- Bitcoin held by major entities has surged in the past two years to nearly 6 million.

- The BTC/USD pair must rally beyond $99k to invalidate a selloff to $76k.

- Onchain data analysis shows some BTC whales have accelerated selloff YTD.

The demand for Bitcoin (BTC) by institutional investors has surged exponentially in the past two years. The regulatory clarity in major jurisdictions, led by the United States, has increased institutional conviction in Bitcoin as a hedge against inflation and macroeconomic uncertainty.

Bitcoin Supply on Exchanges Diminishes

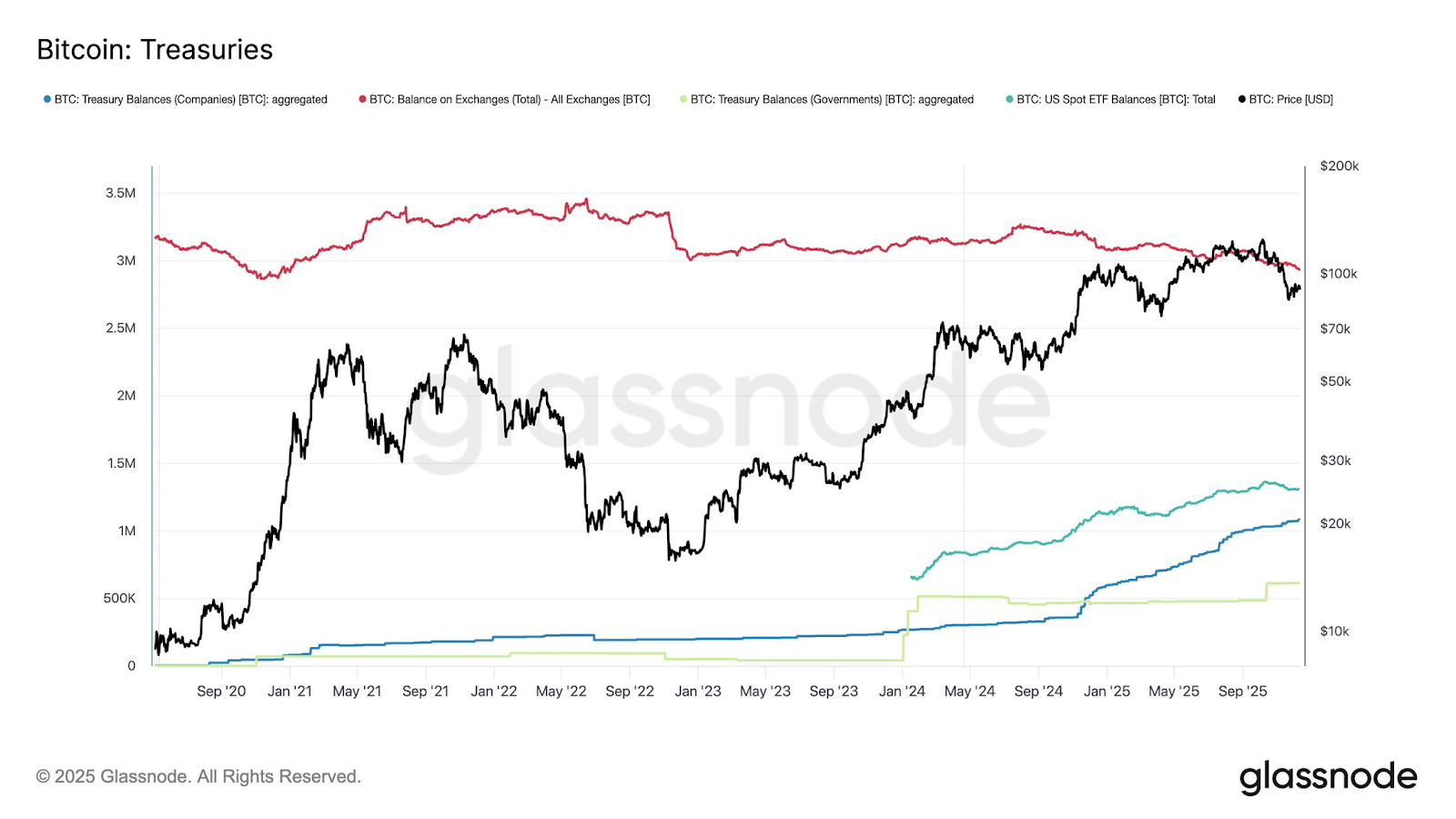

According to onchain analysis from Glassnode, the supply of Bitcoin on centralized exchanges has dropped exponentially to below 3 million in the last two years. Major Bitcoin holders have expanded their positions to roughly 5.94 million BTC, accounting for nearly 29.8% of the asset’s circulating supply.

At press time, the distribution of Bitcoin holdings by major entities includes:

- Public companies have around 1.07 million BTC.

- Governments around 620k BTC.

- The U.S. spot ETFs hold around 1.31 million BTC.

- Crypto exchanges hold around 2.94 million BTC.

Glassnode data show that the supply of Bitcoin on centralized exchanges has declined more rapidly since the approval of spot BTC exchange-traded funds (ETFs) and the re-election of U.S. President Donald Trump. Moreover, President Trump has already implemented a strategic Bitcoin Reserve for the United States through an executive order.

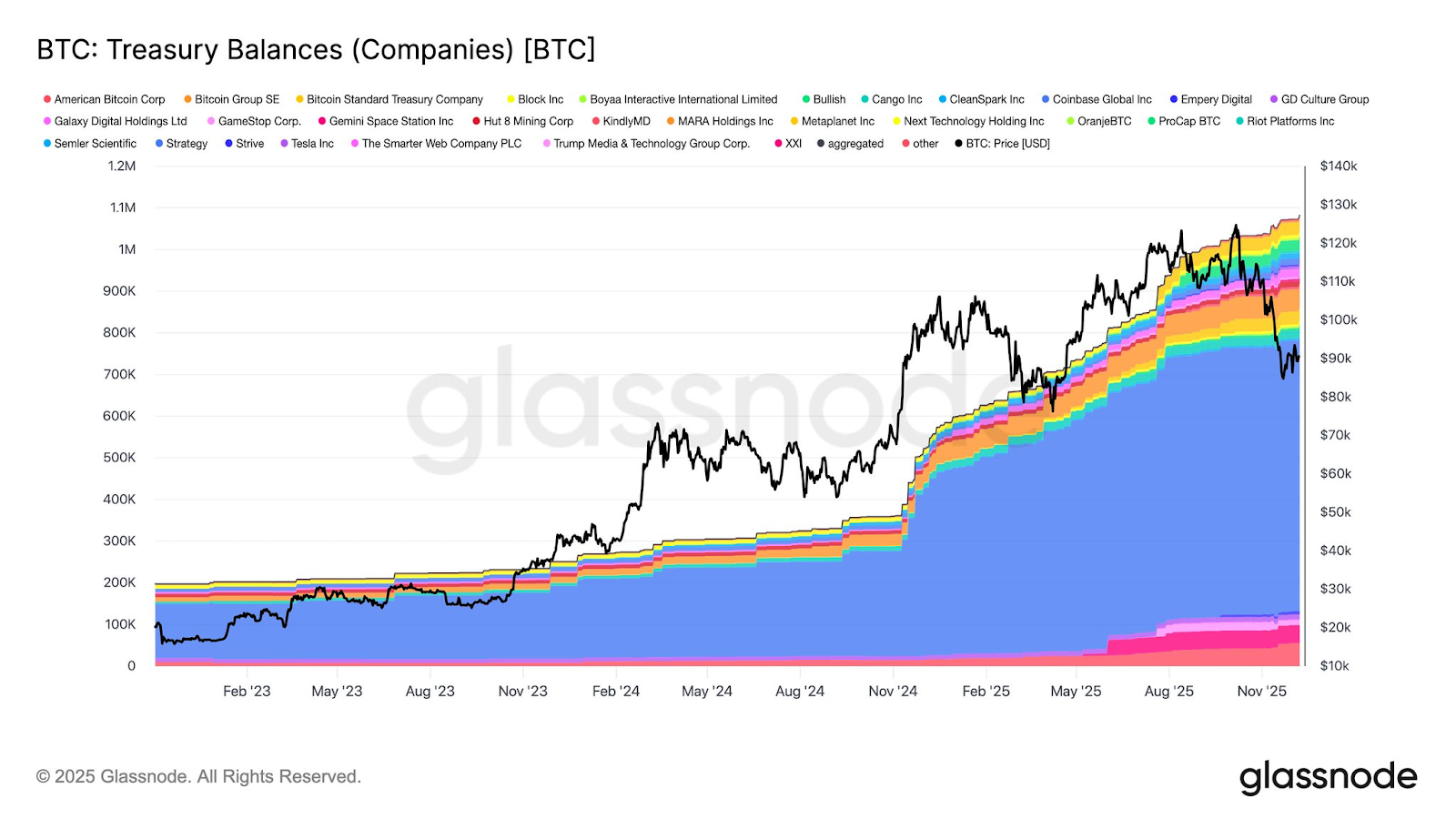

Historically, a drop in Bitcoin supply on centralized exchanges has led to bullish sentiment due to the dynamics of supply and demand. The success of Strategy in implementing its Bitcoin treasury plan has attracted dozens of similar companies, thus increasing their holdings by 448% since 2023 to about 1.08 million.

Why is BTC Price Still Under $100k?

During the past two years, the Bitcoin price has enjoyed bullish sentiment, but the momentum has recently faded. The conflict between supporters of Bitcoin’s four-year cycle and a new wave driven by institutional investors and governments has intensified.

Earlier this week, Cathie Wood, founder and CEO of ARK Invest, stated that Bitcoin’s four-year cycle should be treated as a secondary opinion in the short term. Furthermore, historical data shows the four-year Bitcoin cycle ended in mid-October 2025, thus favoring an extended business cycle.

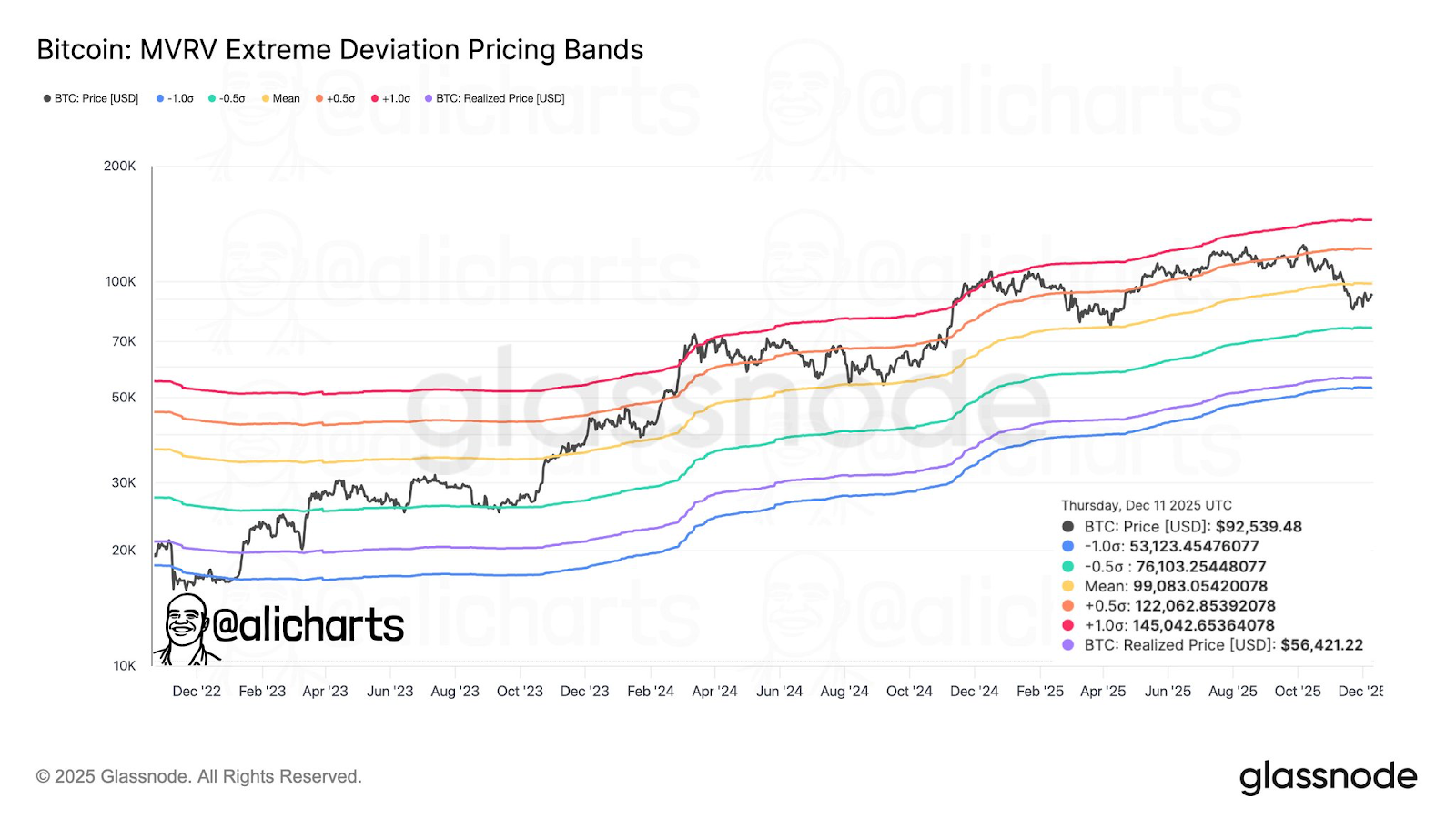

Following the rising conflict between short-term and long-term investors, the Bitcoin price recently dropped below the MVRV Extreme Deviation Pricing Bands mean of $99k. According to crypto analyst Ali Martinez, BTC must rally above $99k to invalidate the mid-term bearish sentiment toward $76k.

According to the analyst, some of the largest Bitcoin whales have offloaded 170,500 BTC in the past year, potentially distributing to the altcoin market.

Related: Bitcoin Defends Macro Support: $110K Breakout Needed to End Correction

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.