- Bitcoin (BTC) holds near $110K ahead of critical October 24 U.S. CPI inflation data

- CPI outcome dictates BTC’s path: soft print targets $120K, hot risks $100K breakdown

- Inflation data crucial for Fed rate cut expectations, a key Bitcoin price driver

Bitcoin initially fell more than 3.5% this week, retreating from $114,000 to the $107,000 range as traders turned cautious ahead of the October 24 U.S. Consumer Price Index (CPI) release. Meanwhile, it reversed the loss with a 1.6% uptick in the past day, trading at $109,879.

Why Does the October 24 CPI Report Dictate Bitcoin’s Next Move?

The CPI report, delayed by the government shutdown, has taken on outsized importance as the Federal Reserve prepares for its next policy meeting on October 29.

Related: Bitcoin Price Prediction: BTC Consolidates as Traders Await Breakout Signal

Economists expect headline inflation to rise 3.1% year-over-year, slightly higher than August’s 2.9%. Core CPI, which excludes food and energy, is expected to remain unchanged, signaling a gradual cooling trend.

However, with inflation climbing for six consecutive months, market participants worry that another upside surprise could renew volatility across equities and cryptocurrencies.

Will CPI Spark a BTC Breakout or Breakdown?

Whether Bitcoin breaks higher or lower will largely depend on the CPI outcome and the Federal Reserve’s reaction at its October 29 meeting. A softer inflation reading could encourage risk-taking and push Bitcoin back toward the $117,000–$120,000 range, while a hotter print could fuel another selloff toward $100,000.

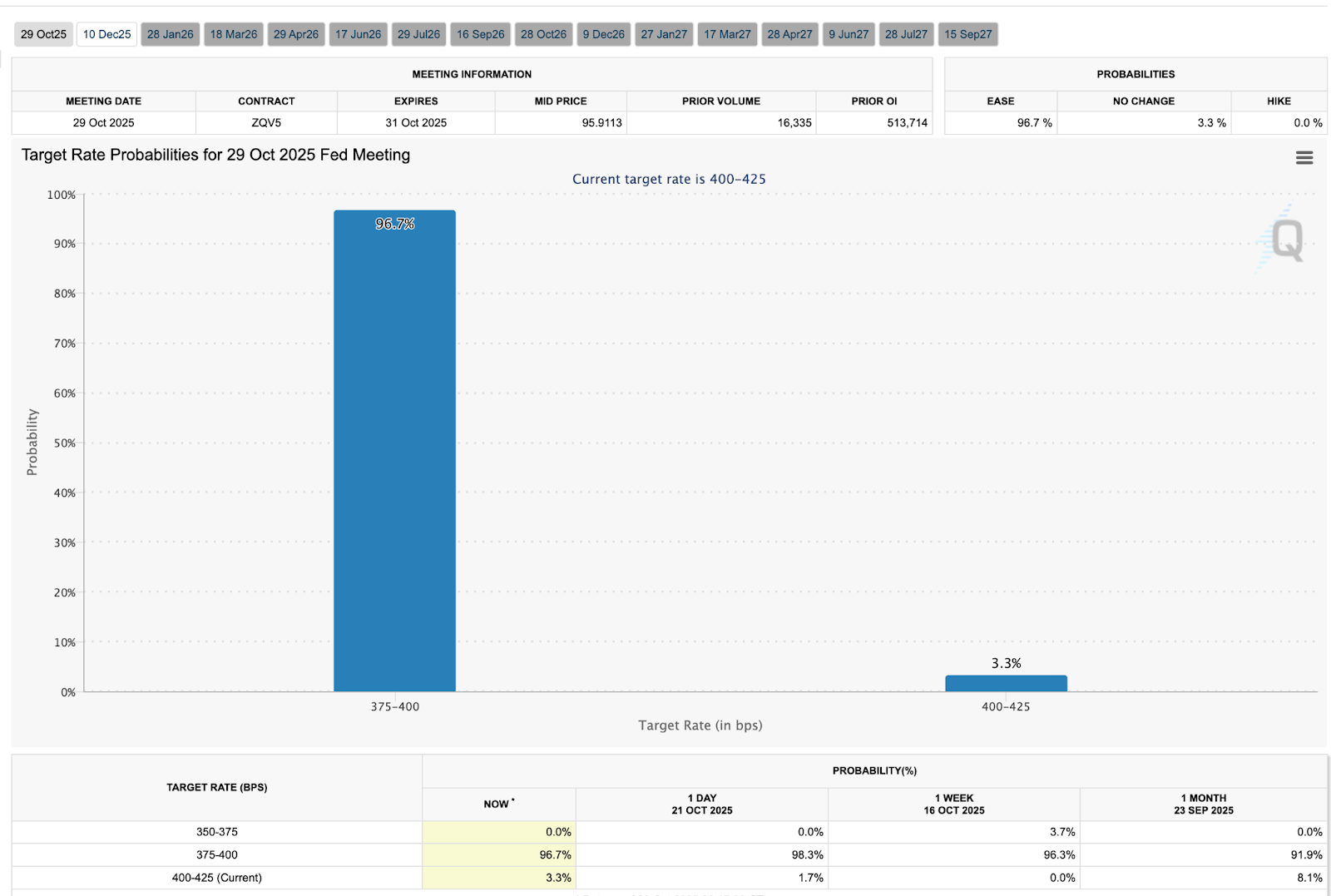

Analysts say the CPI holds unusual importance this month because it’s the only major inflation gauge available before the Fed’s policy meeting. According to the CME FedWatch Tool, futures markets show a 96% probability of a rate cut in October and an 85% chance of another in December.

Historically, rate cuts have boosted Bitcoin’s performance. After the September 2024 cut, BTC gained 6.6% in a week, while the November cut saw a 32% monthly surge. Analysts suggest that a lower-than-expected CPI reading could spark a similar response.

Gold’s $2.5 Trillion Plunge May Lead Capital Rotation to Bitcoin

Notably, Gold extended its decline this week, losing 8% in two days and erasing nearly $2.5 trillion in market capitalization, its largest drop since 2013. The decline has led some analysts to anticipate a shift in capital flows toward digital assets.

Asset manager Bitwise estimated that a modest 3–4% rotation from gold into Bitcoin could push BTC above $242,000. Historical patterns support this argument, as Bitcoin often accelerates following periods of weakness in precious metals.

Market Volume and On-Chain Indicators Point to BTC Resilience

Data from CryptoQuant proves Bitcoin’s resilience with daily spot trading volume on Binance nearly doubling since early October, rising from an average of $3–5 billion to $5–10 billion. The surge in trading activity reflects heightened investor interest and could help build a base for a more sustainable Bitcoin recovery once macro uncertainty eases.

At the same time, the Bitcoin NVT Golden Cross, an on-chain valuation metric, indicates that the bull cycle may not be over, despite short-term price corrections.

What Comes Next

Dean Chen, an analyst at digital asset firm Bitunix, said market reactions will hinge on Treasury yield and dollar movements after the CPI release. “If both rise, Bitcoin could face pressure. If both decline, risk appetite may return,” Chen said.

Related: SpaceX Moves $268 Million in Bitcoin as BTC Holds Above Key Support

Chen added that a cooler inflation reading could reignite ETF inflows and lift Bitcoin toward the $117,000–$120,000 range. However, a stronger CPI result might drive capital back into safe havens, testing BTC’s support near $100,000.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.