- Bitcoin fell below $89,600, pushing U.S. spot ETF investors into losses.

- Crypto ETPs saw $2 billion in outflows last week.

- Analysts suggest Bitcoin is nearing a bottom, describing the current price as a “generational opportunity.”

Bitcoin has now retreated below a key cost-basis level, officially pushing U.S. spot Bitcoin ETF investors into the red.

Data from Glassnode’s Sean Rose shows the average ETF investor cost basis sits around $89,600, a level Bitcoin broke on Tuesday. The decline means spot ETFs are now holding unrealized losses.

Bitcoin ETF Realized Price Now Lost

On Monday, analyst JA Maartunn reported that the ETF’s realized price was just 9% away from breakeven with Bitcoin at the time. With Bitcoin now hovering just below that level, institutional holders are slipping into losses.

Analysts believe it could trigger further selling from ETF issuers as they seek to reduce risk. However, the opposite remains possible. In 2024, ETF providers accumulated BTC during corrections, helping fuel a strong recovery.

CryptoQuant CEO Ki Young Ju maintains that Bitcoin remains outside bear-market territory as long as it holds above $94,635. Meanwhile, the latest dip has pushed BTC below that mark.

ETF Outflows Accelerate as Investors React to Macro Weakness

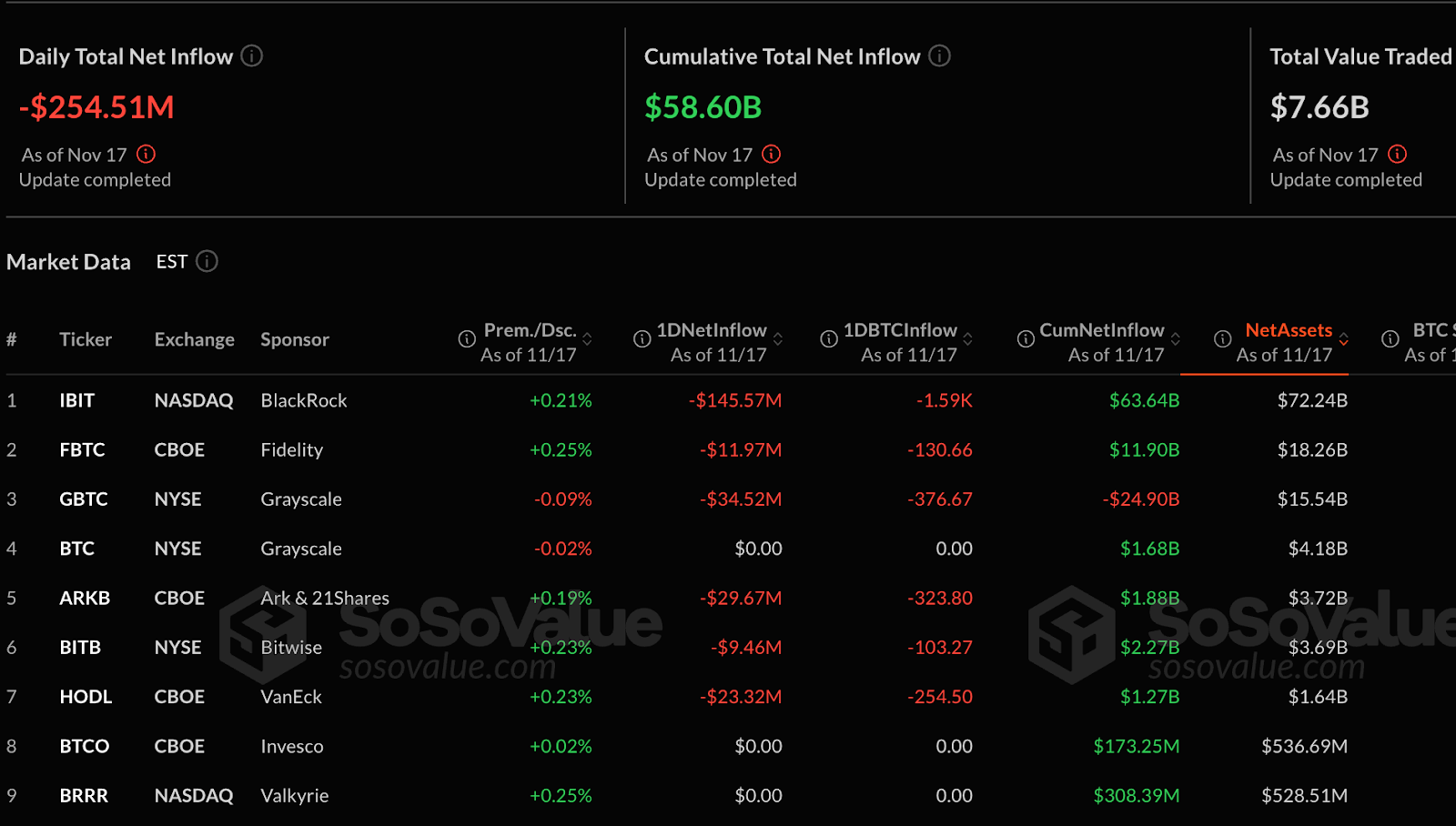

The downturn comes amid weeks of heavy redemptions across digital asset funds. Last week alone, crypto ETPs saw $2 billion in outflows, the largest since February. BlackRock’s IBIT posted a record $463 million single-day withdrawal on November 14, and the outflow trends have only continued.

According to CoinShares, global crypto ETP assets declined from a peak of $264 billion in early October to $191 billion, representing a 27% drop. The U.S. accounted for $1.97 billion of last week’s redemptions, while Switzerland and Hong Kong saw smaller outflows. Germany bucked the trend with $13.2 million in inflows as investors bought the dip.

CoinShares analysts highlight worsening macroeconomic conditions, including shifting expectations for Federal Reserve policy.

Acheron Trading CEO Laurent Benayoun noted that upcoming flows will likely hinge on economic data and central-bank signals. Meanwhile, VeChain’s Johnny Garcia cautioned that short-term ETF moves often reflect rebalancing and arbitrage, not purely sentiment.

Market Searches for BTC Bottom

Bitcoin briefly plunged to $89,253 on Tuesday, its lowest level since April, before rebounding slightly above $90,000. Yet, BTC is now down more than 5% on the day and 3% year-to-date, erasing the gains sparked by its October all-time high of $126,080.

Major altcoins also suffered. Ethereum slid to $3,011, down 23% in a month, while Solana fell 27% to $135. XRP remained comparatively resilient, declining just 8% to $2.16.

Now, several prominent figures believe Bitcoin is nearing a cyclical bottom. Gemini co-founder Cameron Winklevoss called BTC under $90,000 a “final buying opportunity.”

At the same time, Bitwise CIO Matt Hougan and BitMine chairman Tom Lee both expect the market to stabilize this week. Hougan described the current price zone as a “generational opportunity.”

XRP and Solana ETFs Continue to Attract Fresh Capital

In contrast to Bitcoin and Ethereum’s heavy outflows, XRP and Solana ETFs continue to post steady inflows.

Canary Capital’s recently launched XRPC fund recorded $245 million in inflows on Friday, followed by another $25 million on Monday, even as Bitcoin ETF holders turned net-negative.

Solana ETFs have also remained resilient, adding $8.26 million on Monday and pushing total inflows since October to $390 million.

The divergence indicates a growing appetite for alternative large-cap assets perceived as undervalued in relation to Bitcoin following its steep pullback.

Related: Bitcoin and Crypto Q4 Predictions vs Reality: Where the Market Stands Now

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.