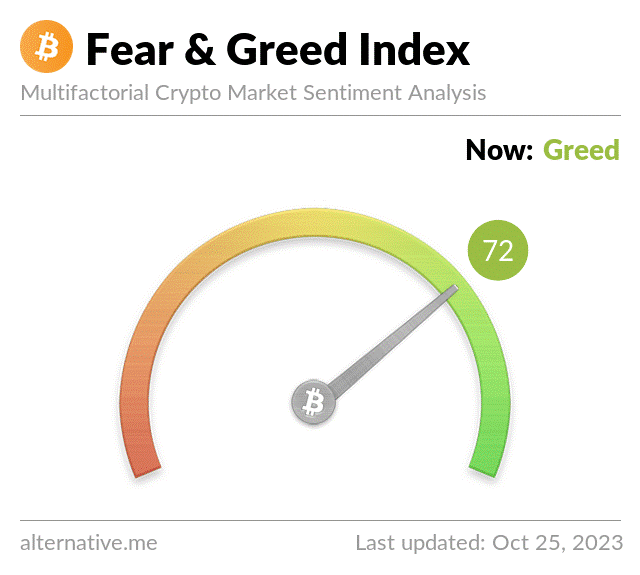

- Bitcoin Fear and Greed Index has turned green following days of significant price rallies.

- The social metric’s value rose to 72 as of today, October 25.

- Investors use the Fear and Greed Index to measure the prevailing sentiment within the Bitcoin market.

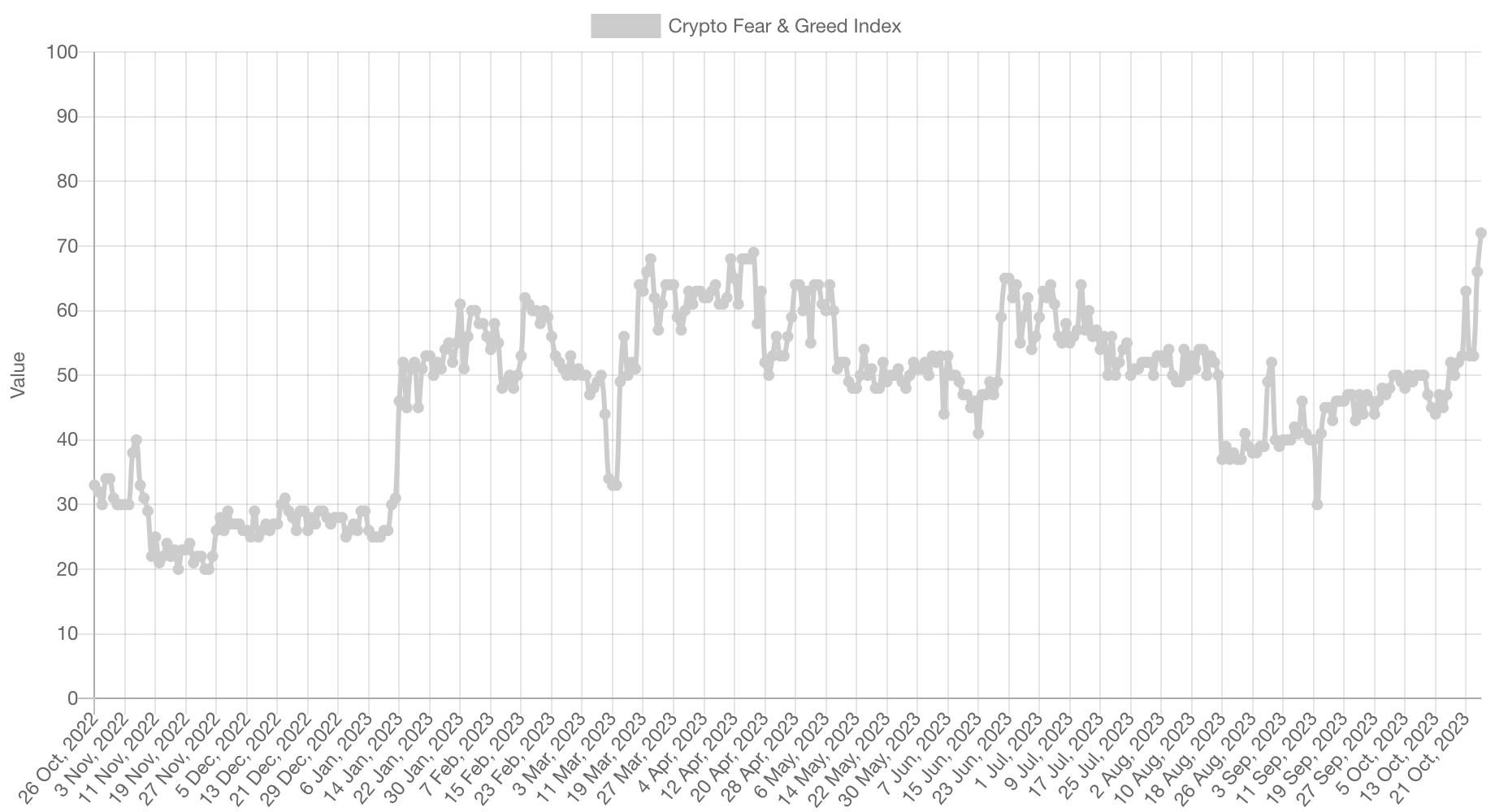

The Bitcoin Fear and Greed Index has turned green following days of significant price rallies. The value of the social metric rose to 72 as of today, October 25, with Bitcoin trading for $34,125, just 3% below the recently established yearly high.

Today’s Fear and Greed Index value represents the highest level the metric has reached in the past year. The highest it achieved before this time was 69, and it got that high on April 17, when Bitcoin traded for $30,337, following a sustained rally from the middle of March.

Bitcoin investors use the Fear and Greed Index to measure the prevailing sentiment within the market. The metric is calibrated such that a value of 0 means “Extreme Fear,” whereas a value of 100 represents “Extreme Greed.”

As a social metric, traders apply the Fear and Greed Index to determine when there is a Fear Of Missing Out (FOMO), or when the market is in a condition of Fear Uncertainty and Doubt (FUD). Usually, FOMO results when the market rallies and investors scamper for a share of the rallying market. They often get greedy in the process. However, the “Extreme Greed” gauge signals the rally is exhausted, and the market may be due for a correction.

On the contrary, in a falling market, “Extreme Fear” conditions signify the drop may be nearing an end, and the market may turn around. Hence, under the current conditions, with the Fear and Greed Index at 72, traders expect the rally to be nearing exhaustion, and a correction might be due.

Bitcoin rallied nearly 30% in the past seven days following a piece of false news about a spot ETF approval. The price has climbed above significant support as the bulls appear to have taken charge after a prolonged bear season.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.