- Bitcoin dominance hits 64.38%, showing stronger momentum than altcoins.

- Altcoin Season Index at 16, confirming it’s still Bitcoin Season.

- Ethereum drops to $1,577 while Bitcoin surges above $88K.

The crypto market is seeing a clear divide: Bitcoin is booming, while many altcoins are lagging.

Bitcoin dominance reached a new cycle high of 64.38%, its strongest level since February. This increase signals a continued shift of capital from altcoins back into Bitcoin.

Altcoin Season Index Confirms Bitcoin’s Lead

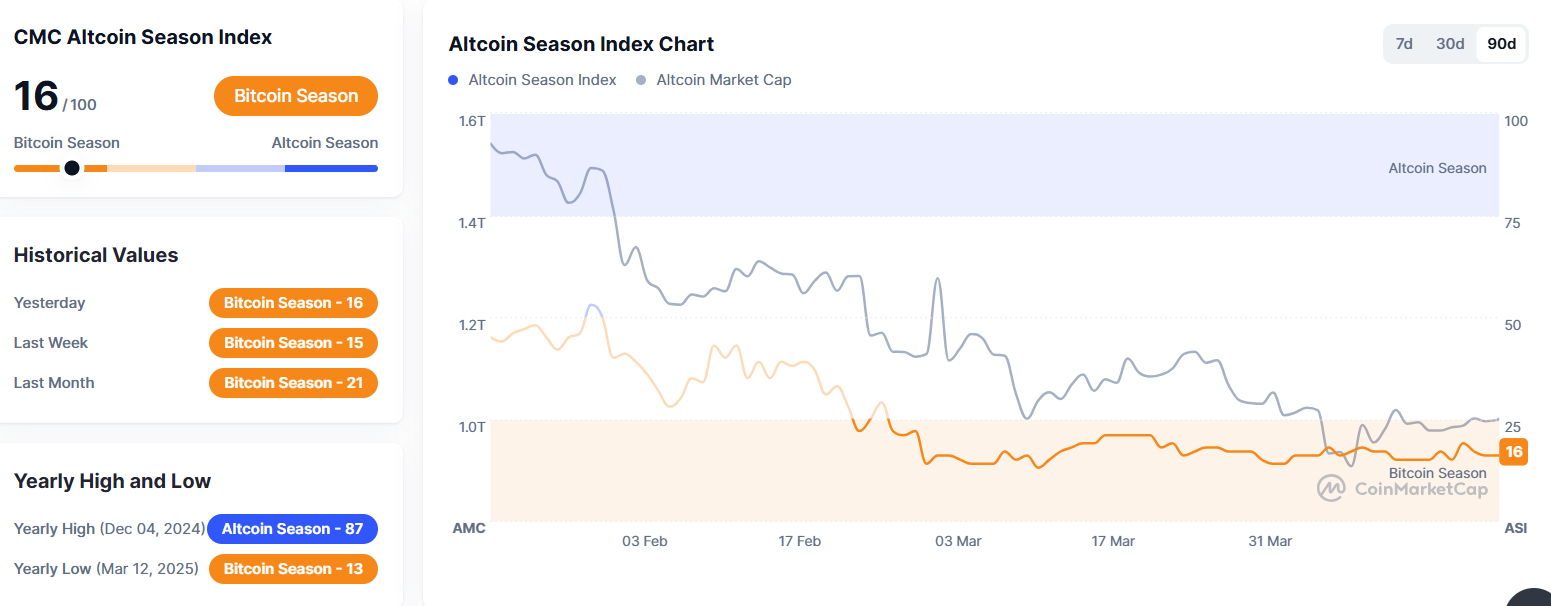

Furthermore, the CMC Altcoin Season Index gave a snapshot of the current state of the crypto market by tracking how the top 100 altcoins have performed against Bitcoin over the past 90 days. A score closer to 100 indicates Altcoin Season, while a lower score suggests Bitcoin Season. As of now, the index stands at 16/100, clearly signaling Bitcoin Season.

This marks a slight increase from 15 last week but is still well below last month’s level of 21. The highest level over the past year was 87 on December 4, 2024, and the lowest was 13 on March 12, 2025.

Related: Why Is Bitcoin Failing Its Original Mission as a Payment Method

Analysts Divided on Dominance Peak

According to analyst Benjamin Cowen, historically, Bitcoin dominance has moved higher during QT (Quantitative Tightening) phases and tended to peak when monetary conditions loosen. Current charts suggest the dominance level could climb to 66% or higher in the coming weeks if these conditions persist.

Cowen also points to a lack of altcoin momentum and repeated lower highs against Bitcoin as further signs of weakness in the altcoin sector. While some are hopeful for an altcoin rebound later in the year, Cowen said that current indicators favor continued BTC strength in the short term.

Offering a sharply contrasting perspective, commentator Altcoin Gordon took to social media and wrote, “Every indicator and narrative is pointing towards a HUGE bull market. Alt season is coming.”

Market Action Reflects Bitcoin’s Strength

As of today, Bitcoin has surged to $88,007, with a 1% gain in the last 24 hours. With a market cap nearing $1.75 trillion, BTC continues to attract investor attention, especially as traditional markets show signs of weakness. In fact, over $1.5 trillion was wiped from the U.S. stock market recently, while $60 billion flowed into crypto—with Bitcoin leading the charge.

Related: Spotlight on XRP, Solana as 72 Crypto ETFs Seek SEC Approval This Year

In contrast, Ethereum (ETH) has taken a hit. Despite brief signs of recovery earlier this month, ETH has now dropped to $1,577, marking a decline as it struggles to keep pace with Bitcoin. Other major altcoins like Solana (SOL) and BNB posted only minor gains in comparison, remaining well behind BTC’s strong momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.