- Bitcoin’s hash rate hits an all-time high, signaling increased network security and activity.

- Despite the rising hash rate, Bitcoin’s price faces fluctuations, with resistance near $60,000.

- Technical indicators suggest potential caution as Bitcoin’s MACD turns bearish RSI at neutral.

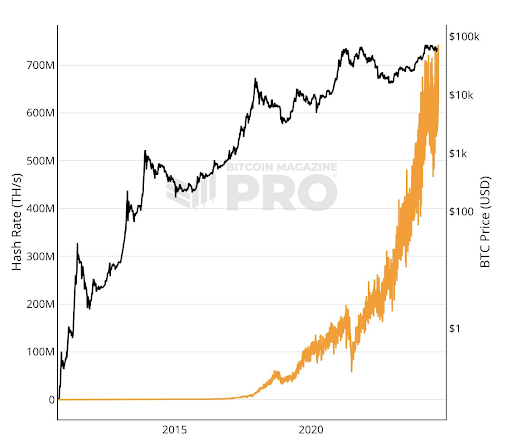

Bitcoin’s hash rate recently reached a new all-time high, underscoring the increasing security and activity within the network. This milestone comes as Bitcoin’s price experiences fluctuations, highlighting the complex relationship between mining power and market value.

The hash rate, measured in terahashes per second (TH/s), represents the computational power dedicated to Bitcoin mining. From 2013 to 2023, this metric has shown a steady upward trend, signaling growing interest and investment in Bitcoin mining.

This growth in the hash rate corresponds with Bitcoin’s market behavior, particularly after 2017. As the hash rate climbed during this period, Bitcoin’s price also experienced an upward trajectory.

This correlation suggests that increased mining activity, fueled by the desire for rewards and bolstered network security, may positively impact Bitcoin’s overall market value.

Bitcoin’s price has been volatile despite its consistently increasing hash rate. Particularly in 2017 and 2020, the digital asset witnessed tremendous increases and sharp declines. These price fluctuations are often mirrored in the hash rate, although the latter typically displays a more gradual and consistently upward trend.

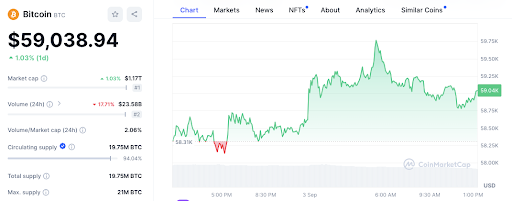

Furthermore, Bitcoin’s price dipped slightly, indicating some downward pressure or a minor sell-off around the $58,000 level.

However, the price quickly rebounded, peaking near $59,750, before correcting back to around $58,900. This movement hints at a period of either growth or uncertainty in the crypto market.

Bitcoin’s technical analysis raises potential caution as the Moving Average Convergence Divergence (MACD) signals a bearish crossover, with the MACD line below the signal line and negative histogram values. Moreover, the Relative Strength Index (RSI) at 45.76 suggests a neutral market sentiment.

These signs imply that Bitcoin might be entering a correction after its recent rise, facing resistance near the $60,000 mark. As the market displays uncertainty, traders appear cautious and may wait for clearer signals.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.