- Bitcoin’s decoupling from gold highlights investors’ shift to risk-off assets in 2024.

- Social dominance spikes often signal major Bitcoin price shifts amid market volatility.

- Excessive leverage in Bitcoin leads to sharp corrections during volatile price movements.

Bitcoin’s price is slipping, and no longer moving in sync with traditional safe havens like gold. Cryptoquant’s research head, Julio Moreno, pointed to this as a sign that investors were getting more cautious and shying away from riskier assets.

Read also: Bitcoin’s Risk-Adjusted Returns Challenged: NVIDIA, Meta, Gold Rise

Bitcoin Volatility Contrasts with Gold’s Stability

Bitcoin’s price volatility stands in stark contrast to the relative stability of gold, which has maintained its reputation as a secure store of value. This divergence reflects changing investor sentiment as they move away from high-risk assets and towards traditional investments during turbulent market periods.

This trend is especially clear in Bitcoin’s price action since mid-2024. After a July peak, it has dropped around 2.5%, while gold has steadily climbed 1%. This contrast highlights gold’s enduring appeal as a stable asset, while Bitcoin’s volatility backs the crypto market’s uncertainty.

Read also: U.S. Gold Could Fund Bitcoin Buy, Says Analyst: Lummis Bill in Focus

Fluctuating Sentiment and Liquidations

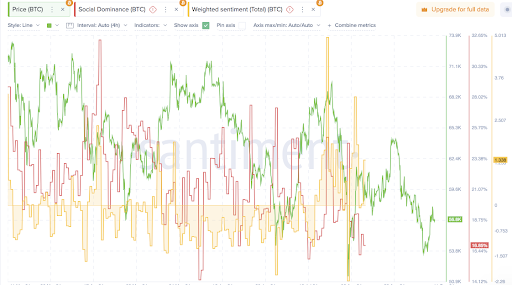

Social dominance and sentiment around Bitcoin have also fluctuated throughout 2024. Notably, Bitcoin’s price peak in mid-July aligned with spikes in both social dominance and weighted sentiment.

However, these indicators, along with the price, declined in subsequent months. The drop in sentiment suggests a diminished market outlook, while the oscillation in social dominance indicates varying interest from the crypto community. These fluctuations often signal impending price movements, as extreme sentiment tends to follow or precede significant changes in Bitcoin’s value.

Liquidation data further emphasizes the volatile nature of the Bitcoin market. Both long and short positions have experienced significant liquidations, particularly during periods of price spikes and drops.

These liquidation spikes reveal market corrections driven by over-leveraged positions. During such periods, excessive leverage is cleared, leading to substantial Bitcoin price movements.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.