- Bitcoin is set for its worst month since 2022, dropping over 23% in November.

- $2 billion were wiped out in the past 24 hours alone, according to CoinGlass.

- The $70K to $73K zone is the decisive support for the bull cycle.

Bitcoin is heading toward its sharpest monthly decline since the brutal market crash of 2022, when the collapse of major crypto firms like FTX and Celsius led to panic in the sector. Meanwhile, in the past 24 hours, the Fear and Greed Index fell to 11.

As November approaches its end, Bitcoin has dropped roughly 23%, a level of monthly pullback not seen since June 2022. Despite supportive regulations for digital assets and a massive increase in institutional involvement earlier this year, crypto is cooling now.

With Bitcoin crashing to $83K, Ether (ETH) also dropped to a daily low of $2,664, down 30% in the last 30 days. After the liquidation-driven crash on October 10 erased $19 billion in leveraged crypto bets, bears continue to dominate.

CoinGlass data shows that in the past day, an additional two billion dollars in leveraged positions were liquidated. A massive $1.47 billion was liquidated in the past 12 hours alone.

Institutional Outflows and Fading Momentum

Instead of stepping in to absorb the selloff, large investors are pulling back. Twelve US-listed Bitcoin exchange-traded funds collectively recorded $903 million in outflows on Thursday, the second-largest day of redemptions since their debut.

Meanwhile, Bloomberg reported that US stocks, which recently rallied on AI enthusiasm and strong earnings from major tech companies, have lost all their gains amid expectations of a Federal Reserve rate cut.

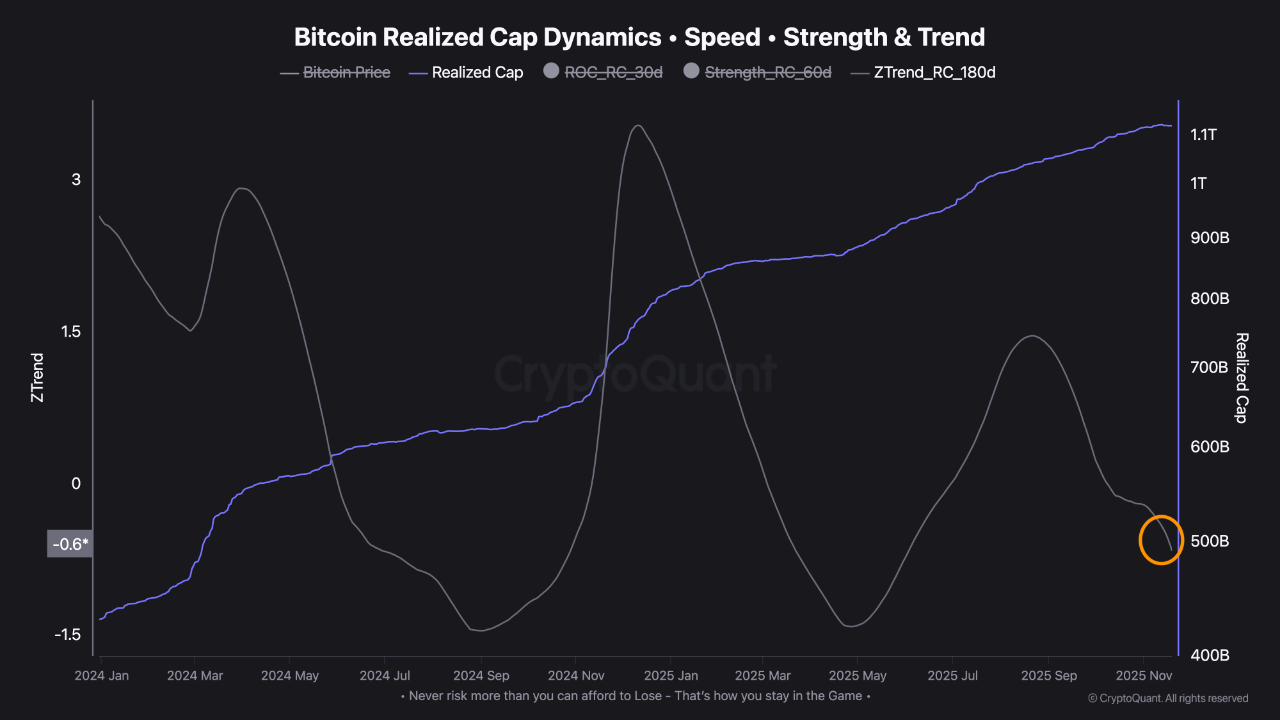

According to analyst TeddyVision, Bitcoin’s Realized Cap is elevated, but its 180-day Z-trend continues to shift into negative territory. This basically means that the growth rate of Bitcoin’s fundamental valuation is slowing.

Technical Breakdown Toward Critical Support

After the drop below $90K, analysts note that spot trading volume data from Binance shows a new trading range forming between $70K and $90K. The most traded price within this range, currently around $83K, may act as a support as well.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.