- Although Bitcoin has historically performed well in October, the bulls must defend the midterm support levels.

- The rate of new capital deployment by institutional investors has significantly declined.

- Crypto analyst Michaël van de Poppe believes BTC price is establishing a bottom for its Q4 rally.

Bitcoin closed Thursday on a bearish note, sliding nearly 4% to a seven-day low around $108,964 before staging a slight rebound to $109,246 by Friday’s mid-London session.

The weakness dragged the broader altcoin market lower, trimming the total crypto market cap by 2% to about $3.85 trillion.

Midterm Chart Structure Weakens

Since the Federal Reserve’s first 25 bps rate cut earlier this year, Bitcoin has traded in a midterm downtrend. Two failed attempts to reclaim the $117,000 resistance deepened bearish momentum, pushing the coin below key support at $112,000.

Related: Top 3 Mid-Cap Altcoins to Watch as Bitcoin Falls Below $109K, ETH $4K

In the daily timeframe, BTC price has formed a symmetrical falling channel following this week’s drop. If Bitcoin price loses the support level above $107 in the coming days, a drop to $102k will be inevitable.

The midterm bearish sentiment is bolstered by the daily MACD indicator, whereby the MACD line crossed below the signal line amid rising bearish histograms. Additionally, the daily Relative Strength Index (RSI) recently dropped below 50, signaling heightened selling pressure, and is currently hovering around 35, a possible rebound area.

Why Is Bitcoin Struggling

Declining Demand From Institutions

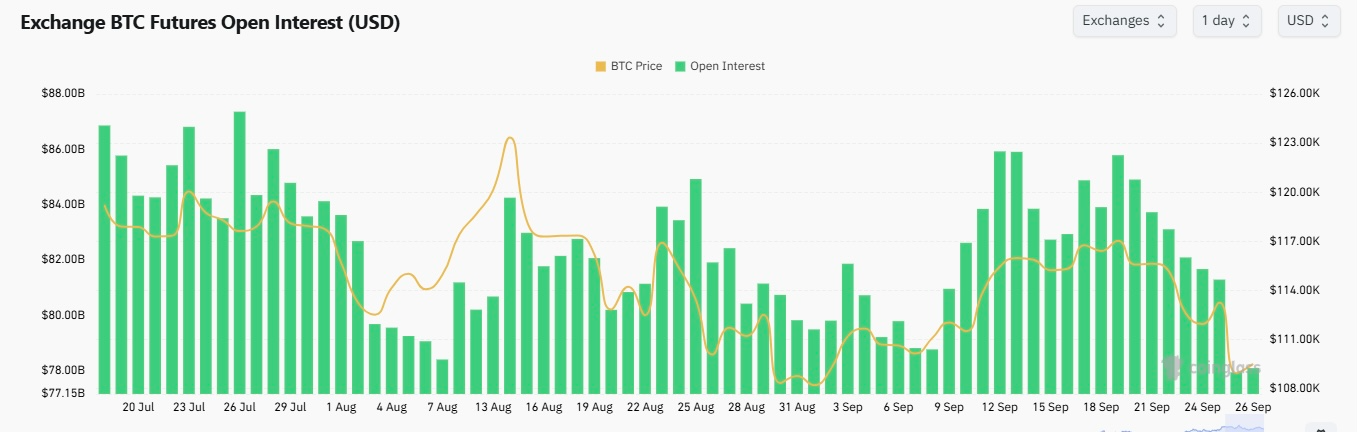

On-chain and derivatives data show fading appetite from institutional whales. According to CoinGlass, Bitcoin’s futures open interest has been sliding for weeks, hitting its lowest level since mid-July 2022.

Spot Bitcoin ETFs also recorded net outflows of about $484 million this week, reflecting hesitation among U.S. investors despite September’s rate cut. Even Michael Saylor’s MicroStrategy has slowed its pace of weekly Bitcoin purchases, a contrast to its earlier accumulation runs.

Cumulative Impact of Long Squeeze

Since the 25 bps Fed rate cut on September 17, the wider crypto market has experienced bearish sentiment fueled by the sell-the-news hype. Earlier this week, the leveraged crypto market recorded a net liquidation of $1.7 billion, with the majority involving long traders.

Even before the bulls recovered, the forced liquidation of long positions amounted to over $1 billion during the past 24 hours. As such, the odds of a prolonged long squeeze have significantly increased.

Moreover, Bitcoin buyers have dramatically shifted their mindset to bearishness, thus outweighed bullish outlook.

Related: Traders Target $120K as Bitcoin Awaits Key U.S. PCE Inflation Report

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.