- BCH’s buying strength has become weak since less money flowed into the market.

- Despite a slightly bullish bias, the coin might only cope with consolidation around $262.

- Traders evaded long positions, as signs emerged that BCH’s price could drop lower.

Bitcoin Cash (BCH) has been forced to deal with retracement after a recent long period of printing green. Despite the decrease in price, the coin’s 30-day performance remained around a 149% hike.

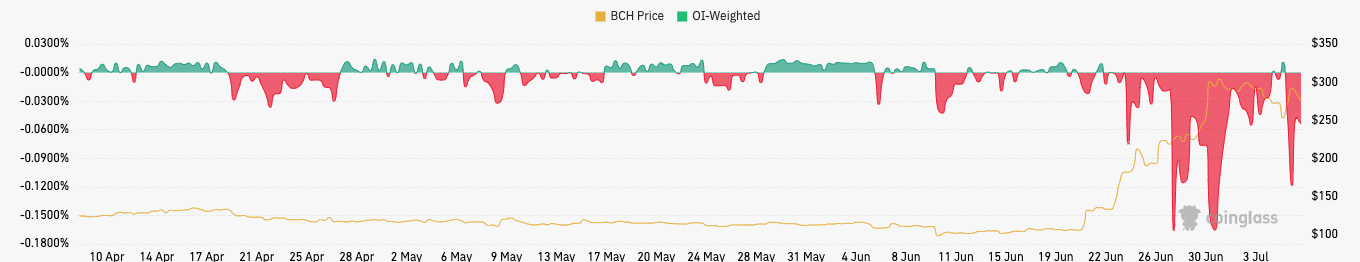

One reason why BCH, Bitcoin’s (BTC) 2017 hard fork rallied, was because of its inclusion in the EDX Markets exchange launch. As a result, BCH crossed the $300 threshold on June 30.

A Rally May Not Be Quick

Besides that, the BCH/KRW trading pair had the highest volume on South Korean exchange Upbit, CoinMarketCap revealed. This helped the cryptocurrency recover again on July 6 after an initial drawdown.

But despite remaining in the top two trading volumes on Upbit, BCH’s price had decreased to $282 at press time.

From the BCH/USD 4-hour chart, the Chaikin Money Flow (CMF) had fallen to -0.04. The CMF, crossing below the zero line indicates that BCH’s strength in the market could have become weak.

Furthermore, this was a sign of more capital outflows than inflows. So, distribution thrived over accumulation. Thus, BCH could find it extremely challenging to trend upward due to the waning demand.

The chart above also considered BCH’s volatility. Based on the Bollinger Bands (BB), the coin’s volatility began contracting since selling pressure started around $297.21 on July 3.

However, the pressure led BCH to an oversold level after the price touched the lower band at $262.42. At this point, the contraction cooled a bit. Also, the BCH price had eluded touching the lower or upper band. Therefore, the coin might continue consolidation in the short term.

Anticipating Another Decrease?

Furthermore, the Moving Average Convergence Divergence (MACD) collapsed around the mid-point at 0.67. In the same vein, both buyers and sellers were struggling for control since the orange and blue dynamic lines closed in on each other.

However, the MACD remaining above zero indicates that there was more bullish tendency than a bear signal. But at the same time, if the BCH price was to increase, it might only be slight.

Meanwhile, BCH’s 8-hour funding rate was down to $274 at press time. Typically, the funding rate means the difference between the perpetual price of an asset and its spot price.

When the funding rate is positive, it means that traders are bullish. But BCH’s funding rate decrease suggests that short traders were dominant. Thus, the broader market expects the cryptocurrency to plunge further.

In conclusion, investors expecting BCH to regain the $300 mark might need to wait longer. As the technical outlook revealed, consolidation or a drop below its current price could be on the cards.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.