- On-chain data analysis shows that long-term whales have been offloading in the past few days without achieving extreme profits.

- The fear of further BTC price capitulation remains high as several indicators signal the end of the historic four-year bull cycle.

- The BTC/USD pair will either rally towards its euphoric phase or drop by 36%, similar to 2018.

Bitcoin (BTC) has opened the first week of November 2025 in a bearish outlook. After closing October with a 3.69% drop, BTC price dropped 3% on Monday, November 3, to trade at about $107,259 at press time.

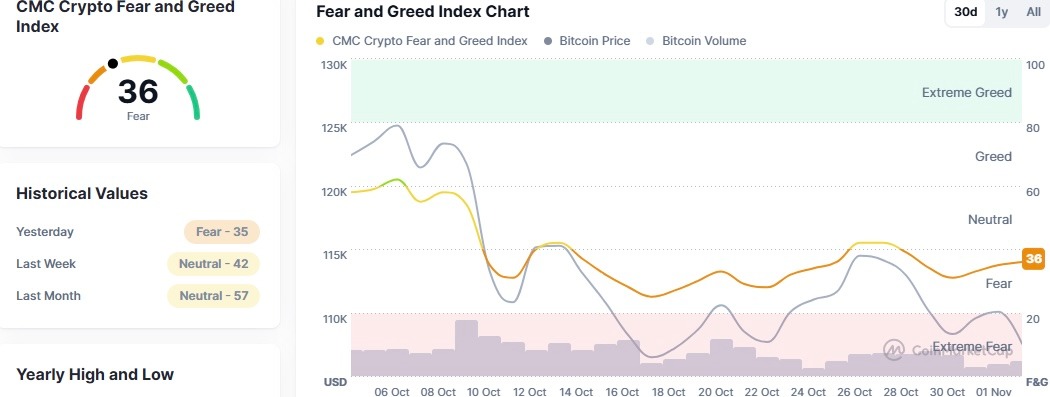

The continued Bitcoin choppy outlook has increased its midterm fear of further capitulation. According to market data analysis from Binance-backed CoinMarketCap, the crypto fear and greed index hovered around 36, which shows traders’ fear.

Is the Bitcoin Bull Market Over?

Will a bearish November happen similar to 2018?

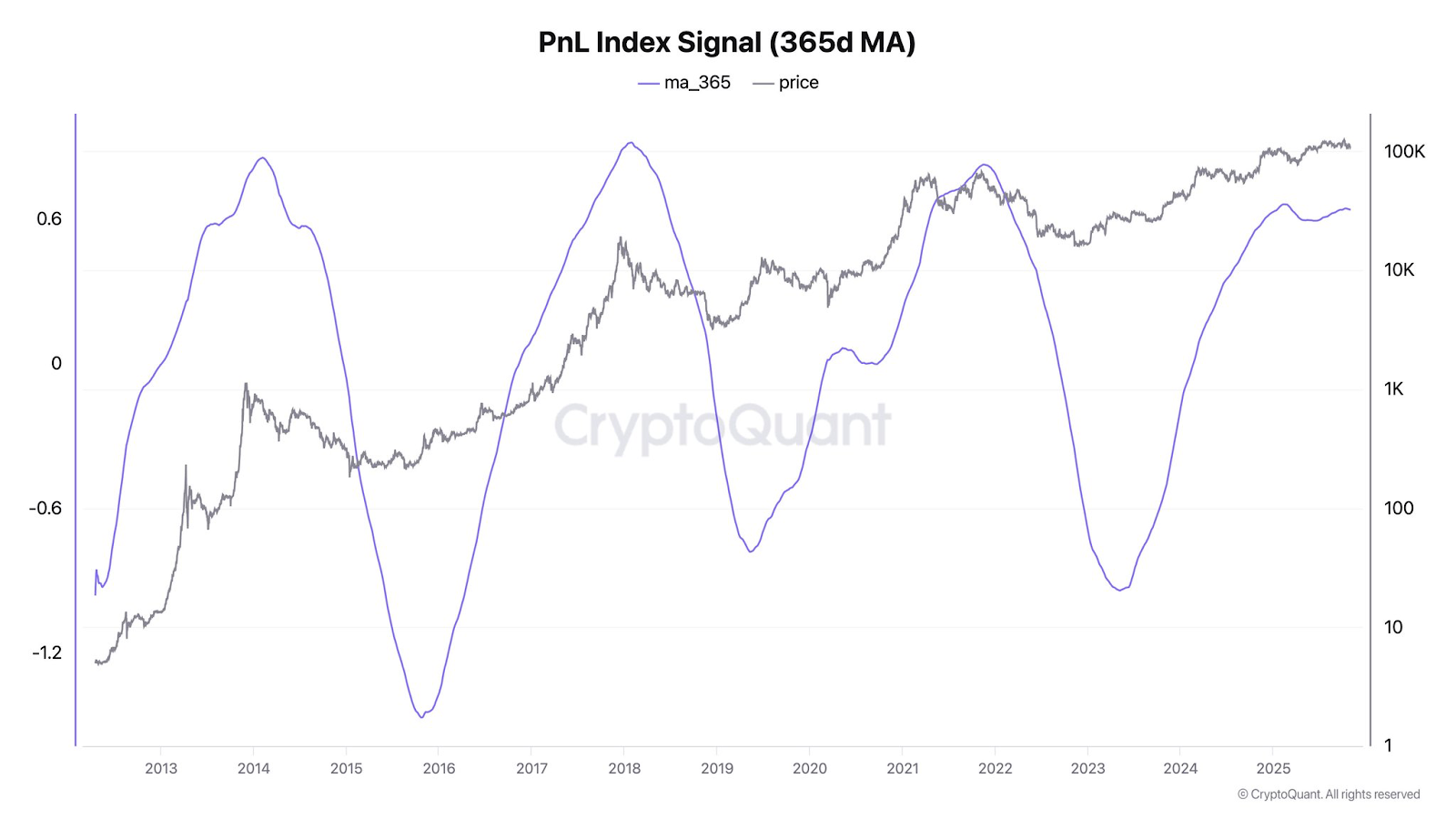

According to market data analysis from CryptoQuant, the 365-day Moving Average (MA) has signaled a potential cycle top. If history repeats itself, the Bitcoin price may be trapped in a multi-week bearish trend in the coming months.

The midterm bearish sentiment for Bitcoin price was exaggerated by its October bearish close for the first time in six years. Notably, the last time that Bitcoin price recorded a negative monthly close in October was in 2018, which was followed by a 36% drop in November and 5% in December.

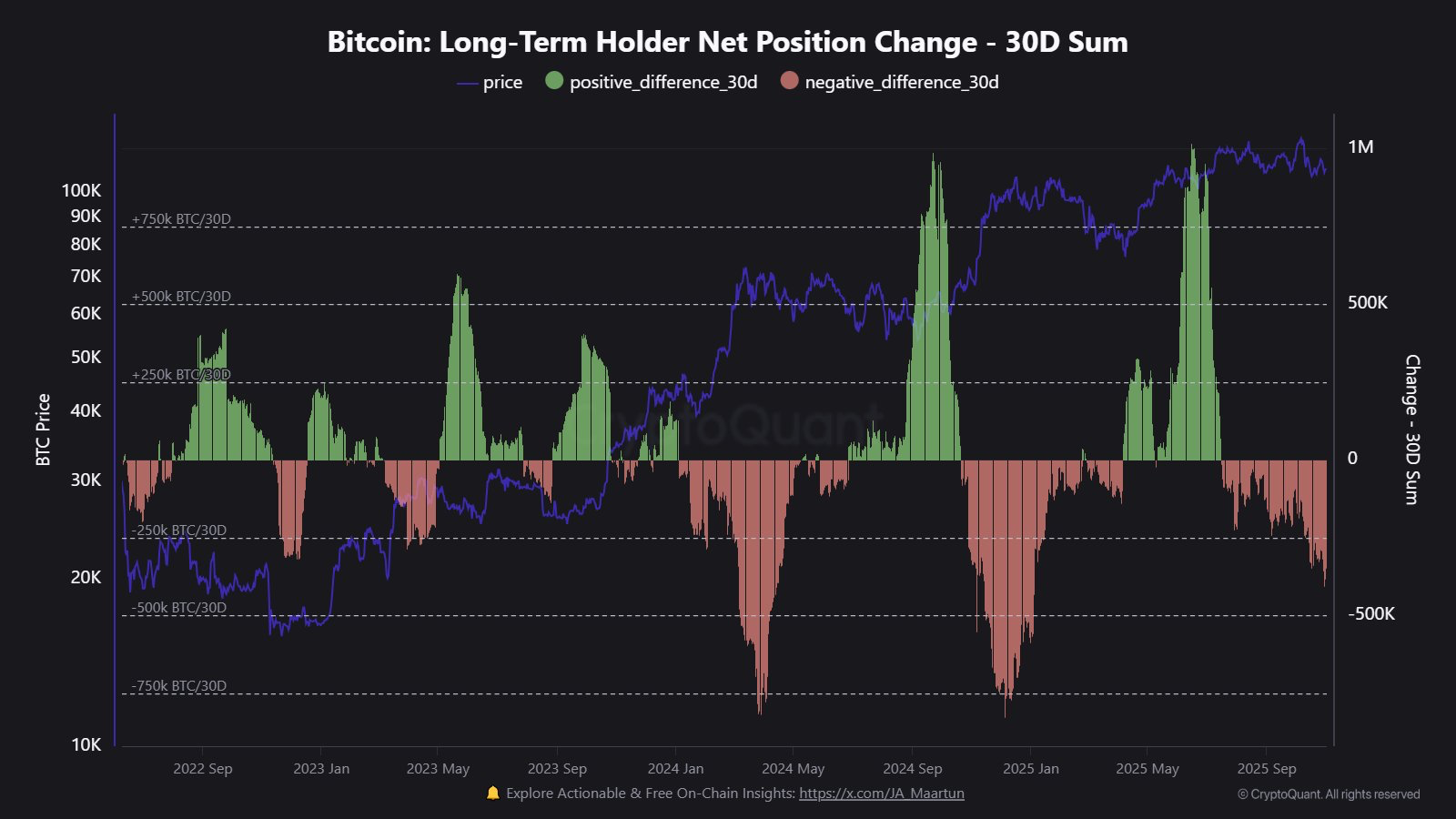

Long-term BTC whales are on a selling spree

The midterm bearish sentiment for Bitcoin is bolstered by the low demand from long-term holders. According to market data from CryptoQuant, the long-term Bitcoin investor offloaded 405,000 BTC during the past 30 days.

The notable BTC selloff by long-term investors has coincided with the low demand from institutions such as Strategy, which has been making significantly fewer weekly purchases compared to earlier this year.

Will BTC’s Euphoric Phase Happen?

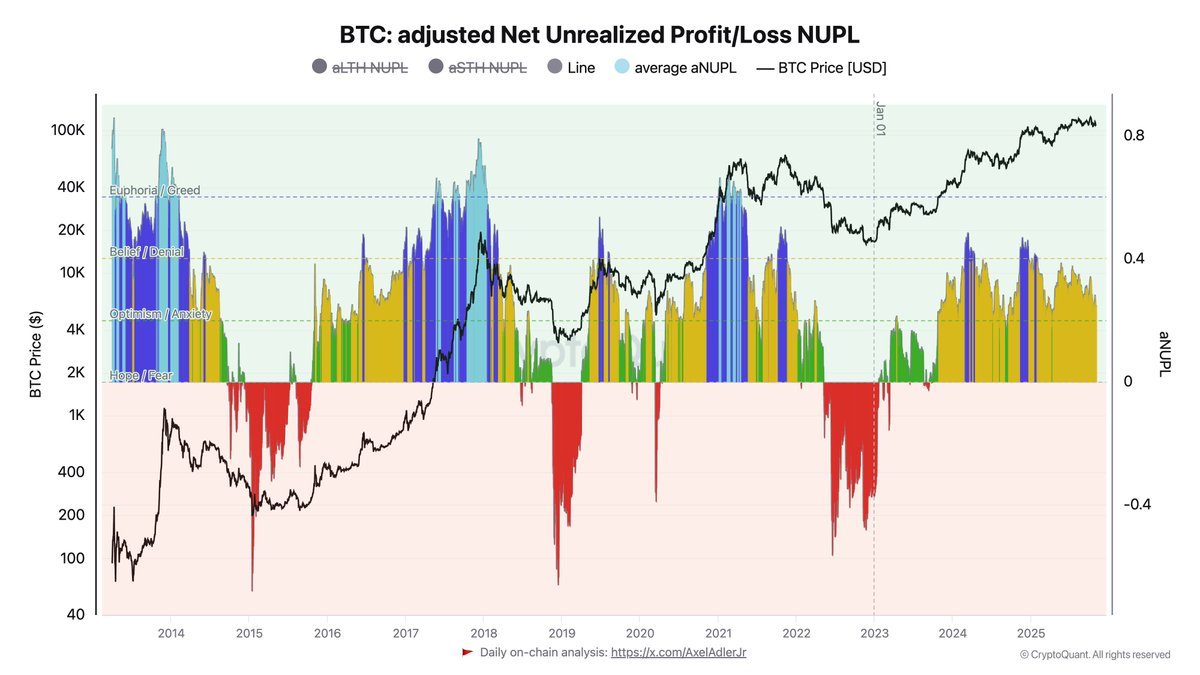

Whales’ unrealized profits show no euphoric phase yet

According to on-chain data analysis from CryptoQuant, Bitcoin whales’ unrealized profits have not hit extreme levels akin to prior bull market cycles.

As such, Ki Young Ju, the founder of CryptoQuant, noted that it is either that Bitcoin’s bull rally has not yet happened or the crypto market is too big for extreme profit ratios.

Related: Bitcoin At $2 Trillion Still Faces Psychology Risk Newton Learned The Hard Way

A retest of a crucial support level increases uncertainty jitters

From a technical analysis standpoint, the BTC/USD pair has been retesting a crucial support level. In the weekly timeframe, the BTC/USD pair will either rebound towards its euphoric phase of the 2025 bull market or capitulate towards $69k.

If the BTC/USD pair rebounds from the current support levels, several analysts led by Tom Lee and Arthur Hayes expect the asset to hit at least $200k. The bullish sentiment for Bitcoin has the upper hand backed by the expected capital rotation from gold, which recently signaled a rally top.

Related: Bitcoin Price Prediction: Analysts Eye $115K Breakout As November Seasonality Turns Bullish

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.