- The Bitcoin ETF inflow marked a staggering $91.3 million on April 11, retaining the positive momentum.

- The total net inflow of the Bitcoin ETF market has reached a notable $1.5 billion.

- BlackRock’s $192.1 million inflows resulted in canceling out the outflows on April 11.

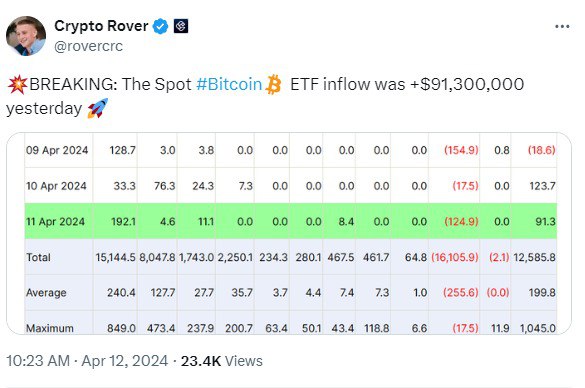

The Bitcoin ETF inflow surpassed an astounding $91 million on April 11, 2024, retaining the positive momentum. Analyst Crypto Rover shared an X post shedding light on the massive inflow of Bitcoin ETFs, which reached a total of $12.5 billion.

As per the report, Spot Bitcoin ETFs’ $91,300,000 inflow on April 11 is much less than the $123,700,000 inflow on April 12. However, the amount has substantially contributed to the overall positive flow of Bitcoin ETFs.

On April 8 and 9, the Bitcoin ETFs exhibited a negative flow, with the total outflow exceeding the inflow. While the outflow was valued at $223.8 million on April 8, the Bitcoin ETFs marked an outflow of 18.6 million on April 9.

WhalePanda, a prominent voice in the crypto space, took to X to share insights on the positive development in the Bitcoin ETF market. According to WhalePanda’s post, BlackRock’s staggering $192.1 million of inflows have canceled out the outflows completely.

Grayscale’s GBTC has reportedly seen increasing outflows. From Wednesday’s $17.5 million outflows, GBTC has reached a massive $124.9 million on Thursday. WhalePanda stated that Grayscale’s outflows are directly proportional to the market strength.

In addition, WhalePanda unveiled Grayscale’s declining Bitcoin holdings. According to Grayscale’s official website, their BTC holdings have dipped to 316,000, and as per Arkham Intelligence, GBTC’s BTC holdings have decreased to 321,000.

Meanwhile, Bitcoin is hovering above the significant $70k point, with the much-awaited halving event nearing. As of press time, Bitcoin is set at $70,972, marking a marginal surge

of 0.35% in one day and a notable 6.35% in 7 days. However, over the last month, Bitcoin has experienced a slight decrease of 1.26%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.