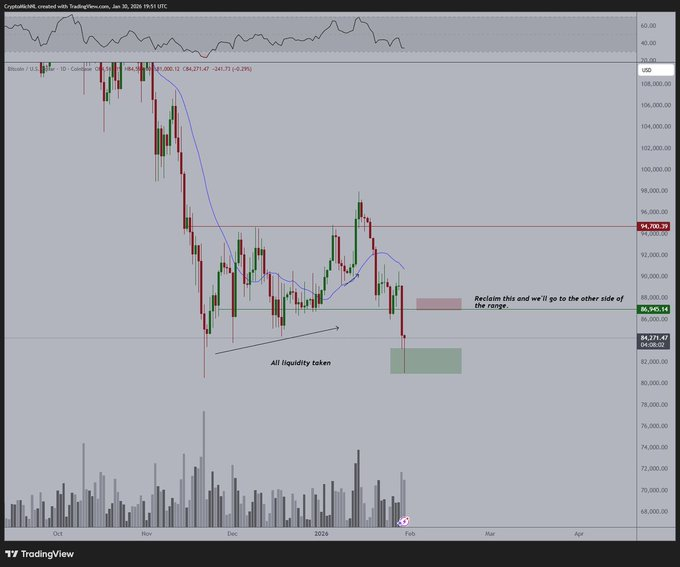

- Bitcoin must reclaim $87,000 to re-enter its previous range and open a path to $100K.

- Long-term indicators are deeply oversold, with Z-Score readings below past bear-market bottoms.

- Bitcoin does not need to drop below $80K, as major liquidity levels have already been taken.

After days of heavy selling and sharp liquidations, the crypto market is starting to show early signs of stabilisation. Total market value has edged up about 0.8% to $2.83 trillion over the past 24 hours, driven mainly by a technical rebound following what experts describe as a “liquidation flush.”

The focus now is on Bitcoin, and whether it can regain momentum and move back toward the $100,000 level.

Why This Zone Matters for Bitcoin

According to analyst Michael van de Poppe, long-term indicators show Bitcoin may be close to an important turning point. One signal is Bitcoin’s relative strength index (RSI) against gold. In past cycles, whenever this RSI dropped below 30, it marked major bear-market bottoms for Bitcoin.

Historically, major tops in gold have also coincided with the start of strong rallies in crypto. Some analysts believe the current setup looks similar, raising hopes that Bitcoin could be nearing the end of its corrective phase.

Levels to Watch Next

According to the analyst, Bitcoin has already taken out most of the important liquidity levels during the recent sell-off. He noted that the price does not need to fall below $80,000 to gather enough liquidity for a reversal.

Instead, the next critical step is a break above $87,000. If Bitcoin can reclaim and hold above this level, it would move back into its previous trading range. From there, the analyst says a push toward $100,000 becomes far more realistic.

Another long-term indicator drawing attention is Bitcoin’s MVRV Z-Score, a metric used to compare price to long-term averages. Current readings are lower than those seen at major bottoms in 2015, 2018, the 2020 COVID crash, and the 2022 bear market.

This means Bitcoin is deeply undervalued on a historical basis and could be closer to the end of the bear phase.

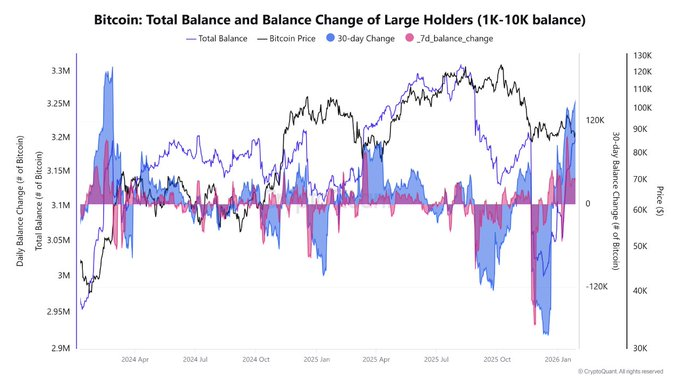

Whales Are Accumulating Again

On-chain data adds another layer. Bitcoin addresses holding between 1,000 and 10,000 BTC, often referred to as whales, have been accumulating at their fastest pace since 2024.

Total whale holdings have risen to about 3.204 million BTC, supporting long-term interest from large investors. Over the past 30 days, whale balances increased by roughly 152,000 BTC, while the 7-day change remained positive at nearly 30,000 BTC.

Data from Binance also shows whale-driven activity climbing to around 0.65, the highest level since November. Analysts say this typically reflects strategic position management rather than panic selling.

Related: Arthur Hayes Explains Why Dollar Liquidity Decline Is Dragging Bitcoin Lower

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.