- Michael van de Poppe expects Bitcoin to reach $150,000 after a short-term correction below $121.5K.

- On-chain data shows Market Buy Volume surpassing $25B, signaling potential market overheating.

- A negative divergence between Bitcoin’s price and network activity suggests limited retail participation.

Bitcoin’s explosive rally may have further to run, but according to prominent analyst Michael van de Poppe, the market needs to take a breather before pushing higher. The veteran trader shared a cautiously optimistic outlook, suggesting that Bitcoin could correct before surging toward the much-anticipated $150,000 mark.

“I don’t think Bitcoin will blast through the all-time high in one go,” van de Poppe said, adding that the leading cryptocurrency needs a little bit of patience before it hits higher prices. van de Poppe further wrote:

“Anything beneath $121.5K is a good area to enter before we head to $150K,”

BTC Momentum Cools After Vertical Surge

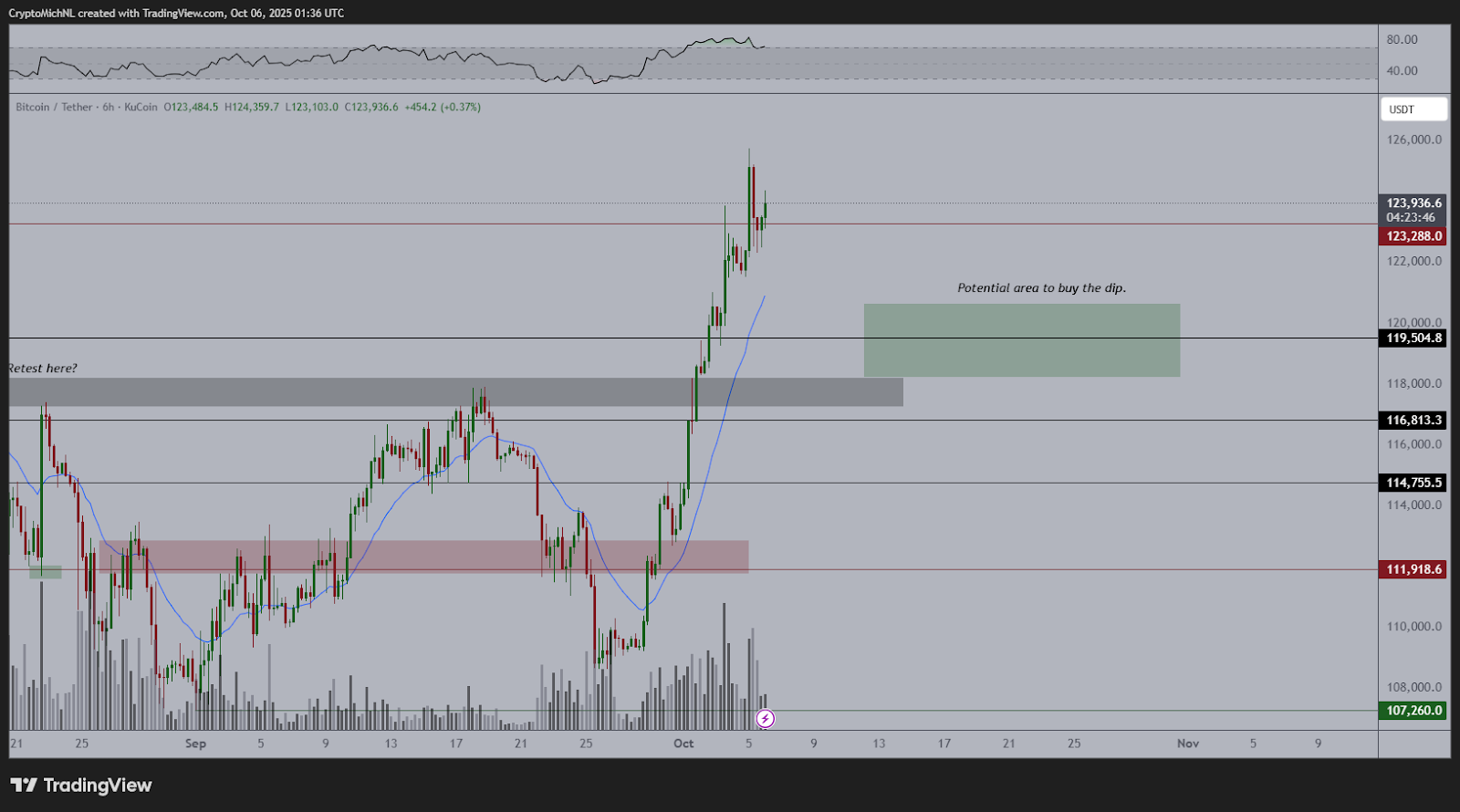

Van de Poppe’s BTC chart on KuCoin’s 6-hour timeframe shows a textbook breakout from consolidation, followed by a steep vertical rise to around $123,936.

The surge from below $112K to current levels indicates overheating in the short term. The Relative Strength Index (RSI) hovers near overbought territory, also hinting at possible exhaustion.

Related: Bitcoin Price Prediction: Analysts Target $130K As U.K. ETF Decision Sparks Inflows

The analyst marked $119,500 to $120,000 as the ideal dip-buy range, a former resistance zone that may now flip into support. If selling extends, deeper support layers sit near $116,800, $114,755, and $111,918, all viewed as potential springboards for the next rally leg.

On-Chain Data Hints Market Is Running Hot

CryptoQuant reported that Bitcoin’s Market Buy Volume recently surpassed $25 billion, a threshold that historically signals potential inflection points, often preceding trend reversals.

Whenever Market Buy Volume reaches $25B, the market tends to be overheated. In downtrends, this figure often marks a buying opportunity; in uptrends, it can serve as a warning that prices may be due for a cooldown.

Meanwhile, CryptoQuant also highlighted a negative divergence between Bitcoin’s price and its network activity. Despite record prices, the 14-day moving average of active addresses has dropped to its lowest point since April 2020.

Related: Arthur Hayes Warns France’s Debt Spiral Could Spark Eurozone Crisis and Fuel Bitcoin Demand

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.