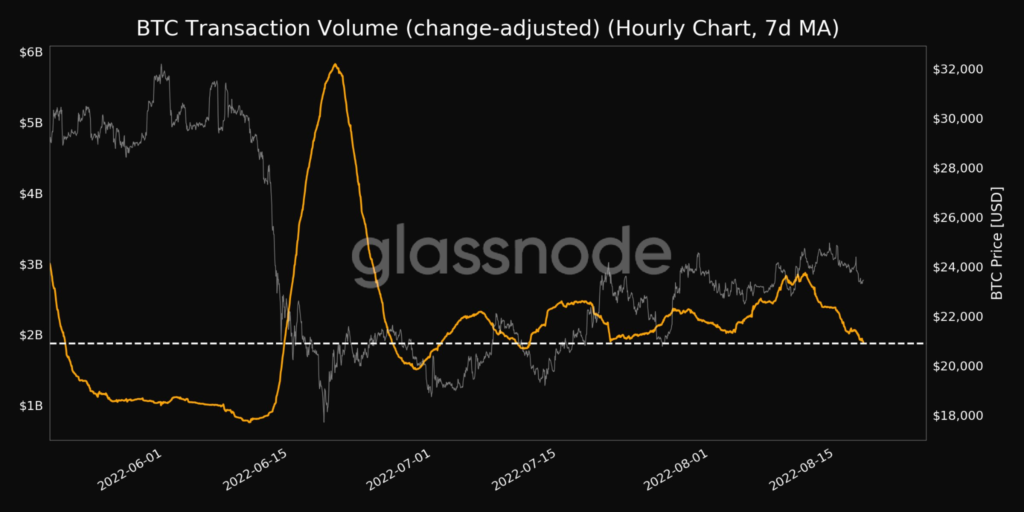

Recent data from the blockchain analytics firm, Sanitiment, shows that the seven-day transaction volume for the crypto market leader, Bitcoin (BTC), has just reached a one month low.

The data released by Santiment shows that the change-adjusted seven day moving average for BTC’s transaction volume reached a one month low of $1,877,202,612.45. Furthermore, the previous one month low of $1,903,681,487.59 was observed on July 20, 2022.

Looking at the four hour chart for BTC/ USDT, Bitcoin’s price has been in a downwards trend over the last two days that has seen its price dip below the 9 Exponential Moving Average (EMA) line.

Technical indicators do suggest that BTC is in a short-term bearish cycle. The first indicator that suggests this is the Moving Average Convergence Divergence (MACD), as the MACD line has crossed below the MACD signal line and the histogram is negative.

The other indicator that investors need to take note of is the Relative Strength Index (RSI), as the RSI line has crossed below the RSI SMA line towards oversold territory. In addition to the two lines crossing bearishly, the RSI line’s gradient is negative, which suggests that bears are not through yet.

At the moment, BTC’s price is resting on a support level and looks to break above the 9 EMA line. Should it be able to do so, the bearish thesis will be invalidated and BTC’s price may rise to as high as $24,000 and if bulls step in at that time, we could see BTC make a move towards $25,000.

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of Coin Edition. No information in this article should be interpreted as investment advice. Coin Edition encourages all users to do their own research before investing in cryptocurrencies.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.