- Bitcoin is trading near $86,000 as volatility, sell pressure, and ETF outflows keep the market range-bound.

- Analysts are divided between short-term downside risks.

- Failure to break $88K could send Bitcoin toward $83K–$80K despite a bullish long-term outlook.

Bitcoin is trading at $86,414, and analysts are debating whether the market may fall. They’re focusing on liquidity, market cycles, and continued selling pressure. Investors are divided on whether Bitcoin is mainly a risky asset or a long-term store of value.

Bitcoin Current Price Action

Bitcoin is up just 0.1% in the last day but is still down 6.7% over the past week and 9.6% over the past month due to ongoing volatility. Strong resistance near $94,000 has kept prices stuck in a narrow range.

Some analysts believe this period of stability indicates a redistribution phase, in which long-term investors and institutions are buying from sellers. While short-term price moves may look bearish, the trend suggests the market is absorbing liquidity rather than heading for a major drop.

Related: Why Bitcoin Stays Volatile After the Latest US Jobs Report

Schiff’s Warning: Gold Rises, Bitcoin Dies?

Economist Peter Schiff says a rise in gold and silver could come before a Bitcoin crash, arguing that Bitcoin behaves like a risk asset and tends to fall early in times of market stress. He warns that investors trying to hedge against a weaker dollar could lose money in Bitcoin before the dollar actually drops.

Other analysts disagree, saying Bitcoin’s role changes with market conditions. In short-term shocks, it may fall as investors seek cash. But during longer confidence crises, Bitcoin can break away from traditional risk assets and act as a store of value.

They add that gold protects wealth within the financial system, while Bitcoin offers mobility and independence from it.

Selling Pressure and Market Participants

Bitcoin’s price is under pressure from ongoing selling. Reports suggest Chinese local governments may have sold large amounts of Bitcoin seized from criminal cases, including coins linked to the 2019 PlusToken scam.

Most of those holdings are believed to be far smaller than the original 194,000 BTC and are often sold through offshore or over-the-counter markets.

On the other side, institutions, banks, ETFs, and large investors are steadily buying. Still, ETFs saw heavy outflows, with $358 million leaving on Monday and another $277.2 million the next day.

Analysts say the market is fairly balanced, with sellers driven by past market cycles and buyers focused on long-term fundamentals. Analyst PlanB summed it up by saying roughly half the market is selling while the other half is accumulating.

Cycles and Institutional Adoption

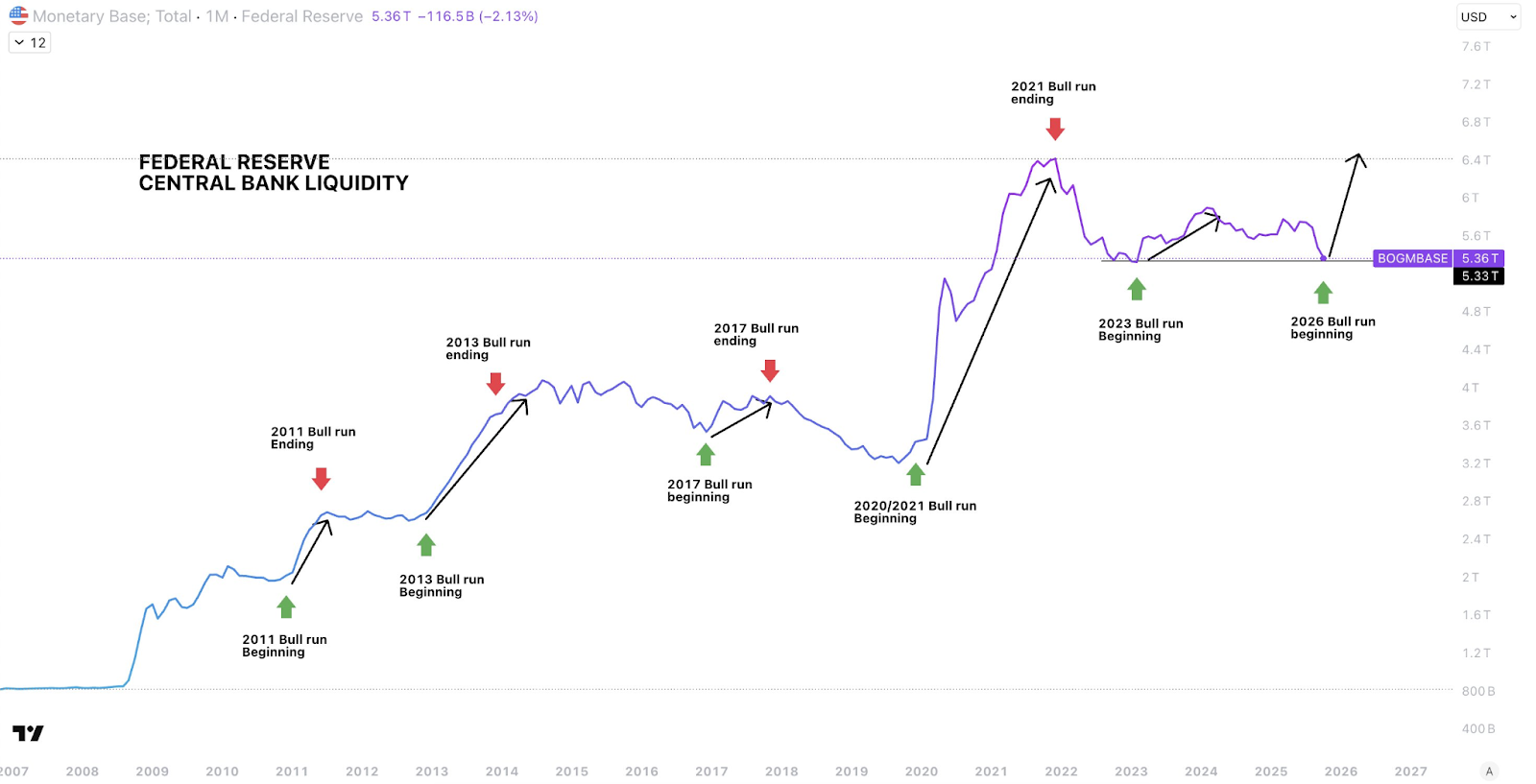

Meanwhile, the traditional four-year Bitcoin cycle is being questioned. Analysts like Sykodelic say Bitcoin’s moves are now driven more by liquidity and the broader economy than by fixed halving cycles. This time, Bitcoin didn’t reach extreme price highs, and no clear market top appeared.

Institutional adoption is also changing the market. Bitwise CIO Matt Hougan expects Bitcoin could reach a new all-time high in 2026, pointing to weaker halving effects, lower interest rates, and growing institutional involvement.

Related: U.S. Jobs Report Miss: Payrolls Up 73K, Fed Cut Bets Rise, Bitcoin Reacts

Short-Term Risks and 2026 Outlook

Despite the positive long-term view, short-term risks remain. Analyst Michael van de Poppe says Bitcoin needs to break above $88,000 to confirm upward momentum. If it fails, prices could revisit $83,000 or even $80,000, especially as macroeconomic pressures continue.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.