- Bitcoin’s slide to $97K has created a major disconnect between surface-level technicals and deep on-chain data.

- The Bear Case: BTC’s 0.8 correlation with the Nasdaq has become “one-sided.” It follows tech stocks down but doesn’t follow them up, signaling “exhaustion” last seen in the 2022 bear market.

- The Bull Case: This drop has triggered “extreme fear” (a classic bottom signal). On-chain data from Swissblock shows capital is not leaving, as stablecoin balances are rising—meaning “buying power” is just “parked on the sidelines.”

Bitcoin’s slide below the $100,000 level has created a sharp divide in the market, pitting bearish “exhaustion” signals against classic “buy” signals. While the drop to $97,000 is being driven by a one-sided, negative correlation with the Nasdaq, on-chain data shows “extreme fear” and a build-up of “parked” capital, a historical setup for a local bottom.

Related: Bitcoin Plunges to $100K as US ‘Data Blackout’ Prices Out Fed Rate Cut Hopes

The Bear Case: A “One-Sided” Correlation Signals “Exhaustion”

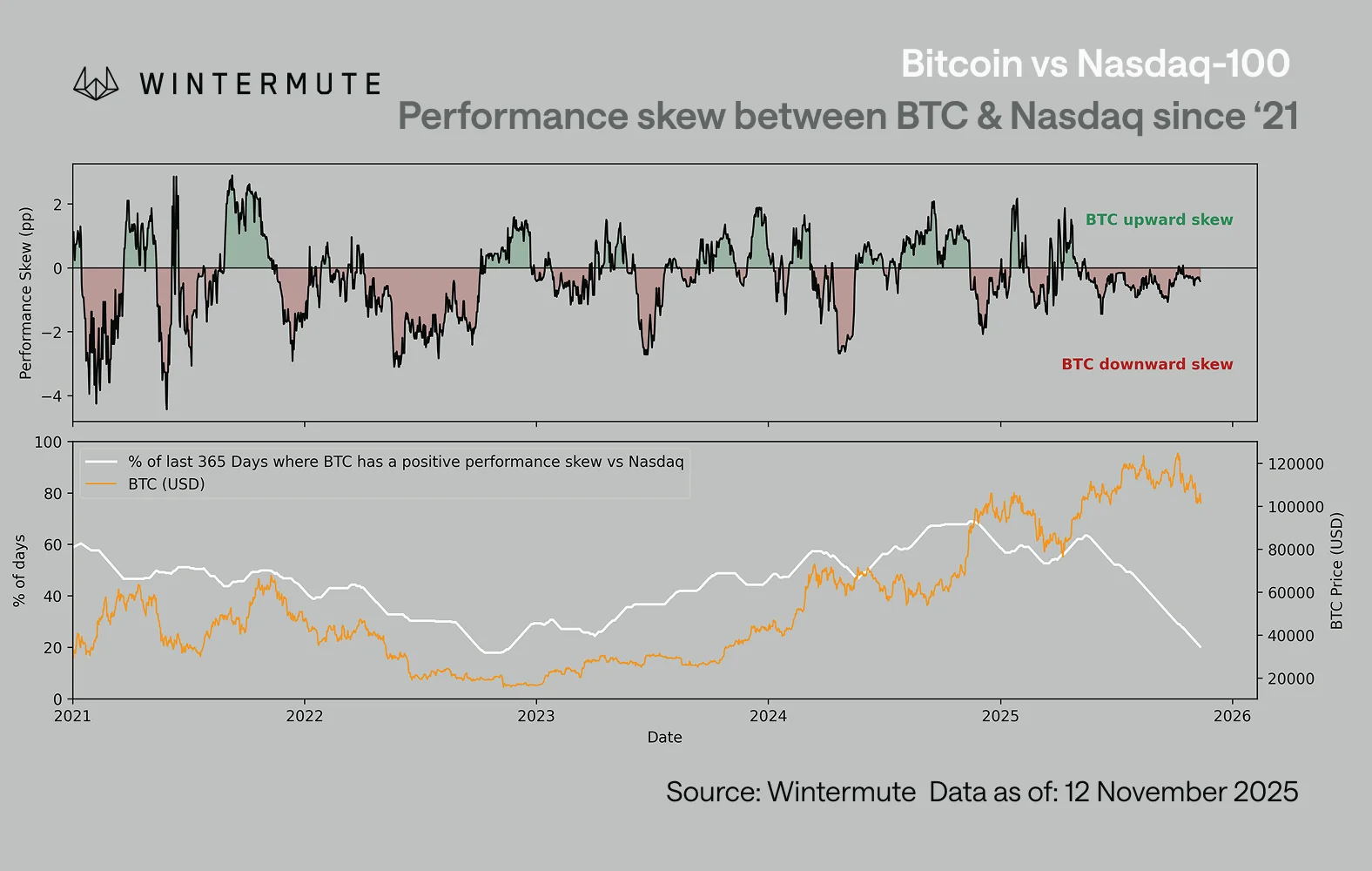

According to Wintermute’s recent market research, Bitcoin continues to behave as a high‑beta extension of equity risk, i.e., it reacts sharply when tech stocks fall but barely participates when they rise. The imbalance has lasted through much of 2025, indicating not euphoria, but exhaustion.

BTC Still Tracks Nasdaq, But Only When It Hurts

The correlation between BTC and the Nasdaq-100 remains high at around 0.8 but their relationship has become increasingly one‑sided. Bitcoin tends to fall sharper on equity down days than it rises when equities recover. Such patterns were last seen during the 2022 bear market.

Historically, such behavior rarely appears at market tops and it typically forms around major cyclical bottoms. Wintermute noted that two structural forces explain why Bitcoin is lagging risk assets even while maintaining a strong correlation.

First, market attention has migrated toward equities. Mega‑cap tech names have hoarded the spotlight in 2025, attracting both institutional and retail flows that would have previously supported crypto.

Second, the liquidity profile of the crypto market has weakened. With fewer fresh inflows, Bitcoin’s reactions to macro stress have become disproportionately heavy. When equities pullback, BTC feels the shock more intensely.

The Bull Case: “Extreme Fear” and Parked Capital

Bitcoin trades at 97,000 at the time of writing, down more than 5% in the past 24 hours. As Santiment’s sentiment‑ratio chart shows, Bitcoin has moved from a mixed environment into a strongly bearish social‑media bias. Historically, the situation aligns with local bottoms rather than major pullbacks.

Retail‑driven panic often tends to create the conditions for rebounds, i.e., when most traders expect lower prices, markets often reverse. Swissblock’s latest analysis also reveals that capital is not leaving the system, it’s simply waiting.

Stablecoin balances are rising, showing that buying power is parking on the sidelines rather than fleeing the ecosystem. This typically happens before large re‑entries.

According to their models, a capitulation sweep toward $95K or a clean reclaim of $100K could get the rally back on track, especially as Bitcoin is currently defending the $97K–$98.5K band, a zone that has repeatedly acted as a springboard.

Related: Gold’s Breakout Is the ‘Forerunner’ to DXY Collapse, Bitcoin Rally – Analyst

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.