- Bitcoin and digital asset ETPs face record outflows amid market instability.

- US Spot Bitcoin ETFs saw over $1 billion in withdrawals on February 24.

- XRP ETPs showed resilience with $38 million inflows despite market downturn.

Digital asset exchange-traded products (ETPs) and Bitcoin-specific funds have seen outflows lately, with Bitcoin and other cryptocurrencies feeling the impact of market instability.

James Butterfill, head of research at CoinShares, pointed out that the outflows, which have reached $2.6 billion this week, represent the largest on record for Bitcoin and digital asset ETPs. However, he notes that the selling appears to be cooling as the basis trade unwinds.

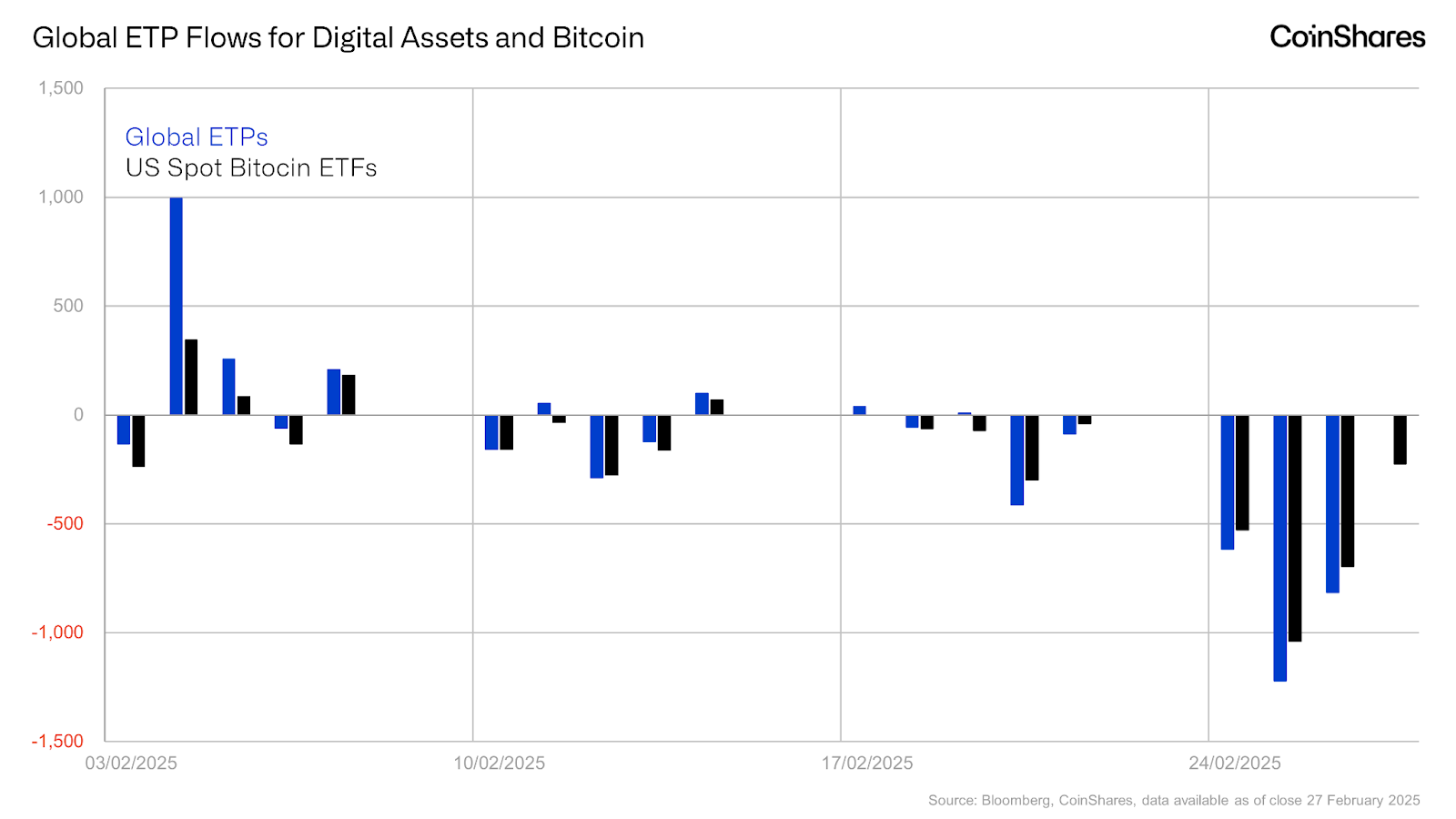

From February 3 to February 24, 2025, the global ETP market for digital assets, including Bitcoin, saw considerable fluctuations. The market experienced a surge, with global ETPs showing inflows exceeding $1 billion. This peak was followed by a decline in the following weeks, including notable dips on February 10 and 17.

While the general market saw more movements, the US Spot Bitcoin ETFs maintained a stable performance during this period. However, the most notable event occurred on February 24, when Bitcoin ETFs saw an outflow, showing a shift in investor sentiment despite growing economic uncertainty.

Related: Crypto Giant CoinShares Slashes Bitcoin ETP Management Fees

Spot Bitcoin ETFs Suffer Massive Losses

The US Spot Bitcoin ETFs, part of the 11 SEC-approved Bitcoin funds, recorded their largest-ever outflows on February 24, with more than $1 billion worth of investments withdrawn in 24 hours.

This unusual selloff marks the worst day for Bitcoin ETFs since their introduction last year, surpassing the previous record set in December when outflows reached $672 million.

Related: Spot Bitcoin ETF Surge Set to Eclipse $50 Billion Crypto ETP Market

Bitcoin ETF Outflows: Economic Concerns and Market Pressure

These withdrawals occurred after six days when the funds lost more than $2 billion in value.

This large exit follows US economic policy concerns, particularly trade tariffs, inflation, and the recent US presidential inauguration. These factors have added pressure to the crypto market, which has led to the ongoing decline in digital asset prices.

XRP ETPs See Inflows, Contrasting Bitcoin’s Trend

Moreover, the outflows were focused on Bitcoin, the leading cryptocurrency, accounting for $571 million. In contrast, altcoin ETPs, including XRP, showed more resilience. XRP ETPs recorded $38 million in inflows, continuing a trend of investor optimism fueled by the belief that the US Securities and Exchange Commission (SEC) may soon drop its lawsuit against Ripple. Since November 2024, XRP ETPs have seen $819 million in inflows.

Bitcoin’s price decline has mirrored the broader market’s challenges. Since early February, Bitcoin has dropped from over $100,000 to below $85,000 due to US trade policies, the high-profile hack of crypto exchange ByBit, and various memecoin scandals.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.