- Bitcoin will print its final ATH of this cycle in Q4, 2025.

- Analyst Ignas said that the bull cycle is far from over for BTC.

- Trump being the president could result in a “MEGA CRAZY bull run.”

Bitcoin (BTC) reached an all-time high of $93,434.36 on Thursday before slipping 1.42% and falling below $90,000. Despite the pullback, crypto analyst Ignas predicts BTC will hit a new all-time high in Q4 2025, continuing its established market cycles.

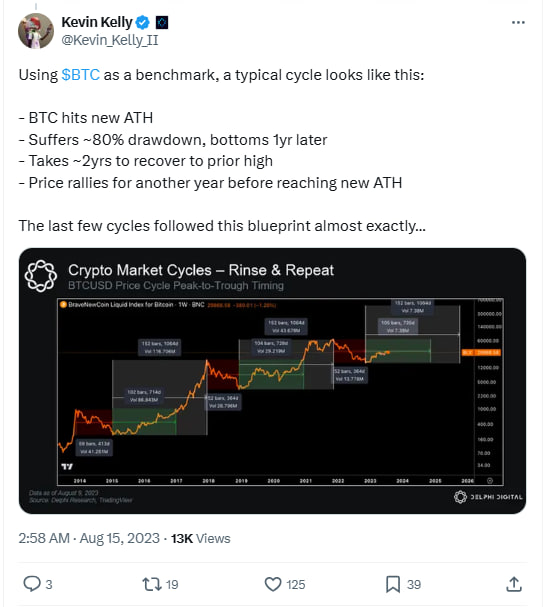

According to a post on X by Ignas, the BTC cycle was predicted in 2023 by Delphi Research, a digital asset research firm, and market observers have been observing the path ever since. Talking about the price predictions in the market, Ignas said, ‘“BTC goes up, ETH, SOL and other large caps follow, and then everything else (probably memecoins most) moons.”

Further, the analyst emphasized the potential of a “MEGA CRAZY bull run” in the crypto market after the pro-crypto candidate Donald Trump, won the 2024 United States presidential elections. Trump’s promise of crypto-friendly regulations could act as a catalyst for increasing the adoption of cryptocurrencies, thereby boosting the market.

Read also: Stablecoin Market At $181B To Lay the Foundation for $100K Bitcoin?

In the post, Ignas pointed out that Bitcoin has weathered bearish challenges, including the Grayscale ETF outflows, Mt. Gox dumping FUD, and uncertainty over the U.S. elections. These hurdles, combined with global interest rate cuts, have set the stage for a promising bullish phase.

Ignas predicted that BTC would sustain a year-long rally, wherein, the price and higher highs of the coin would increase, followed by a correcting phase, in which the prices would drop, till it reaches the bottom.

Bitcoin’s Price Surged Following Trump’s Victory

Bitcoin’s price responded positively to Trump’s election win, rising almost 9% on November 6th followed by a 4.82% surge on November 10th. Later, on November 11th, the leading digital asset rose to 10.30%, breaking $93,000 on November 13th.

As per CoinMarketCap data, Bitcoin gained 16.25% in the past week, followed by a tremendous surge of 31.90% in the past 30 days. The Relative Strength Index (RSI) stands at 75, signifying that the digital asset is overbought. Also the demand for BTC is extremely high as investor sentiment remains bullish.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.