- Bitcoin’s 30-day Nasdaq correlation jumps to ~0.80, near 2022 peak.

- Five-year average sits lower near 0.54, proving unusual recent movement.

- BTC shows near-zero correlation with gold, bonds, or cash assets.

A sharp risk-off sentiment is pressuring the crypto market, but the dominant trend grabbing analyst attention is Bitcoin’s behavioral shift. Fresh data shows Bitcoin’s 30-day correlation with the Nasdaq 100 has surged to nearly 0.80, one of the highest readings since the 2022 bear market, meaning BTC and big U.S. tech stocks are currently moving in almost the same direction.

For years, Bitcoin has been marketed as “digital gold”, but the recent data hints something different. Instead of behaving like a safe-haven asset or inflation hedge, Bitcoin appears to be trading like a high-risk, growth-based tech asset.

Related: Death Cross Hits Bitcoin, but Bulls Say Bottom May Be In

Correlation Numbers Explained

Here’s what the recent trend reveals:

- 30-day BTC–Nasdaq correlation: ~0.80 (near decade-high)

- 5-year average correlation: ~0.54 (consistently positive)

- Correlation to cash and gold: almost zero

This means Bitcoin reacts more like Apple, Microsoft, Nvidia or Meta than gold or bonds, especially when markets become emotional, risky or policy-driven.

How We Got Here: A Quick Look at History

Bitcoin’s relationship with equities hasn’t always been stable.

2019 — Independent bull run:

BTC climbed from $3,000 to $12,000, while stocks moved slowly. Bitcoin showed strong independence and acted like a separate asset class.

2020–2022 — Macro shock era:

When the pandemic hit and liquidity flooded markets, Bitcoin’s correlation with tech spiked, as all risk assets started moving together under the impact of central bank policies.

2023 — Short decoupling attempts:

BTC briefly showed independent moves but quickly re-aligned with tech when market fear returned.

What’s Next For Bitcoin?

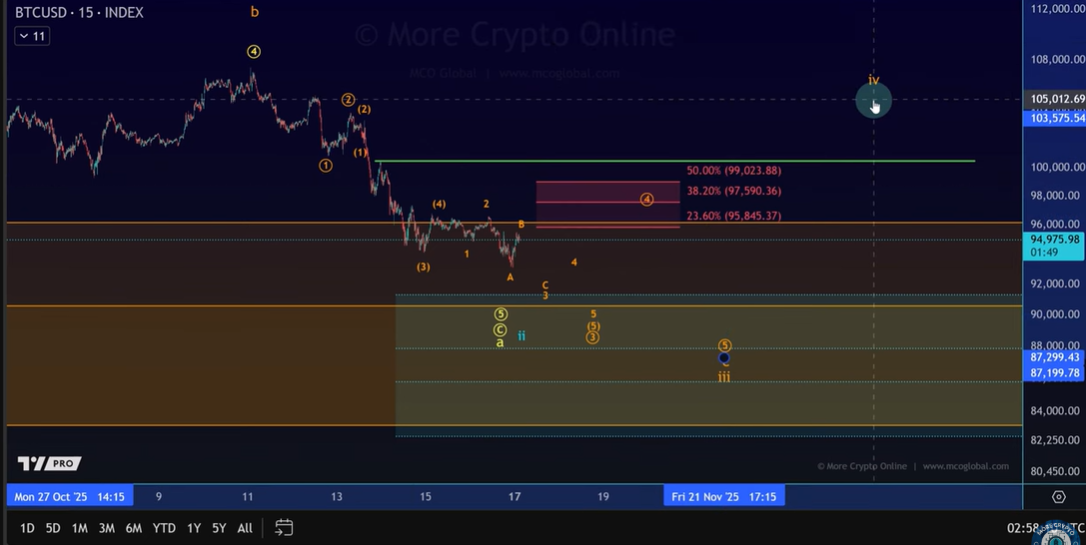

Bitcoin has now formed a death cross, meaning the 50-day moving average has dropped below the 200-day moving average. In previous cases, Bitcoin bounced 30% to 45% after similar crosses. This does not guarantee a rally, but it shows the market may be in an oversold zone rather than starting a deeper long-term crash.

In the short term, Bitcoin has not confirmed a final bottom. Price could still dip toward $91,400 before a strong recovery attempt. Upside confirmation comes only if the price breaks above the resistance zone between $95,800 and $99,200, and a stronger bullish shift may start above $99,000.

Related: Bitcoin Drops to 6-Month Low Amid Mixed Signals

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.